The Challenge With the Long-Haul, Low-Cost Business Model

Skift Take

When Norse Atlantic released its results for 2023, it was a celebration of several milestones. These included completing its first full year of operation and carrying over a million passengers on more than 4,000 flights.

The most noteworthy: It claimed the business case for long-haul, low-cost operations was “validated.”

Many low-cost carriers face difficulties establishing a viable strategy for long-haul operations, which we discuss in our latest Skift Research report, The Challenge With Long-Haul Low-Cost Airlines.

How did Norse do it? It points to the exclusive use of widebody aircraft and connectivity to some of the most popular destinations in the United States, such as New York, Los Angeles, and Miami, and in Europe, such as Paris, Rome, Berlin, Athens, and Oslo. Norse also provides flights to Bangkok, a popular leisure destination in Southeast Asia.

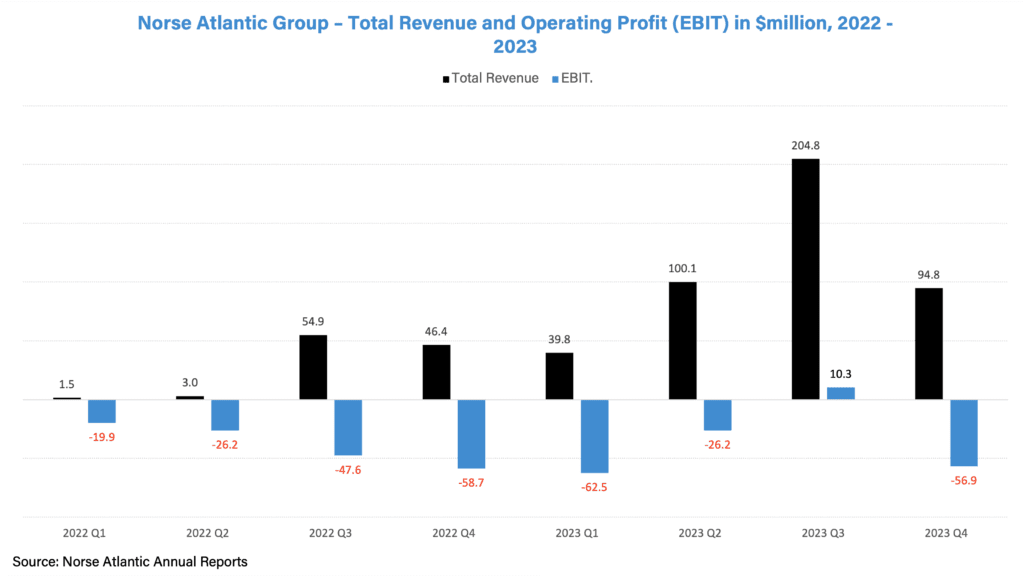

However, Norse's financial performance is a cause for concern: The total operating loss for 2023 amounted to $78.4 million, with losses in each quarter except the third. These losses, below-average passenger load factor, and low ancillary sales indicate a suboptimal performance.

Skift Research’s latest analysis breaks down the challenges faced by low-cost carriers venturing into long-haul. These challenges include higher operating costs of larger aircraft; difficulty in stimulating leisure and business demand from regional and secondary airports; the use of single-class economy cabins that result in low overall revenue per flight; and high finance costs.

Essentially, all the advantages that low-cost carriers have on short- and medium-haul operations are eroded on long-haul operations, and airline executives find it increasingly challenging to maintain these operations' viability, let alone profitability.

Even so, there are many positive developments for low-cost airline executives like Bjorn Tore Larsen, Chief Executive of Norse Atlantic. One is the post-pandemic travel boom, particularly among younger generations who prioritize experiences.

Another is the availability of a newer generation of aircraft that offer a higher range with improved fuel efficiency. That can help reduce operating costs and allow airlines to consider many locations.

It's not an easy business, but proponents of the long-haul, low-cost model may be on to something big.