Overtaxed UK tourism companies launch campaign to cut VAT to 5 percent

Skift Take

The UK companies want their taxes to be on par with Italy and Spain, but will have a tough time convincing Parliament to make any decisions that might lead to a fate similar to those of the bankrupt governments.

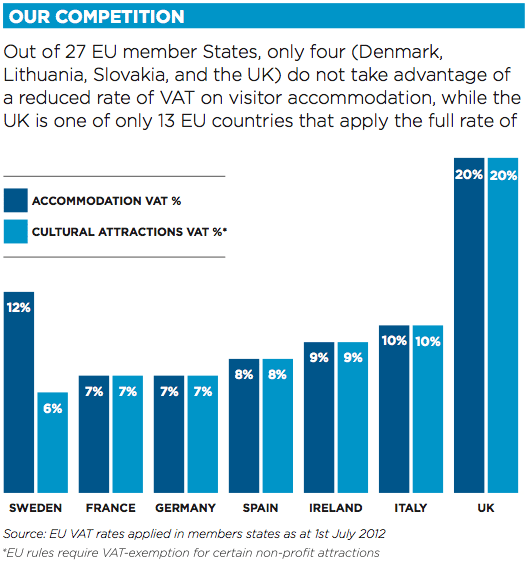

A group representing nearly 400 hospitality businesses, largely in the hotel and leisure sector, have launched its official campaign to cut VAT on accommodation and attractions to just 5% in Parliament.

The latest report into the effects of a VAT cut...shows that a VAT cut to 5% on tourism services would:

- Create 78,000 jobs over 10 years

- Create a net present value fiscal return to the Exchequer over 10 years of £2.6b (2011 prices)

- Assuming VAT were to reduce in 2013, the first year would see a direct loss to the Exchequer in VAT revenue of £1.7b, but the notional loss would be lower at £232m, after the effect increased trade and employment were taken into effect.

Up Next

Hotels

How Data Quality Issues Impact Global Hospitality Operations

There are wide discrepancies in data quality for hotel transactions across global regions, with the largest occurring in Asia-Pacific. Because hotels and agencies need to harness data quality to thrive, they must take a more nuanced regional approach to monitoring potential issues.

Sponsored Tourism

The White Lotus Effect Could Be a Disaster for Thailand's Koh Samui - And Travel Media Is Making it Worse

It is disheartening to see the same publications that have previously reported on the perils of overtourism now behaving like golden retrievers chasing a tennis ball, sprinting after the hype with little critical reflection.

Startups

Travel Startups Raise $580 Million Over Two Weeks

The ticket experiences sector has been ripe for modernization, and Klook is among those cashing in.

Airlines

Tariffs and Travel: What Trump’s Trade Moves Could Mean for Airlines

President Trump’s proposed tariffs on aluminum and steel imports could have ripple effects on the aviation industry — and eventually result in passengers footing the bill.

Hotels

Accor CEO: Opening Hotels in Mykonos Too Risky due to Climate Change

When a major hotel group like Accor decides not to build in Mykonos because of climate risks, it's a sign that climate change is reshaping business decisions.