Minding the Gaps: Reconciling Discrepancies in Hotel Booking Data

Skift Take

The global travel business is set for a record year in 2024. The hotel industry alone will garner more than $446 billion in revenue worldwide this year and is projected to grow to more than half a trillion by 2028, according to Statista. Data cited by EHL Insights shows that room demand and occupancy will climb this year, and average daily rates (ADR) will add 4.9 percent growth to historically high showings in 2023.

These headlines foretell good news for hoteliers and travel management companies (TMCs). However, in the dynamic world of hotel booking, what you see is not always what you get. It’s far too easy to look at certain metrics and make assumptions about their impact on the business.

For example, there can be significant gaps between what hotel booking data is captured at the time of booking and what’s owed as a commission after a guest’s stay. Therefore, a holistic view of various metrics and their relationships is critical.

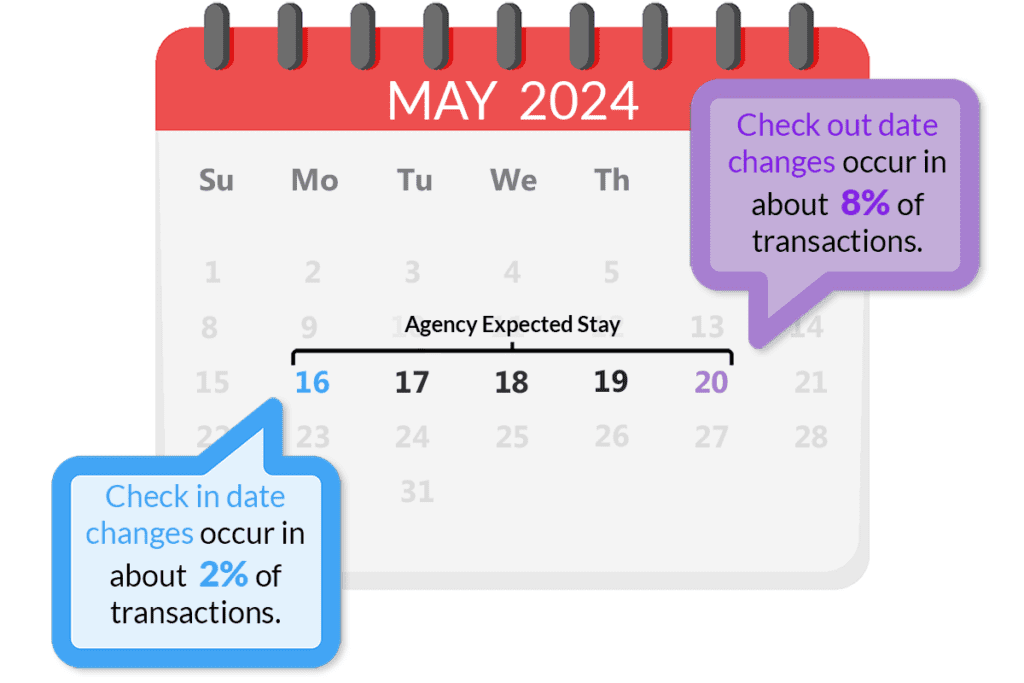

Onyx Insights data from 2023 show that the actual revenue confirmed by hotels, known as total transaction value (TTV), was 12 percent lower than the booked figures. Furthermore, reservation modifications also led to significantly overestimated ADR and commission per commissionable room nights, at more than 10 percent each. While overall length of stay (LOS) showed far less deviation, with an overestimation of 1.8 percent, TMCs’ estimates for guest check-in and check-out dates were inaccurately projected by approximately 9 percent.

Why Do Hotel Booking Data Gaps Occur?

One example of a common discrepancy in hotel booking data comes from modifications after the initial reservation. A modification could include significant changes like updating room nights or minor adjustments such as room upgrades or a rate plan code change at check-in. Typically, these changes are made directly with hotels, which means that an agency or other TMC may not be privy to the information.

Onyx Insights data shows that roughly 10 percent of all bookings undergo modifications, representing a meaningful percentage of potential commissions. Extrapolated out to the entire industry, Skift Research estimates that hotels paid more than $75 billion for indirect distribution costs in 2023. If 10 percent of all of those bookings see potential data discrepancies, that’s a significant chunk of revenue that could be impacted.

*Data Source: All hotel and TMC transactions processed by Onyx CenterSource from January 1, 2018, to December 31, 2023, with a checkout date within this range.

Why Does This Matter?

Discrepancies between pre- and post-stay data, driven by evolving booking details and travel behaviors, present significant challenges. If hotel commission payments are delayed, never arrive at all, or, in this case, are based on rates or stays significantly higher or lower than expected, TMCs may incur additional administrative overhead and potential disputes that strain relationships between travel bookers and hotels. Depending on the size of their book of business and the number of partners they work with, these issues can spiral quickly.

On the flip side, understanding these gaps can lead to better forecasts, clearer revenue management insights, optimized ADRs, and faster, more accurate commission payments. All of these factors benefit hotels and TMCs alike, helping them maximize revenues and foster better supplier-agency relationships.

How Is the Industry Working to Close the Gap?

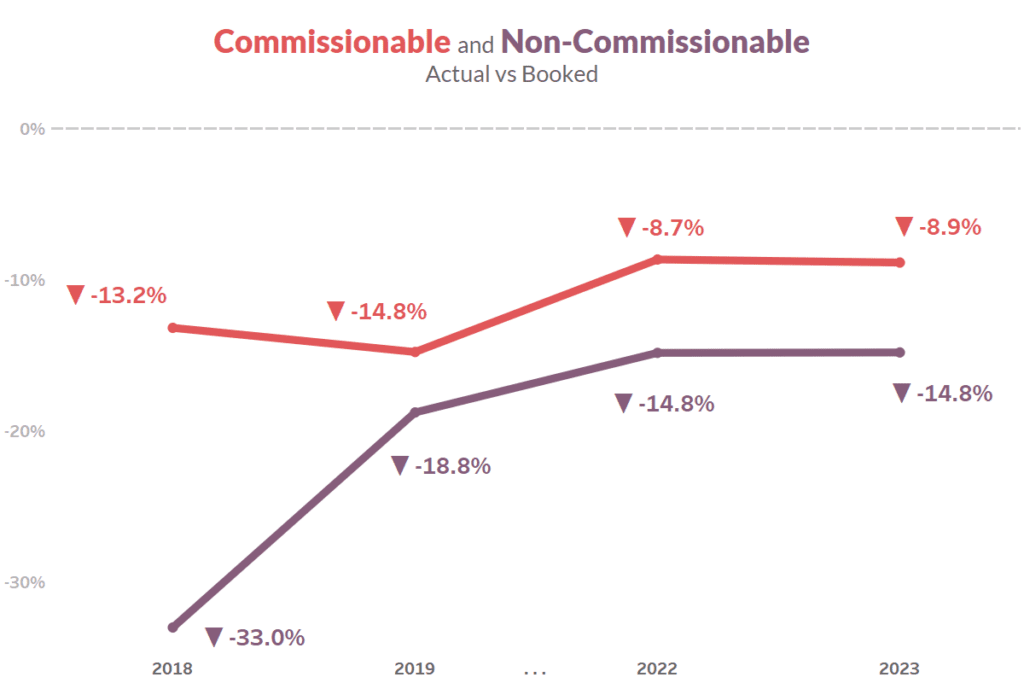

The good news is that these gaps are narrowing. Onyx data shows that the commissionable rate discrepancy fell from 13.2 percent in 2018 to 8.9 percent in 2023. For non-commissionable rates, the discrepancy was close to 33 percent in 2018, having since been trimmed to 14.8 percent.

So what’s changed? In the past, when modifications occurred, hotels often canceled the original booking and created a new reservation. This practice made it challenging to reconcile commissioned and non-commissioned items based on the initial bookings. Over the years, hotels and agencies have adopted better practices by working together, treating these changes as part of a single continuous transaction rather than separate events. These improvements in data handling and communication have significantly narrowed the gaps.

Even so, a 10 to 15 percent discrepancy is quite meaningful, potentially meaning lower revenues for TMCs and administrative headaches for hotel operators as their partners look to reconcile these gaps after the fact.

Understanding and adapting to these dynamics is crucial in today’s fast-paced travel industry. By closing the gap between pre-stay bookings and post-stay realities through merging agency-booked data with hotel-actualized data, hotels and TMCs can work more seamlessly together and keep their focus on what really matters — serving the customer.

Onyx Insights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skift’s branded content studio, SkiftX.