Operating performance at many hotels worldwide is getting closer to pre-pandemic levels, according to a Hotels Global Asset Management Report released on Tuesday by JLL Hotels & Hospitality — an investment advisory firm that helps manage more than $6.8 billion in hotel assets.

A few charts from JLL’s report stand out.

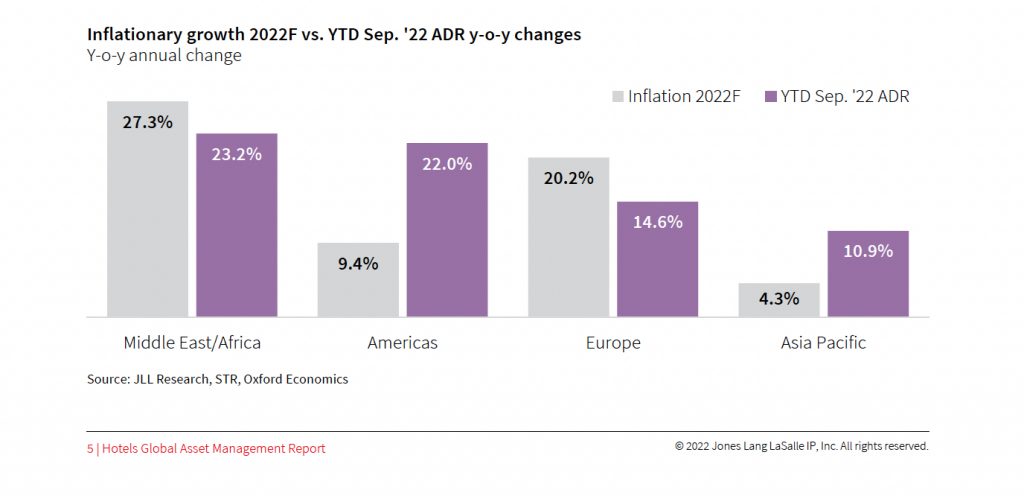

Inflation has been rising in much of the world, but hotels have been able to pass along higher rates to customers to keep nearly in sync.

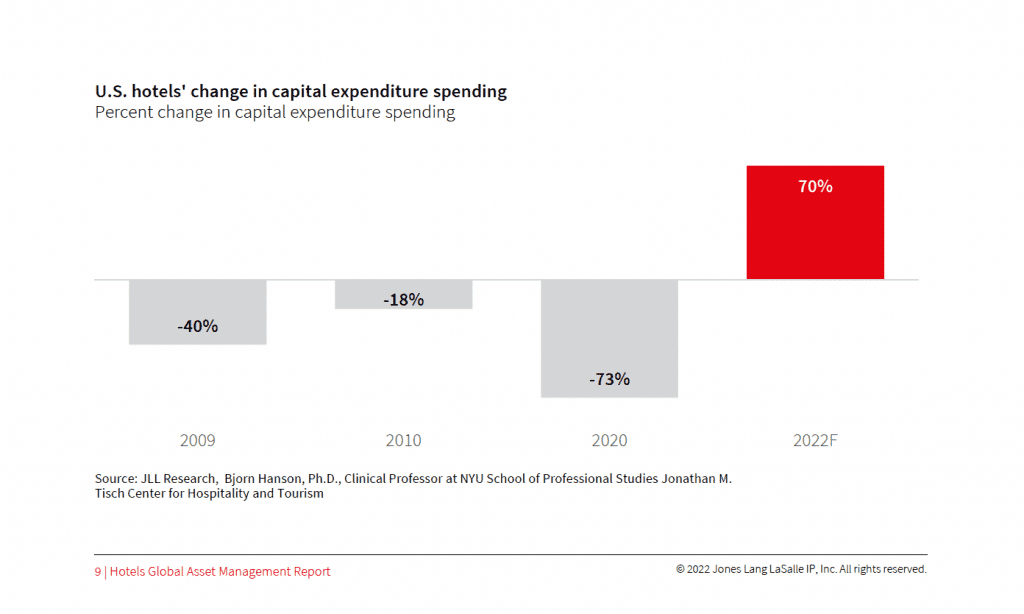

Hotels have been able to keep up even though many have ramped up their capital expenditures on furniture, furnishings, and property upkeep, as this chart suggests:

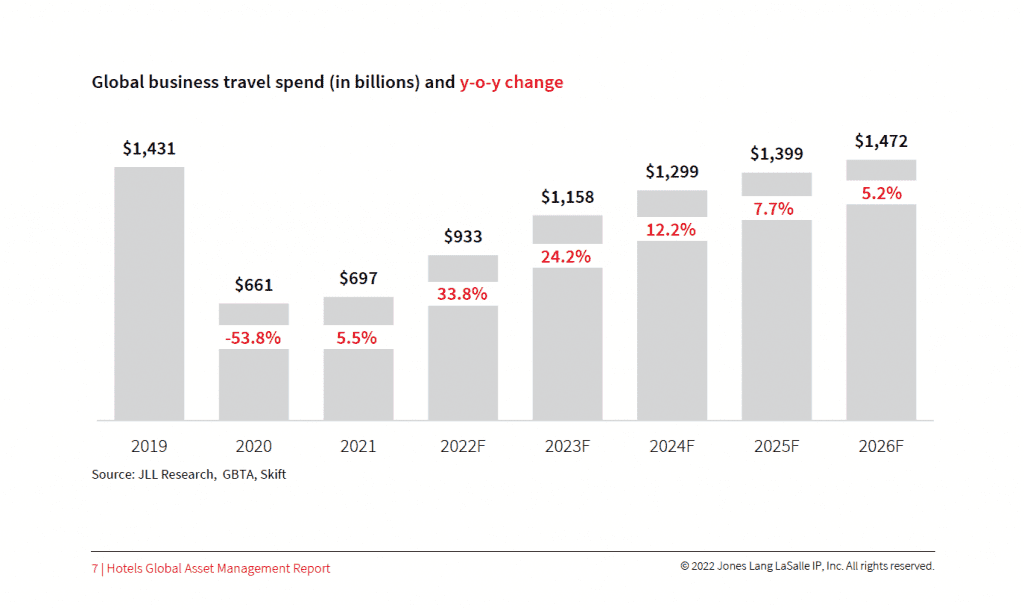

Can hotels sustain the momentum and continue to price well to cover inflationary pressures? It’s possible. Levels of business travel, especially international and long-haul business travel, remain quite low relative to 2019 levels in many markets. Even in a downturn, companies want to fight for market share by sending colleagues out into the field to close deals. So there may be more room for growth, as this chart suggests:

On Monday Skift published an interview with a top JLL executive, Andrea Grigg, to learn what she’s been hearing in 2023 budgeting sessions at hotels worldwide. Grigg summarized that forecasts are broadly and cautiously optimistic. But she noted that too many hoteliers are trying to restaff to 2019 levels when that often won’t be the route to profitability. Getting better at upselling and cross-selling is a key priority for hotels next year, she said.

JLL’s Hotels Global Asset Management Report is embedded below and is available on JLL’s site.

Breaking News Blog

Short stories and posts about the daily news happenings across the travel industry.

Tags: future of lodging, hotel operations, jll, news blog, reports