Fallout From Thomas Cook’s Demise Will Reach Far and Wide in Travel

Skift Take

One of Europe’s biggest travel companies is no more and the damage it leaves in its wake is likely to take some time to clear.

After weeks of speculation, in the early hours of Monday morning, Thomas Cook announced it was shutting down after failing to complete a $1.1 billion rescue deal. The collapse isn’t just awful news for its employees and customers but the hundreds of other businesses likely to suffer as a result.

The company was something of a throwback to a pre-internet era, operating a fleet of aircraft together with retail shops and hotels, packaging it all up and selling it to customers. This approach meant that plenty of other companies had skin in the Thomas Cook game.

Countless hoteliers, tour operators, and other travel businesses will be owed millions of dollars and are unlikely to see a full return given the scale of Thomas Cook’s debts, which total about $2 billion (£1.7 billion).

As soon as the news broke, companies started revealing the scale of their involvement.

UK-based online travel agency On the Beach said it anticipated “a one-off exceptional cost associated with helping customers to organize alternative travel arrangements, and lost margin on cancelled bookings” although it should be able to cover the cost of canceled flights.

On the Beach itself is no stranger to hardships from packaging services. The airline Monarch’s collapse in 2017 cost the company around $2.5 million (£2 million).

Others feeling the Thomas Cook sting are Australian travel company Webjet, which takes an even greater hit. The firm signed a hotel outsourcing deal with Thomas Cook in 2016, taking over around 3,000 hotel contracts.

Webjet had banked on making up to $135 million in sales (based on total transaction value) from the Thomas Cook partnership in its 2020 financial year, adding that was still owed around $30 million (€27 million). How much of this it gets back remains to be seen.

In 2017, Thomas Cook agreed another outsourcing deal, this time Expedia supplied hotels for the UK firm’s city and domestic holiday business.

“We are aware of the news from Thomas Cook today. We are working quickly to contact all our customers who are affected to provide the appropriate assistance and advice,” Expedia said in a statement. No word yet, though, on how much this loss of business might be worth.

It’s not just companies that will be affected. Turkey, a key destination for European tourists, stands to lose out on as many as 700,000 visitors, according to the head of Turkey’s Hoteliers Federation.

“There are a large number of small businesses whose fates depend on Thomas Cook,” federation Chairman Osman Ayik told Reuters.

Who Stands to Benefit?

Richard Clarke, a senior analyst at broker Bernstein, said Thomas Cook’s demise could “set off a chain reaction” in the travel world given that it a significant chunk of its business was as a leisure airline for other tour operators and travel agents.

Smaller companies that relied on Thomas Cook are likely to suffer in the aftermath but what about its biggest rival?

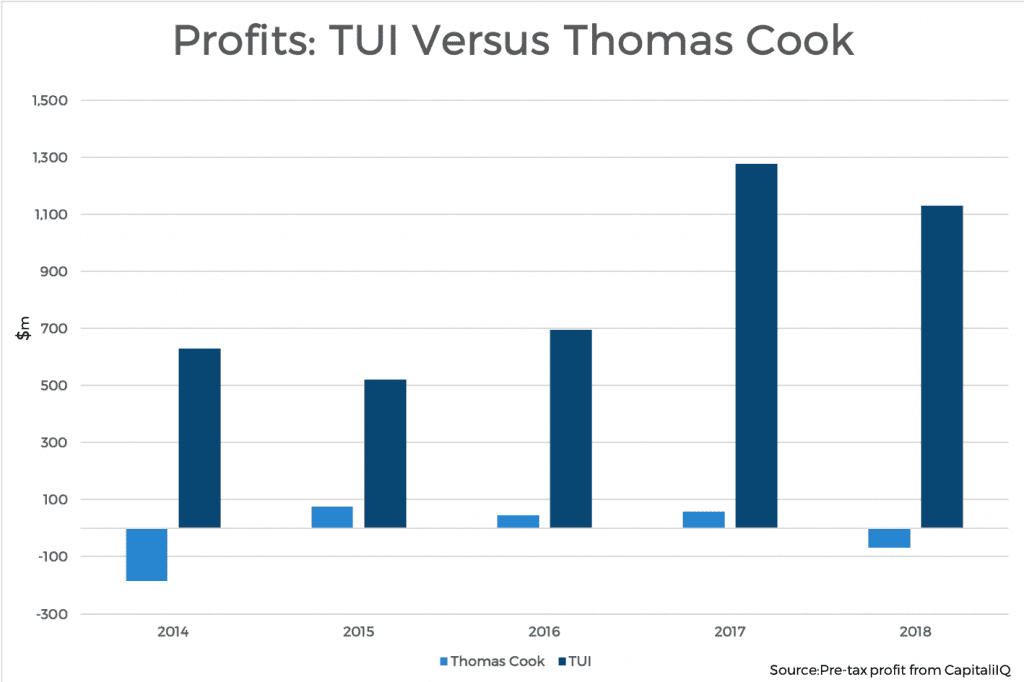

With Thomas Cook gone, TUI Group is the only vertically-integrated tour operator left standing in Europe. It too has a business model susceptible to shocks but has spent a considerable amount of money investing in hotels and cruise ships in the last few years, putting it in a better position.

“Thomas Cook’s collapse likely highlights the risk that the tour operator model takes, with certain large liabilities taken on and uncertain revenues to be collected later. However, TUI is a far more resilient business with less leverage and far more stable cash flows coming from its cruise and hotels businesses,” said Clarke in a note to investors.

Others too, could benefit. Leisure airlines like Ryanair and EasyJet, which fly to sun and beach destinations in Europe now have less competition. UK-focussed Dart Group, which owns the Jet2 airline and tour operator business, could also take advantage.

“We think Thomas Cook’s collapse should alleviate some of the overcapacity in the industry, and perhaps lead to medium-term margin recovery,” said analysts at Morgan Stanley.

The share prices of Dart Group, TUI, EasyJet, and Ryanair were all trading up on Monday after Thomas Cook’s collapse.

Rescue Mission

Thomas Cook’s collapse has led to the UK government launching its largest-ever peacetime repatriation with more than a dozen planes brought in to fly stranded customers home over the next two weeks. Airlines like British Airways and Virgin Atlantic are involved.

The company’s pan-European operations have caused some confusion across the continent. In Germany, the Condor airline is looking for a bridging loan from the federal government to secure its future and although other tour operator subsidiaries have not filed for insolvency, they have stopped selling holidays.

A message on Thomas Cook’s German website said it was exploring options to try and save the business but it would be forced to file for bankruptcy should these fail.

It’s a similar story in the Netherlands, which is part of the same continental Europe market.

“The Dutch organization is currently looking into the possible options for limiting the impact of the Thomas Cook Group Plc bankruptcy on its customers and employees,” a statement on the website said.

After a day of “intensive work” behind the scenes, Thomas Cook Airlines Scandinavia will resume flights on Tuesday but given its parent company’s bankruptcy its future like the other parts of the European business remains incredibly uncertain.

UPDATED: This story was updated to include comment from Expedia and news about Thomas Cook Scandinavian business.