The Airport of the Future Is Coming, But It’s Still Not Here

Skift Take

More airlines are dropping their resistance to participating in the Internet of Things and plan to invest in new technologies to improve the passenger experience, a new survey of executives found.

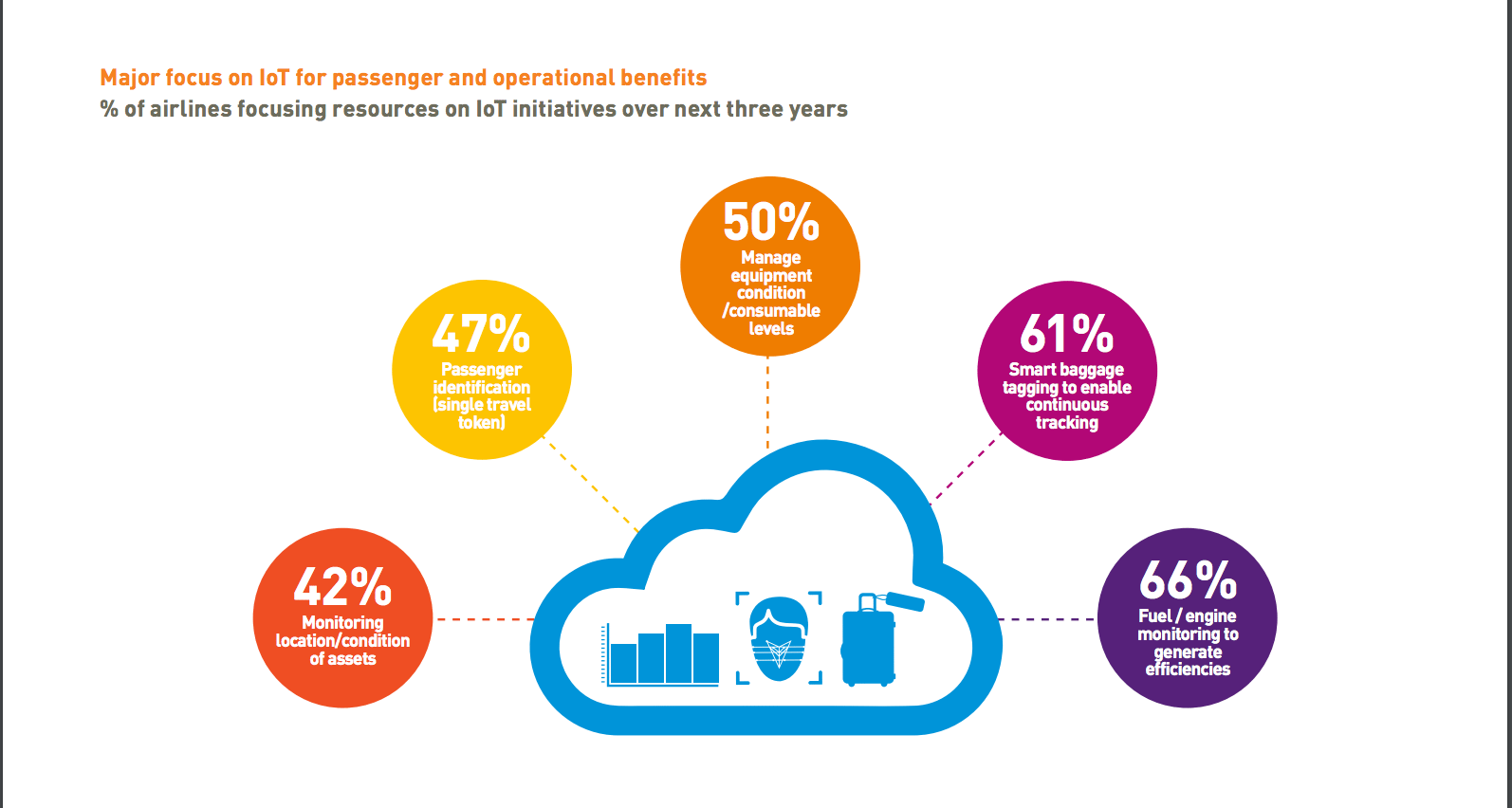

Today, fewer than a third of airlines have embarked on major Internet of Things projects, according to a recent survey by SITA, a European firm that provides technology solutions for the industry. And many of them are not using new technologies on passengers, but rather on strategies to help maximize fuel efficiency and to maintain their aircraft.

But that’s starting to change.

Technology executives at more than 50 carriers of all sizes and models told SITA they are more seriously evaluating Internet of Things solutions that benefit passengers. Interestingly, Chinese carriers are particularly intrigued by the Internet of Things, with 80 percent of the country’s carriers telling SITA they were planning a major project by 2019. SITA, however, take a wide view of what constitutes the Internet of Things, including just about all projects in which airlines plan to use technology to personalize the travel experience.

The Internet of Things describes a web of devices and people connected over the internet. Often, the idea is to make a consumer’s life easier, which is why products like an internet-connected refrigerator – it can tell you when to buy more milk – have increasingly been hitting the market. Airlines are intrigued by the Internet of Things, in part because they can use projects to tailor information and offers to individual passengers. Carriers also like the Internet of Things for maintenance reasons, such as when they can learn, through the internet, that there is a problem with a part well before an aircraft reaches the hangar.

At all airlines, many of the consumer-related projects under consideration are relatively minor in scope. For example, more than 60 percent of airlines said they are willing to share accurate estimates of “walk-to-gate” times with passengers, up from about one third in SITA’s 2015 survey. Additionally, more than six in 10 airlines reported they were interested in delivering real-time baggage tracking to travelers, up from about four in 10 in 2015.

Other projects are more invasive, and could take longer to implement, if airlines even bother at all. SITA is betting carriers may adopt what it calls ‘single token travel.’ With this approach, airlines would obtain a biometric scan at the first touchpoint in the traveler’s journey. Then, at the baggage drop, boarding gate, security line, or immigration checkpoint, passengers would submit to a facial scan to prove their identity. They would not need identification cards, passports or boarding passes.

About half of the airlines told SITA they would focus resources on biometric technology over the next three years. However, as with many Internet of Things projects, airlines say they are concerned about privacy issues. Almost every airline agreed that the “the perceived invasion of passenger privacy was an IoT challenge to some degree.”

Still, airlines are calculating they will receive benefits beyond making travel more efficient for customers. Now, according to SITA, most airlines track customer behavior through frequent flier program accounts. But increasingly, carriers understand they can obtain more complete data by track passenger whereabouts in the terminal and elsewhere. If they know more about customers, they can tailor offers to them.

In more traditional technology, carriers continue to invest in mobile applications, the survey found. While most U.S. carriers have long offered mobile boarding passes and check in, airlines elsewhere are beginning to catch up. About three in four airlines have mobile boarding passes, and SITA said more than 90 percent of carriers will offer them by 2019.

Carriers told SITA they hope to use apps to generate more revenue. Today, according to SITA, mobile app bookings account for only about 4 percent of overall revenue, but that number is predicted to triple in three years. Airlines also want to use apps to increase ancillary sales. Now, carriers earn about 4 percent of their total ancillary revenues through apps, but SITA predicts that will reach 14 percent by 2019.

Today, airlines usually sell offers like lounge access, WiFi and seating, but SITA predicts airlines will expand app-based sales by 2019, hawking non-airline related items like travel insurance and car rentals.