Guesty, which makes software for managing short-term rentals and other travel lodging, said on Tuesday it had raised $170 million in a Series E round of funding.

Apax Digital Funds, MSD Partners, and Sixth Street Growth led the round, while existing investors Viola Growth and Flashpoint also took part. Guesty said it was on track to generate $100 million in revenues within the next year.

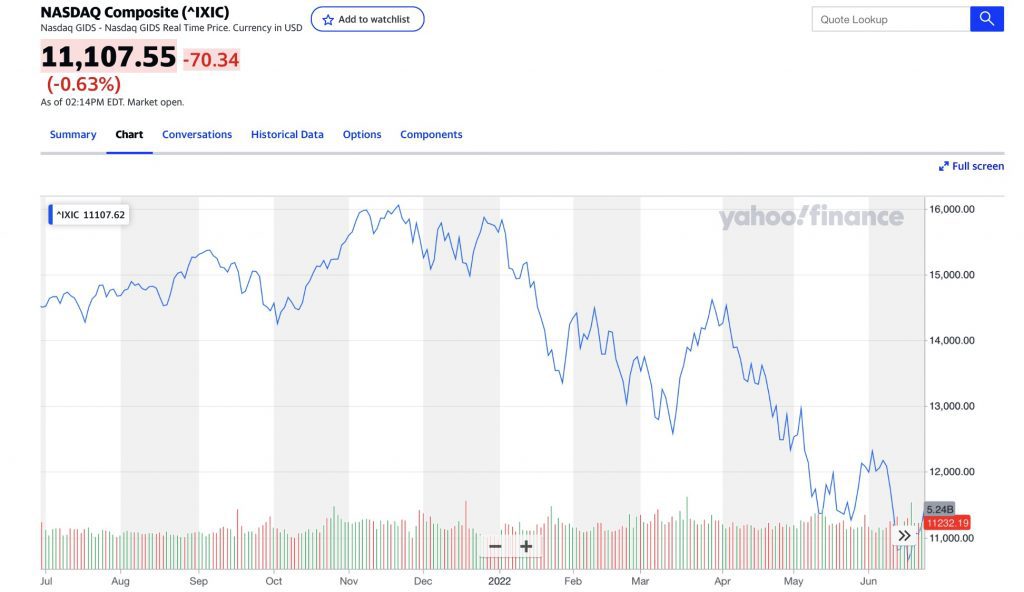

“Despite an exceptionally challenging fundraising climate, the funding Guesty has raised is a vote of confidence in the travel and short-term rental ecosystem,” said co-founder and CEO Amiad Soto.

Customers use Guesty to take bookings and payments directly and via Airbnb, Vrbo, Expedia, Booking.com, and other online travel agencies. The platform helps streamline the process of communicating with guests and handling housekeeping and other operational tasks.

The company will use some of the capital to make acquisitions and expand into unspecified new business verticals. Its executives believe that, as short-term rental managers become more professionalized and grow in size, they will outsource more tasks to tech vendors. They argue that this dynamic will lead to industry consolidation. For context, Skift Research subscribers can read Skift Research’s hospitality reports.

Guesty was part of the winter 2014 class at Y Combinator. One of the things the accelerator’s mentors taught Guesty’s founders was to focus on creating a small fan base of dedicated customers and super-serving them before scaling. Soto credits focus on polishing the product for the edge the company has had over rivals.