Hotel Chart of the Week: Extended Stay Boom in U.S. Ramps Up

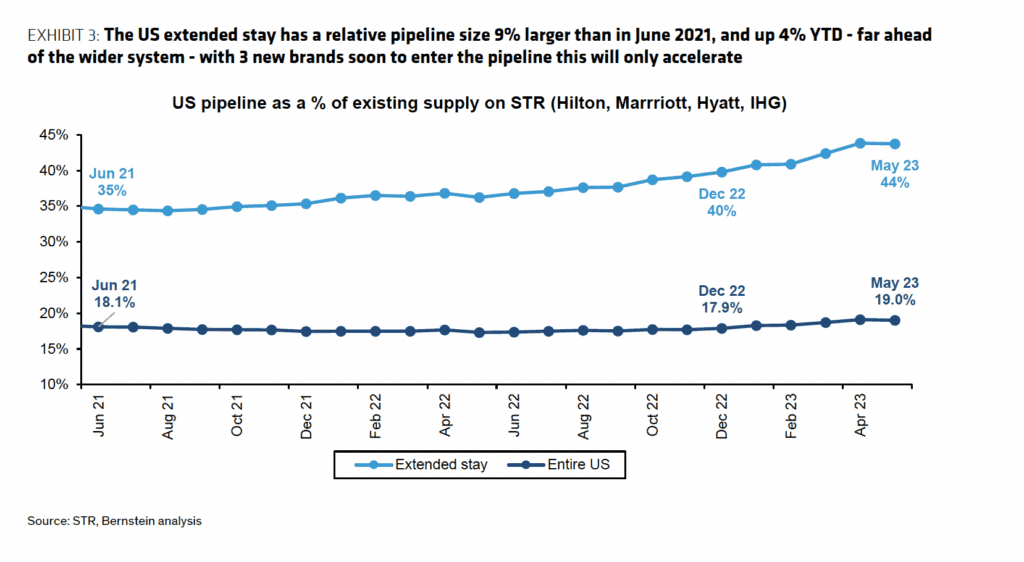

Enthusiasm for extended-stay hotels seems boundless among U.S. hotel developers. The national extended stay pipeline is now 44% of supply, up by almost 10% in the last 18 months.

Analysts at Bernstein, led by Richard Clarke, produced a chart in a research note on Thursday that captures the trend — using data from STR, the hotel performance benchmarking firm. The chart shows how extended-stay development takes an increasingly large share of the mix of hotel development.

The chart has lagging data. Since October, several hotel groups, including Marriott, Hilton, Hyatt, Wyndham, and BWH (Best Western) have debuted new extended-stay brands. The new options may drive developer interest higher.

Looking ahead, which hotel groups are best-positioned to gain from the tailwinds?

"Marriott leads all asset light groups in extended stay exposure, at more than 15% of their global portfolio and 4.5% ahead of Hilton at number 2 — so naturally stands to gain from demand tailwinds. However, Hilton looks best placed to capture supply growth, with its Home2 brand boasting an impressive relative pipeline of 108% of supply, despite being well established with more than 60,000 rooms."

—Richard Clarke, Niall Mitchelson, and Kate Xiao of Bernstein