Saudi Allows Foreign Investment in Holy Cities - What it Means For Tourism

Skift Take

Saudi Arabia has opened up foreign investment into real estate firms in its holy cities this week, a move that will support development in the kingdom's most lucrative tourism destinations. Listed companies that own real estate in Makkah and Madinah can now receive investment from non-Saudis.

The Saudi market regulator Capital Market Authority said in a statement: "Through this announcement, the Capital Market Authority (CMA) aims to stimulate investment, enhance the attractiveness and efficiency of the capital market, and strengthen its regional and international competitiveness while supporting the local economy."

"This includes attracting foreign capital and providing the necessary liquidity for current and future projects in Makkah and Madinah through the investment products available in the Saudi market, positioning it as a key funding source for these distinctive developmental projects."

The Ministry of Hajj and Umrah did not immediately respond to requests for comment on how the change could impact tourism.

The CMA said that the foreign investment would be limited to shares, convertible debt instruments, or both, and would exclude "strategic foreign investors." It added that people without Saudi nationality would not be allowed to own more than 49% of shares of the firms involved.

Religious Tourism

FDI, or foreign direct investment, is a hot topic in Saudi Arabia, especially regarding tourism projects. Multi-billion-dollar projects like Neom, Diriyah and Red Sea draw attention for the immense amount of public spending they have required. However, these projects are largely focused on the leisure market – religious tourism is the largest travel segment in Saudi by a wide margin.

In 2023, religious tourism generated $28.3 billion in spending in Saudi and accounted for 11 of the 27 million international tourists that year, according to the Ministry of Tourism. Almost twice as many international travelers visited Saudi for religious purposes compared to leisure purposes in 2023.

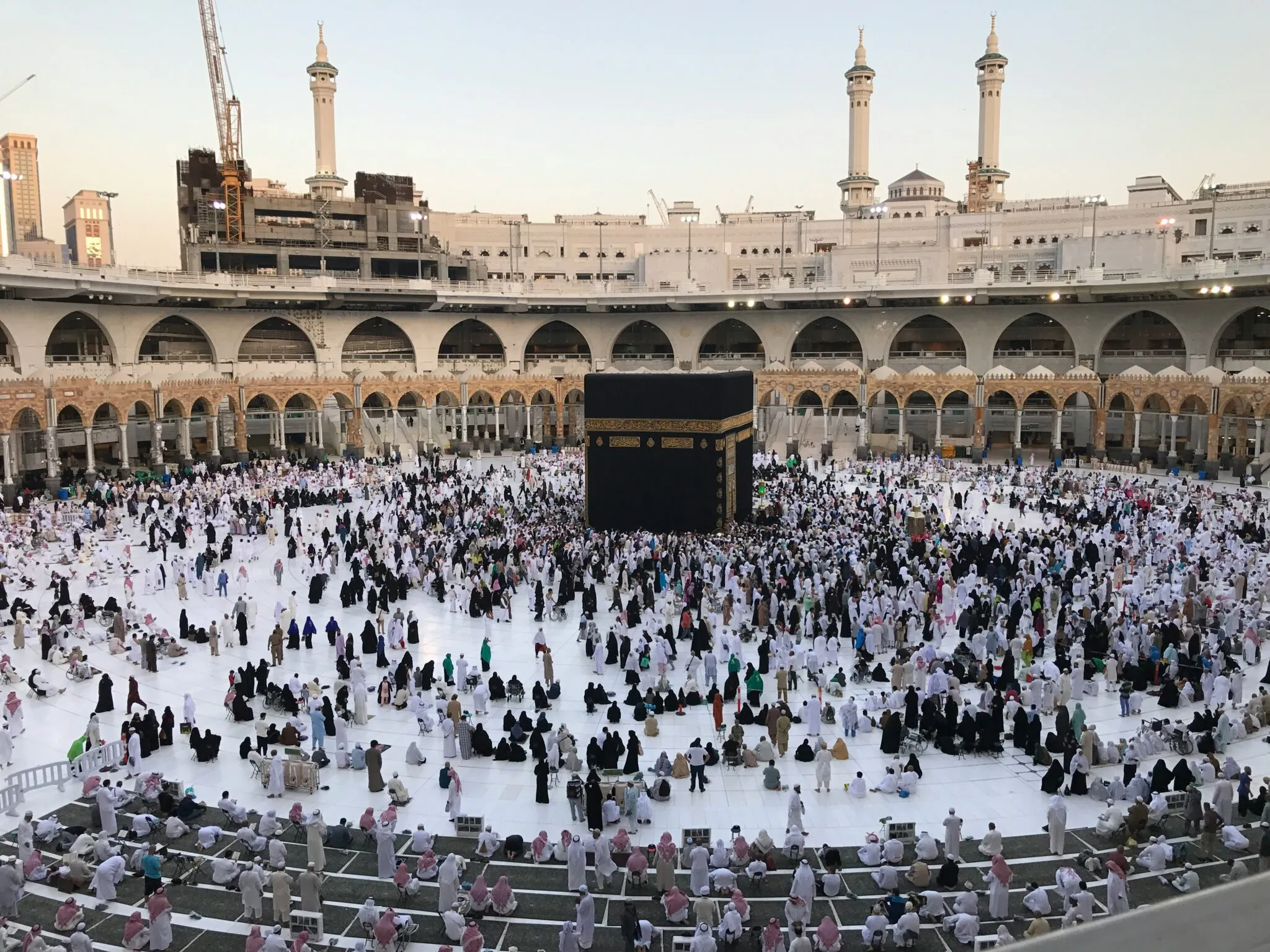

Tourism minister Ahmed Al-Khateeb affirmed at Davos this month that religious tourism is still the country's biggest driver. “Makkah and Madinah still top the list of the most visited destinations in Saudi Arabia, and attract millions of pilgrims annually, due to their religious importance.”

The annual pilgrimage plays a vital role in the country's economy and upping the number of pilgrims is an integral part of its Vision 2030 economic reform agenda that aims to wean the economy off oil revenues.

The two holy cities have their own set of projects, which can now be accelerated with foreign investment. Moreover, religious tourism is already a proven concept in Saudi, whereas leisure travel is still in its infancy, permitted only since 2019.

Makkah:

- Masar Destination: This development project will cover 1.2 square kilometers and aims to transform Mecca's urban landscape. Centered around the King Abdulaziz Road, it will feature residential and commercial areas, cultural centers, and entertainment facilities. The project is expected to be completed by 2030 with an estimated cost of $26.66 billion.

Madinah:

- Rua Al Madinah: In Madinah, a planned urban development project will span 1.5 square kilometers near the Prophet's Mosque. Upon completion, it aims to accommodate up to 30 million Umrah pilgrims by 2030. The first phase is scheduled for completion in 2026, with the final phase by 2030, at an estimated cost of $37 billion.

Foreign Investment in Other Projects

Last April, BlackRock said it would be getting as much as $5 billion from Saudi's Public Investment Fund to invest in the region and build a Riyadh-based investment team.

That same month, Saudi flew dozens of bankers to Neom – Saudi's biggest project – to explore “collaborative avenues,” according to Neom’s then-CEO Nadhmi Al-Nasr in a statement. The event drew representatives from 24 international banks and financial institutions, including those from Europe and the U.S. and in the region.

Media reports have said parts of Neom, including The Line, has been scaling back. But according to Diriyah group CEO Jerry Inzerillo in a previous interview with Skift, that could merely reflect shifting priorities to other Saudi projects.

"See, everybody is focused on what they think Neom is struggling with. Here’s how to look at it: There was a lot of money originally committed to Neom, but that money didn’t take into consideration the Kingdom would win the bid for the 2029 Winter Games in Trojena. So now, with the whole world going there to see the Winter Games, you need to put a lot of money into building Trojena."

"Trojena could’ve been built after The Line, but now it’s before The Line. You need Trojena for 2029. A lot of it isn’t austerity, quite the opposite. It’s redirecting where the money goes."