Kayak IPO maiden flight: Will it take off? Live updates

Skift Take

The wait is over: Some 20 months after filing its IPO registration statement and years of speculation about an IPO before that, Kayak's stock debuted this morning on the Nasdaq stock exchange.

Earlier, Kayak sold 3.5 million shares at $26 each and raised $91 million in net proceeds for general corporate purposes, new product introductions and acquisitions, Bloomberg reports.

The company has 44 million outstanding shares, priced at $26 per share.

The float, as it is known, is relatively small with just 3.5 million shares, and existing shareholders are not selling.

7:45 p.m.

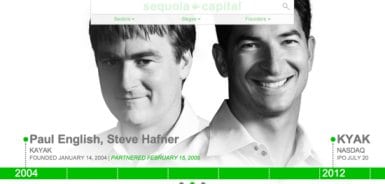

Sequoia Capital strutted its own stuff with these glam shots of Kayak co-founders Paul English (left) and Steve Hafner on a bell-ringing day for an IPO.

Button-down venture capital firms aren't exactly known for their flamboyancy, but Sequoia Capital, which invested in Kayak in early 2005, about a year after its founding, chose today to showcase Kayak's founders in black-and-white on the Sequoia website.

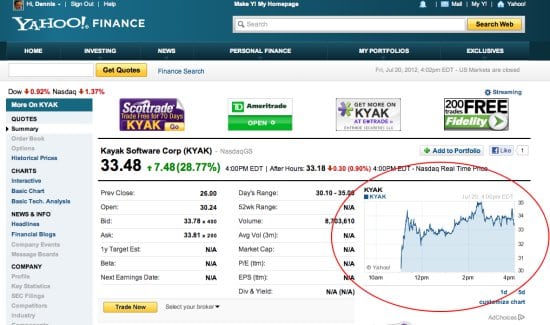

4 p.m. At the end of an historic day for Kayak, its stock closes at $33.18, up 27.62%. Priced at $26, it had reached a high of $35 at one point.

The Orbitz, Travelocity and Expedia vets who got the travel search company off the ground in 2004 have come a long way from here.

3:43 p.m. At this moment, Yahoo Finance indicates that 70% of Nasdaq stocks had declined on the day and 26%, including KYAK, advanced. And, 4% were unchanged.

3:16 p.m. Will Kayak's stock stay strong over the next hour or so in the final hour of trading? Morgan Stanley, which doubled as banker for the the Facebook and Kayak IPOs, is breathing easy so far.

2:35 p.m. Just a random thought, looking back at the last few months: The fact that the world didn't end since the launch of Google Flight Search has something to do with Kayak's performance so far today.

2:28 p.m. Kayak hits $35, up about 35%. There's some symmetry in that:)

2:11 p.m. Asked to comment on Kayak's evolution since the early days, shareholder General Catalyst Partners chimes in:

"General Catalyst is thrilled to have helped co-found Kayak with Paul English and Steve Hafner in our offices in 2004," says Joel Cutler, managing director, General Catalyst Partners. "The entire Kayak team is amazing; they have added real innovation to the online/mobile travel space. All of us at General Catalyst thank them for their huge efforts, both past and future."

1:48 p.m. Reuters reports that Wall Street indexes, including Nasdaq, were down at this juncture, based largely on a region in Spain looking for financial aid from the country's government.

This makes Kayak's performance in the first few hours all the more impressive. Kayak's stock is currently trading around $33.80, up around 30%.

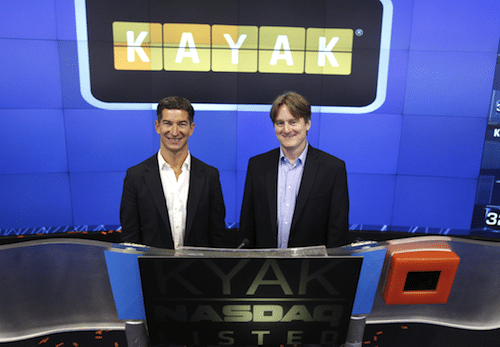

Kayak's Steve Hafner (left) and Paul English at the NASDAQ exchange on Friday, July 20, 2012. Photo courtesy Kayak.

12:44 p.m. The dynamic duo, Hafner and English, making the rounds on opening day, tell Bloomberg in a video interview that they have no ambitions to wander outside of travel, but have expansion on their minds.

Hafner notes that two-third of the online travel opportunity exists outside the U.S. yet Kayak takes in only about 18% of revenue internationally.

Kayak has a presence in 16 countries, Hafner says, and intends to "expand aggressively."

The interviewer says some observers may characterize the two as "brave men" for going public so soon after the Facebook fizzle. English replies that there was concern among investors, but "I think the time is right."

Here's the video:

12:28 p.m. Kayak hasn't been very gabby on the social media front today, merely tweeting: "Becoming a pubic company marks an important and exciting milestone for us, thanks for all your well wishes. http://t.co/zqiYTb0T

And, atop Kayak's Twitter account was a link, posted May 12, to its "Kayak Pupils" commercial.

11:11 a.m. Kayak's stock is up to $32.34, from its $26 pricing. Oh, those temporary gains -- on paper.

11:05 a.m. Kayak opens at $30.29 in first trades.

Interviewed by CNBC, Hafner said of the open, "It's great," but the company is focused on the long-term. "Still, it feels pretty good."

English said maybe there will be a little partying going on today to celebrate the IPO, but "we're looking forward to getting back to work on Monday."

10:55 a.m. ComScore co-founder Linda Abraham tells CNBC that Kayak's traffic, which has grown 33% over the last year, is besting any of its rivals in online travel.

Abraham says Kayak's dependence on ITA Software certainly is a complication, although alternative solutions are under development and in the marketplace.

"It certainly will be a complication for a number of players in this space," Abraham said.

A key question for Kayak and investors is how quickly Kayak can integrate some of those alternatives, Abraham said.

10:22 a.m. Kayak still hasn't opened for trading yet.

10:18: a.m. Forbes declares "The Facebook freeze is over..." as six U.S. IPOs which have debuted since Facebook did in June are up nearly 20% on average since their openings.

10:06 a.m. Kayak's soulmate, Palo Alto Networks, which was also debuting on the public markets today, saw its stock price surging at the opening, Bloomberg reports. The company is in the firewall business. Palo Alto Networks' opening probably is not a bad sign for the Kayakers.

However, there was a Fender bender as the guitar marker withdrew its IPO last night, citing volatile market conditions. So there's one discordant note. Fortunately, for Kayak, Fender is all about electric (guitars) and not electronic commerce.

Meanwhile, Jeff Macke of Yahoo Finance isn't particularly enthused about the current about the current state of the IPO market, arguing that Morgan Stanley, the banker for Facebook and Kayak, has damaged the IPO climate.

9:45: Kayak co-founders Steve Hafner and Paul English, interviewed on cable channel CNBC, indicate that the company, under Google's consent decree with the government, has the option to extend its contract with Google's ITA Software for flight search until October 2016.

Google and ITA Software decline to comment.

CEO Hafner claimed Kayak is reducing its reliance on ITA Software, which just provides flight-shopping results in the U.S. "For us, it really hasn't been an issue," Hafner said.

Hafner added: "We have a great relationships with Google and ITA Software."

Meanwhile, English, Kayak's CTO, said Kayak is busy establishing direct-connects "with all the airlines," which would reduce the company's dependence on ITA, and is making Kayak more international.

Kayak's investors, including General Catalyst Partners, Sequoia Capital, Accel Partners and Oak Investment Partners, aren't selling any shares in the IPO, and the Kayakers were asked if this was done in order to avoid any pessimism about the stock.

Hafner said management has "long-term vision for Kayak," adding, the company "is far from achieving that goal. We feel very bullish about our prospects."

What about the Facebook IPO debacle, where its shares plummeted on day 1?

English said Kayak had decided to back off at that point, but "we felt good about Kayak anyway."

Both officials said they felt good about Kayak's $26 per share pricing, after having received a lot of input and advice during the roadshow after the last couple of weeks.

Hafner said the company is focused on building a great product.

"We're not focused on the valuation," Hafner said.

9:30 a.m. EST: The Kayak team was slated to ring the opening bell on Nasdaq and issued a statement:

“Becoming a public company marks an important and exciting milestone for KAYAK. Our team intends to stay focused on creating the best place to plan and book travel. We will continue to strive to innovate and improve our technology in order to provide travelers with comprehensive, accurate and intuitive travel tools that they can access from whatever device they choose. KAYAK's profitable business model blends the best of technology and travel and we are confident in our long-term health and competitiveness.”