Booking Is on the Road to Becoming a Full-Service Online Travel Agency

Skift Take

Online travel giant Booking.com has been testing ways to expand beyond its traditional specialty in hotel bookings.

In recent months, it has been experimenting with adding flight-hotel packages, airport taxis, and other services. It is also exploring a revamp of its loyalty program.

Some users have seen a test of a flight-plus-hotel feature — sometimes with an optional rental car and airport transfer add-on — across multiple language versions of its platform. The feature is being tested in places such as the U.S., France, Poland, and Turkey.

The tab we’ve seen is labeled “Flight + Hotel,” “Vacations,” or “Packages,” depending on the test.

In March, Booking.com has been sourcing packages for its U.S. audience from its Priceline.com sister brand.

For a few months, it had been getting invenotry via the intermediary LastMinute for users based in the UK and Europe. The latter move enabled Booking to offload responsibility for complying with European and UK regulations about the sale of packaged travel.

A Booking.com spokesperson declined to comment, other than to confirm that the company has not announced that it will offer flight and hotel packages.

Lots of Experimentation

In the summer, Booking.com broke with its hotel focus and added features tabs to its homepage flights from Kayak, car rentals from RentalCars.com, and restaurant reservations from OpenTable — all sister brands of parent company Booking Holdings.

On Monday, we reported that Booking.com is stepping up its alternative accommodation push by more assertively adding short-term rental inventory to the whole home vacation rental properties it had already been signing up.

An expansion would carry risks. Booking.com’s focus on accommodation has partly enabled it to be more profitable and have a more efficient marketing spend than Expedia Inc., the rival online travel conglomerate.

Airfares are less lucrative on average than hotels, due to lower commissions. Expedia sells more airfares as a proportion of revenue than Booking.com has.

Here’s a look at a handful of Booking.com tests and moves.

Flights

Booking.com has not officially launched flights, despite the “flight,” as well as “airport taxi,” and other tabs some users have been seeing for about nine months now.

On March 7, at the ITB trade show in Berlin, Booking.com CEO Gillian Tans said in an on-stage interview that her company might make flights a standard product offering.

It was unclear where Booking.com would source its flight inventory from. It has used sister company Kayak for its flight products in tests. It has used Priceline.com for its flight-plus-hotels packages in the U.S.

But it may want to cut its own supply deals via intermediaries like Amadeus, Sabre, and Travelport or through direct connections with airlines.

Rental Cars

We haven’t seen rental cars as a tab yet in U.S. tests. But in the Flight + Hotel or Vacation features being tested, consumers aren’t limited to flight and hotel packages. They also have the option to book a flight with a rental car — or a flight and hotel with a rental car.

On January 1, parent company Booking Holdings moved its U.K.-based reservation service RentalCars.com under the Booking.com umbrella. That organizational decision will help “to more effectively offer Rentalcars.com’s services to address the ground transportation needs of Booking.com’s customers,” the company said in a regulatory filing.

Airport Taxis and Shuttles

For many months, Booking.com has shown many users a tab for offering “airport taxis.”

Rideways, a private car service aimed at international travelers and small groups, powers that service. Parent company Rentalcars.com launched Rideways in December 2016.

Chatbots Mixed With Human Agents?

Booking.com really really doesn’t want you to call 1-888-850-3958, its U.S. customer service hotline. Calls cost a lot to handle. But the hotel booking giant will get more calls if it expands into selling flights and other complex products prone to last-minute cancellations and other messes.

Um, wait, do we hear the sounds of chatbots being built?

In the summer, Booking.com bought and absorbed Evature, a company specializing in the artificial intelligence that powers chatbots.

It is an ongoing industry debate whether the best chatbot approach is to build a tool in-house or to partner with an interface that average customers already are familiar with, such as Facebook Messenger, Apple iMessage or Tencent’s WeChat.

We haven’t yet seen Booking.com test a chatbot of any kind, even one compatible with these major tech platforms, although other industry players have. For example, TripAdvisor has tested a Facebook-compatible chat.

Corporate Travel

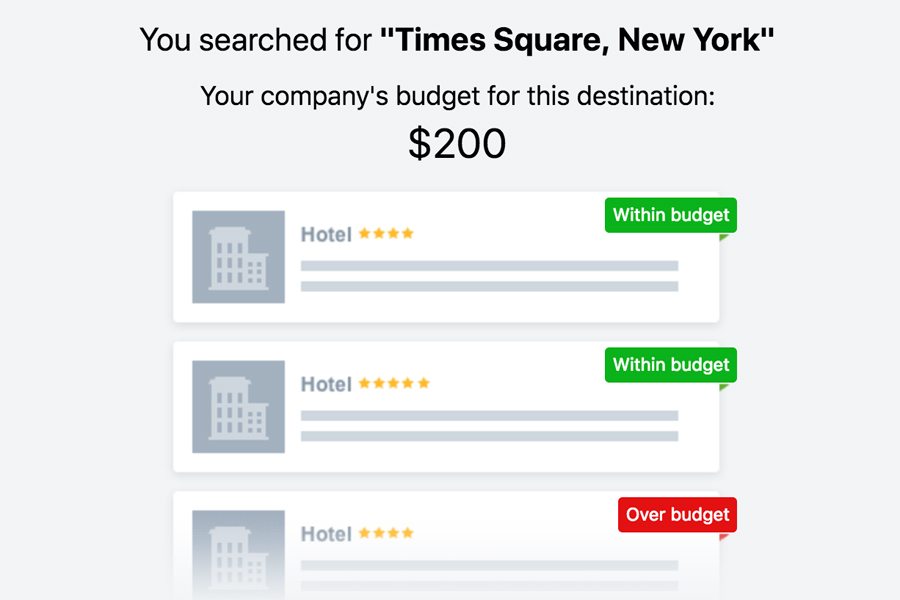

Earlier this month, the company renewed its effort to get employees at small businesses to book travel via Booking.com. It recently debuted a new tool that lets a travel manager set a business’s budget for average nightly rates so that employees signed in via its company-based service only see hotel options highlighted that comply with the policy.

Tours and Activities

Skift has seen Booking.com test tours and activities sales to consumers booking accommodation stays in several cities as part of the upsell process at the end of a transaction — though not yet as a tab on the homepage.

In one test, Booking.com sent a customer an email after their booking is completed suggesting things to do at their destination, with links that often — where products are available — are sold by GetYourGuide, a tour-and-activities aggregator.

Rewards Program

Booking.com has had a rewards program called Genius that it has typically, though not consistently, marketed as a service for business travelers.

The rules keep evolving. As of today, if you say you are a business traveler, that is often enough to qualify. It gives access to additional discounts of 10 percent off at a handful of hotels, typically high-end properties, in many destinations. An inconsistent additional perk is “early check-in priority.”

Booking.com may want to revamp its Genius program or roll out a new loyalty program that is explicitly focused on consumers.

In recent surveys of customers, it has been asking what its users might like if it were to offer such a program, giving a hint of how broadly it is willing to experiment.

One survey this week asked selected users, “Which travel rewards program are you a member of?”

It also asked: “Which 3 benefits would you find most useful in a travel rewards program?”

One of the options was a “free additional night after booking 10 hotel nights” — which is a rewards model popularized by Hotels.com, owned by rival Expedia, Inc.

Other potential rewards being considered included: Vouchers to use at a hotel for dining or other services at the property, and free parking or upgrades, which is reminiscent of the free bottle of wines or complimentary upgrades that some of the couple thousand hotels in Expedia’s VIP+ loyalty program offer.

A curious potential reward was “Online assistance with your trip (like restaurant reservations, booking a taxi, etc.)” Might it someday provide chatbot-based help via a mix of agents and artificial intelligence to loyalty members, as startups like Lola do now?

Another option was “Exclusive discounts on all accommodations.” Might that concept be modeled on HotelTonight’s HT Perks program where users receive different levels of discounts off the base hotel rates depending on how much they have spent via HotelTonight over their lifetime?

Insurance

Last summer, RentalCars.com began offering optional rental car-related insurance products protecting consumers against accidental damage to their rental vehicles. While other Booking Holdings brands, mainly Priceline.com, have long upsold travelers on damage excess waivers, we imagine the insurance product might soon start to appear on Booking.com, too.

In its recent financial filings, the parent company said the brands would be ‘increasing” the “insurance products” it offers — a comment absent from its spring 2017 filings.

Until now, Booking.com has not upsold consumers on insurance or offered installment payments, compared with Expedia Inc.-owned brands and other competitors. This may change.

The company may be keeping its eye on innovations in insurance. One example is price-protection insurance. Backed by JetBlue Technology Ventures, Flyr is a Silicon Valley-based startup whose airfare-prediction algorithms predict when a fare is going to go down and sells various financial instruments to companies and consumers based on that information.

Another example is the growing success of companies like Affirm and UpLift to sign up airlines, online travel agencies and others to use their white-labeled installment payment plan programs. While not traditionally an “insurance” product, installment payments fall under a broader financial technology that is related and that Booking.com might be intrigued by.

What’s Missing?

Ride-hailing apps are missing from the Booking.com arsenal.

In several recent financial filings, parent company Booking Holdings said it “currently, or may potentially in the future, compete with a variety of companies, including… companies offering new rental car business models or car- or ride-sharing services that affect demand for rental cars, some of which have developed innovative technologies to improve efficiency of point-to-point transportation and extensively utilize mobile platforms, such as Uber, Lyft, Gett, Zipcar (which is owned by Avis), BlaBlaCar, Didi Chuxing, Grab and Ola.”

Investors may read this first as a cautionary note that RentalCars.com may see a drop in business if rental car chains as a category see business reduced by the rise of ride-hailing giants like Uber and Lyft and vehicle-sharing businesses like BlaBlaCar.

But one could also wonder Booking.com would experiment with offering ride-hailing.

User-generated reviews to rival TripAdvisor, the giant of the genre, is another area Booking.com seems to be pressing harder on.

After recent stays, many Booking.com users have been receiving surveys not only to rate the properties they stayed at but to provide tips on the destination, including best sites to see.

Overall some of the tests may remain experiments that fail to pan out.

But some expansion beyond hotels may be inevitable as an outgrowth of the company’s mission. Booking Holdings claims that it is “the world leader in online travel and related services.” The industry will be eager to see how it expands upon that concept of “related services.”