Cathay Pacific’s Long View on Investing Outside of Its Jets

Skift Take

On Experience

Colin Nagy is a marketing strategist and writes on customer-centric experiences and innovation across the luxury sector, hotels, aviation, and beyond. You can read all of his writing here.Premium airline messaging is full of hyperbole tailor-made for marketing. Crack open Departures magazine or any of the travel monthlies, and you see glossy pages filled with onboard chefs, offers of chauffeurs to the plane, and all sorts of decadence that makes a traveler’s mouth water.

However, in a business downturn, these are among the first things cut to the bone.

The Etihad lounge in Abu Dhabi that blew my mind the first time I flew the airline nine years ago was a shell of its former self on a recent transfer. There was no magic, and if you squinted, you could probably feel like you were in a decent, but not incredible U.S. lounge. Same goes for the car services, barbers, spa treatments and many other accoutrements that the Middle Eastern carriers were touting for a long time. Now, end-to-end, many of these experiences remain far and away better than most of their competitors, but it does go to show management’s willingness to cut into the premium offering when times get tough.

So it is interesting to observe the story of Cathy Pacific. The brand is quite frankly, under siege in the region from low-cost carriers, newly opening competitive airports, while being in the middle of a three-year turnaround plan. But despite this, Cathay has continued to heavily invest money, time and design thinking in their so-called “soft” product outside of the onboard experience. It is a contrarian move that would undoubtedly make the accounting department at other airlines think twice. But the brand is taking a refreshing long view on hospitality and what their customers want. Other airlines should listen and learn.

“In a business downturn, it is even more important for us to invest in our product,” says Philippe Lacamp, Senior Vice President, Americas, for Cathay Pacific. “When we come out of our turnaround, we need to be able to have the lounge and other “soft” experiences to match our trajectory, so that when we come out on the other side, we are well-placed in what is a very competitive market.”

The brand recently opened another new lounge, The Deck, at Hong Kong International Airport on March 22nd, the latest addition to a range of what I feel are some of the best in the world.

Designed by Ilse Crawford, they are gracious, empathetically designed and offer crisp service. There are healthy options like juice bars, good coffee, an array of print newspapers and in the case of their flagship Hong Kong lounges, cabanas and quiet places to nap on a long layover.

They feel clean, thoughtful, and far removed from the state of most lounges filled with morning croissant crumbs, luggage scuffs on white walls and bland, robot-made coffee. It is not an inconsiderable investment to launch them and to make them run well every day.

The lounges are also remarkably consistent even outside of the central hub in Hong Kong, with high brand standards, perfect signage, consistency, and investment as far afield as Vancouver, Tokyo, Bangkok and more. It’s a far cry from the airline brands that have glitz and glamour on their home turf, but a tired, scruffy lounge in outstations that don’t represent the brand well. Anyone that has tried to board a great carrier in a far-flung outpost is often shuttled to a partner lounge or experiences something that is a shell of the core brand experience.

Long-term Thinking

To understand why the brand can take the long view, part of the answer is with Cathay Pacific’s parent company, The Swire Group, which is over 200 years old. “For six generations, the company has been in the same family,” said LaCamp. “What this means is that we’re not in the quarter-by-quarter game–we look at results in decades. Longevity only comes from long-term thinking.”

While the onboard business class product has needed to play some serious catch-up to the standard of other global competitors, Cathay has started to address this by launching a new approach to meal service that gets rid of the trolly and assembly line experience that passengers disliked as it felt cold and formulaic. The hard product is set to further improve with the metal of the reliable 777s used by the airline shifting to futuristic, passenger-friendly carbon fiber with the delivery of new A350-900s, with destinations well served by the aircraft like Copenhagen, Washington Dulles, etc.

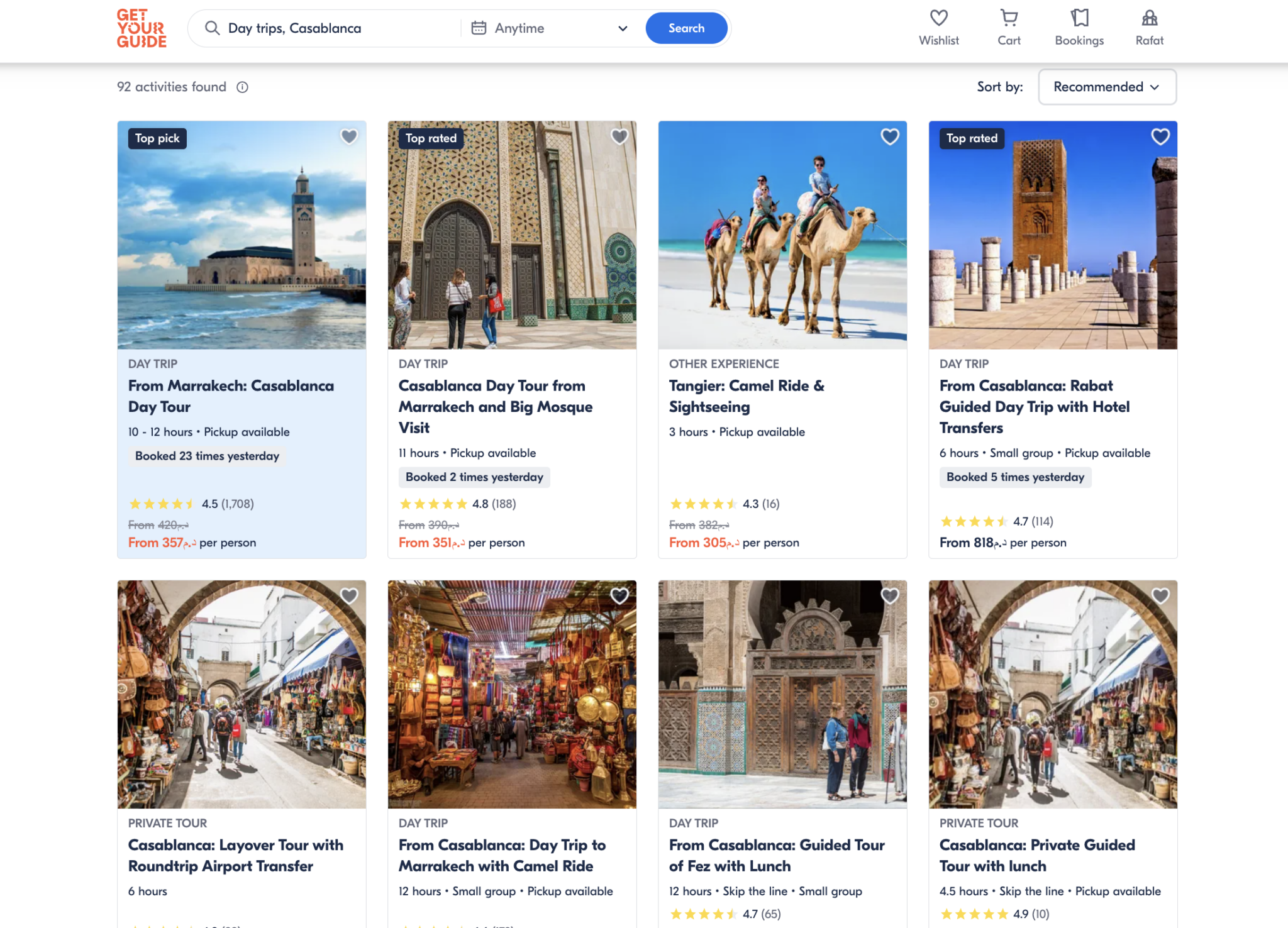

One glaring item that the brand is seeking to address is the issue of competitive pricing within the Asia market. Travelers looking on travel aggregators like Kayak in the past would be surprised to see fare differences of up to 2 or 3 times more for an economy, short-haul fare on Cathay. And one wagers that brand loyalty can only go so far when the price tag is out of whack. But this is something firmly on the radar for Cathay to fix and I got the sense that it is a top priority when it comes to pricing algorithms.

As for the rise of the competition emerging on Hong Kong’s doorstep and through the growth of low-cost carriers, LaCamp points to Cathay’s global view and obsession with creating a customer-centric experience. “The brand was founded by American and an Australian over 70 years ago, and we have international roots and a global sensibility. Our longevity is a testament to our passion for flying.” And one assumes that this longevity is also due to take the long view in hard times, and not caving to short-term analyst demands and the whims of the market minute.

Those carrying a Cathay Diamond Plus loyalty card would tend to agree, and my informal canvassing of Hong Kong-based migratory birds that log 300,000 miles a year on the airline found no sign of them running for the competitors just yet. Turns out “soft diplomacy” still works a charm on them.