Analysis: Expedia, with Trivago, won’t get caught flat-footed this time around

Skift Take

Expedia and Priceline, with their respective Trivago and Kayak transactions, are writing the next chapter in online and mobile travel competition in Europe, and Expedia is ensuring that it isn’t relegated to also-ran status this time around.

Expedia’s announcement December 21 that it intends to take a 62 percent stake in Dusseldorf-based Trivago for $632 million in cash and stock came just six weeks after Priceline revealed it will buy Kayak for $1.8 billion.

Expedia and its Hotels.com and Venere brands have been a relatively weak second over the years to Priceline and its Booking.com and Agoda subsidiaries in the hotel battle in Europe and Asia.

And now the Trivago and Kayak transactions bring travel metasearch prominently into the fray.

Priceline had been negotiating with Kayak for months before the agreement was announced, and undoubtedly Expedia had been talking to privately held Trivago for a protracted period, as well.

Expedia’s Trivago preference?

In the realm of total speculation, consider this possible scenario about the companies’ dealings with one another: Priceline revealed that during its talks with Kayak before the deal was closed, Kayak approached an unidentified “Company X” to see if it was interested in acquiring Kayak.

Kayak and Expedia have a close relationship. Expedia is Kayak’s largest customer and the two companies worked in tandem in 2011 during the unsuccessful effort to block Google’s acquisition of ITA Software.

It is possible — again, this is speculation — that Company X may have been Expedia, which saw Trivago as a more attractive acquisition target than Kayak because of Trivago’s much stronger position in Europe.

Not Booking.com all over again

At any rate, Expedia undoubtedly didn’t want to find itself in the position it occupied in 2004 and 2005 when Priceline acquired Active Hotels and then Bookings BV.

Those two acquisitions, little-recognized for their import at the time, enabled Priceline to build and bolster Booking.com, which grabbed market share across Europe with its retail hotel business while Expedia sat on its merchant-model heels.

Although Trivago doesn’t get Kayak’s $1.8 billion valuation, Expedia’s likely hopes its investment in Trivago will begin to provide a counter-weight to Booking.com.

Trivago’s strengths

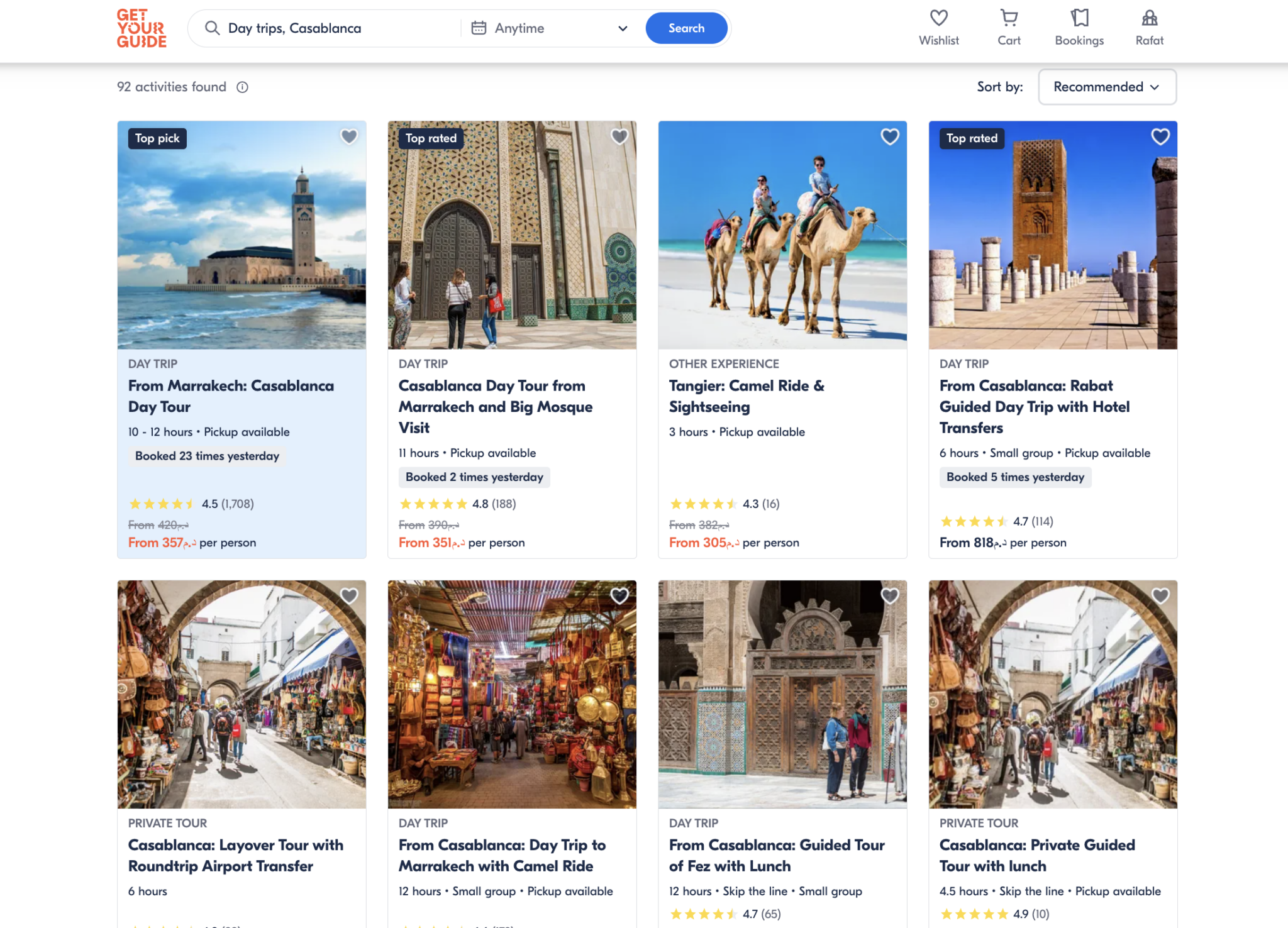

In Trivago, Expedia gets a Europe-grown travel metasearch player with special strength in Spain, Germany, the UK, Italy, and France.

Give the edge to Trivago over Kayak in hotel supply, hotel relationships, and brand awareness, with the latter built on television advertising. Kayak has the advantage in technology skills, including mobile apps, and perhaps in its management team.

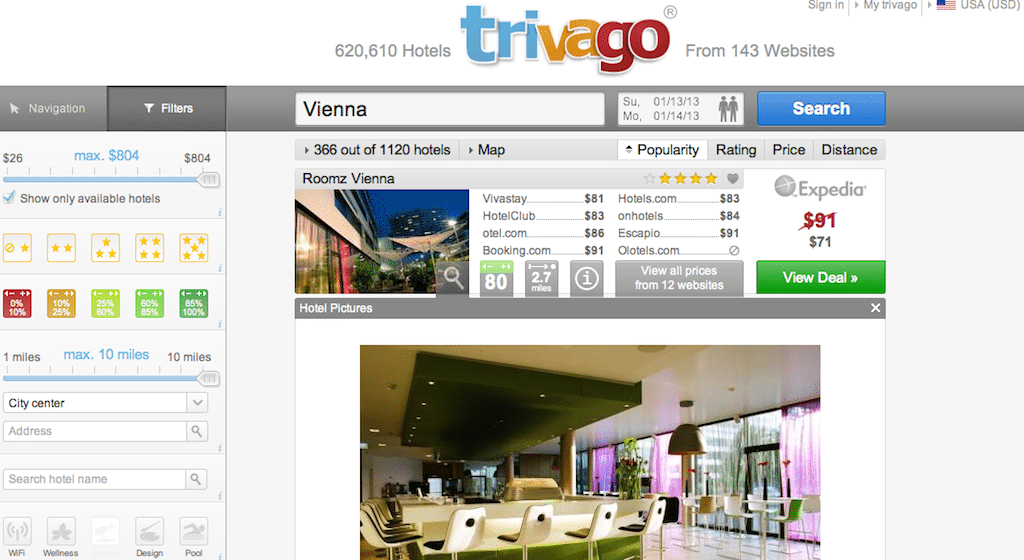

Trivago says it offers 620,600 hotels around the world and gets its inventory from 143 websites, and that portfolio is clearly deeper than Kayak’s.

Just take a look at some random comparisons of hotel supply in Madrid, Vienna and Warsaw.

Trivago boasts 1198 properties in Madrid to Kayak’s and subsidiary Swoodoo’s 922.

It’s a similar story in Vienna and Warsaw, where Trivago boasts of 1121 and 675 hotels, respectively, while Kayak and Swoodoo claim 700 and 389 in the two cities.

Kayak will look for acquisitions in Europe

Kayak has established its European headquarters in Zurich, is pursuing a multi-brand strategy there with Kayak, as well as its Swoodoo subsidiary in Germany, and Checkfelix in Austria.

However, Swoodoo and Checkfelix operate in Trivago’s shadow, in their home bases of Germany and Austria, respectively, although a Priceline-backed Kayak will be well-armed in the future to pursue strategic acquisitions in Europe.

Expedia and Priceline both envision their pending acquisitions as contributing to their bottom lines, and as advertising vehicles for the online travel agencies’ respective hotel businesses.

Tangled relationships

It is somewhat ironic that Expedia is currently Kayak’s largest customer, although Kayak is soon to be owned by Expedia rival Priceline.

And, Priceline’s Booking.com is a major customer of Trivago, which will soon see Expedia as its majority owner.

These advertising relationships are bound to change as Expedia and Priceline find a new battleground for their competition in Europe.

When the history of online and mobile travel in Europe gets written in years, Expedia’s stake in Trivago and Priceline’s buy of Kayak will certainly be viewed as the beginning of something, and will become a central focus.