Skift Take

Kayak for Priceline in some ways is like TripAdvisor for Expedia, although Priceline is eager to acquire Kayak, and has no intent on buying it in order to spin it out, as Expedia did with TripAdvisor.

Priceline’s pending $1.8 billion acquisition of Kayak amounts, in part, to some Google insurance for Priceline.

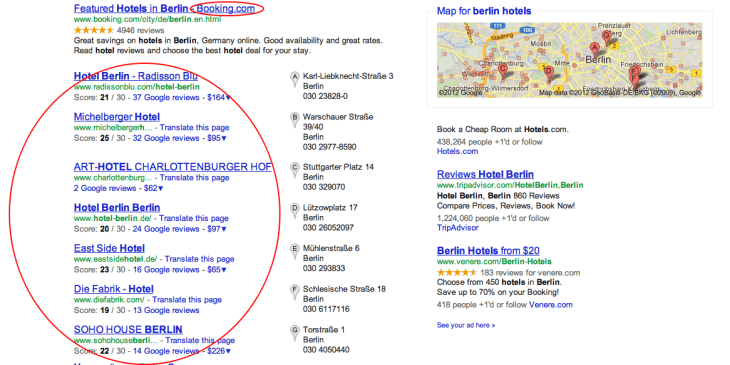

Priceline is one of Google’s largest search engine marketing customers, and Priceline CEO Jeffery Boyd, speaking at the PhoCusWright conference November 15, stated the obvious when he pointed out that Google is a “very important” channel to the online travel agency.

In fact, Priceline shelled out $375.2 million for online advertising in the third quarter, and another $52.9 million for sales and marketing.

Google’s changing traffic rules

Boyd also pointed out that Google is “rearranging” where traffic flows, providing more space for its own Google products to the detriment of others.

He explained that brands such as Priceline and its subsidiaries, Booking.com, Agoda, and CarRentals.com, can spend monies in other ways to reduce dependence on Google.

Reading between the lines

Boyd didn’t spell it out explicitly, but it is clear from his comments that this is where Kayak comes in.

To be sure, Priceline sees Kayak as a profit generator in its own right, and Boyd lauded Kayak’s skills in mobile and in developing all-important user interfaces.

Boyd clearly sees Kayak as a hoped-for effective marketing hedge against Google’s power, and in some ways it’s akin to the way that Expedia uses TripAdvisor.

Priceline already is Kayak’s second largest customer, accounting for 10% of Kayak’s total revenue in the third quarter of 2012, behind Expedia Inc. (26%) and ahead of Orbitz (8%).

As Priceline continues to use Kayak as a marketing wing-man to Google, and now gets more favorable economic terms with the acquisition, then this scenario could be very favorable to Priceline.

Giving Kayak the resources to expand into more international markets would assuredly benefit Priceline and its subsidiaries, as well.

What a difference a year makes

Boyd’s cryptic criticism of Google represents a change of tone, and an admission of overt concern — and that’s a marked contrast to the run-up to Google’s acquisition of ITA Software, when Boyd downplayed the threat.

Kayak, on the other hand, was one of the leaders, along with Expedia, of the anti-Google and anti-acquisition chorus. There was speculation at the time that Expedia might acquire Kayak or invest in ITA to head off the Google-ITA deal. Now Priceline will get its hands on Kayak instead in a transaction that puts a punctuation mark on its concerns about Google.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: google, kayak, search engine marketing