The Evolution of Low-Cost Carriers: Shaping The Future of Leisure Travel

Skift Take

You can barely recognize low-cost carriers these days. The focus had always been on single-aisle, narrow-body aircraft for short- to medium-haul routes. But there's been a dramatic shift in market dynamics: The LCCs are now venturing into long-haul flights and expanding their fleets to include wide-body aircraft.

Look no further than the news last month, first reported by Simple Flying, that IndiGo Airlines is poised to finalize a deal to lease six Boeing 787-9 Dreamliners, which would enable it to launch routes connecting India to Western Europe and North America.

Should IndiGo proceed, it would become the second Indian airline to operate flights to Europe, following Air India, and it would be the only low-cost carrier from India to do so. IndiGo confirmed Friday that's seeking to speed up its introduction of long-range aircraft and serve new markets.

This evolution of the low-cost business model is not just a trend, it is a clear indication of how the leisure travel market is changing.

In my latest report for Skift Research, I delve into this transformation. I examine critical themes such as the expanding role of low-cost carriers on intercontinental routes, the rise of premium leisure travel, and the shift toward modern distribution strategies in the low-cost sector.

Consider the success of airlines such as IndiGo, Ryanair, and GOL. While premium cabin revenues play an increasingly important role in airline economics today — with major carriers investing billions of dollars — the demand for discount airline products remains strong, particularly in Europe and the Asia-Pacific region.

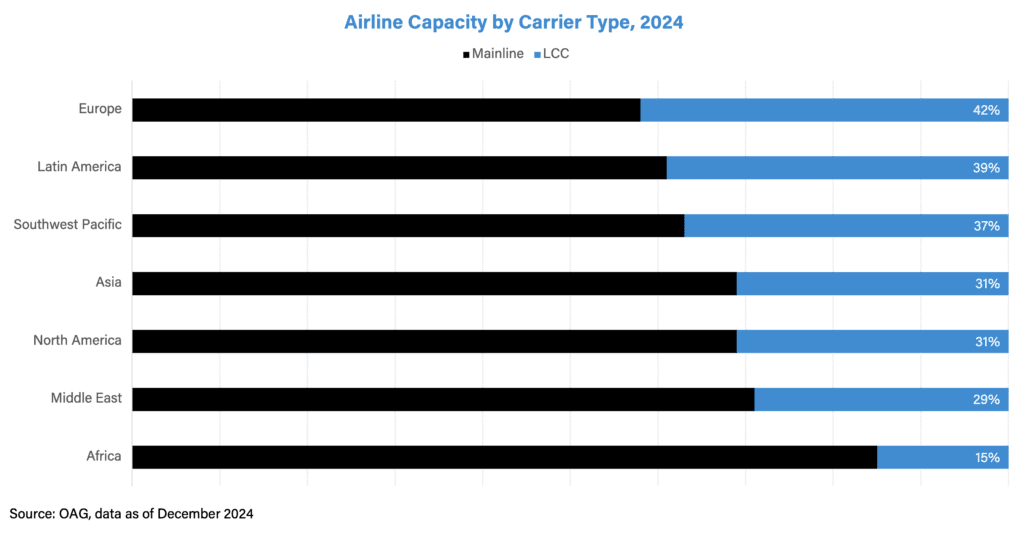

Low-cost carriers have a strong presence in Europe and Asia, commanding a market share of up to 42% in Europe, the second-largest aviation market in the world. Europe is home to some of the wealthiest countries globally, which further fuels the LCC market. Airlines such as Ryanair, EasyJet, and Wizz Air dominate the intraregional market, demonstrating the strong trust and loyalty they have cultivated among travelers.

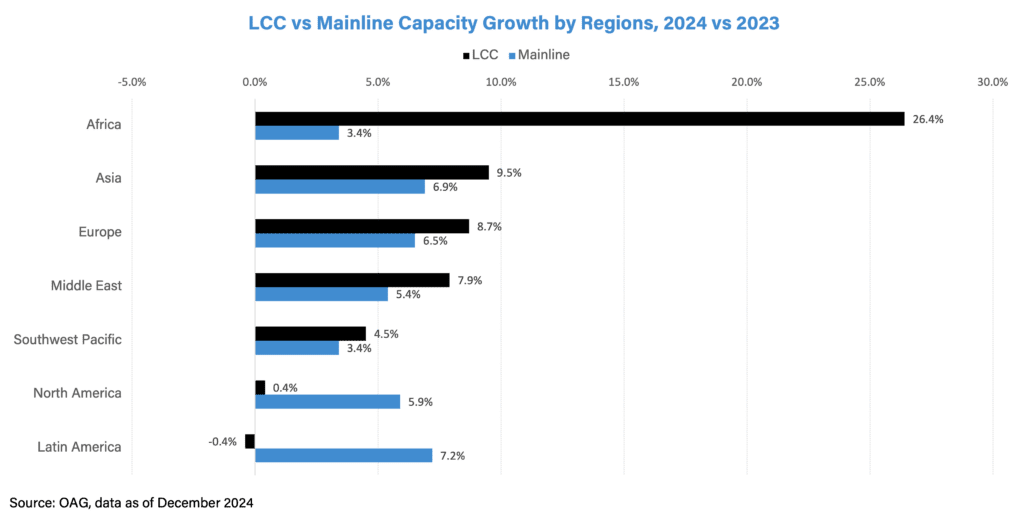

Outside of the Americas, low-cost airlines surpassed mainline carriers in terms of capacity growth in 2024.

In Africa, their capacity increased by nearly 27% in 2024 compared to 2023, while mainline carrier capacity only grew by 3.4%. A similar trend was observed in Europe and Asia, two of the largest inbound markets for leisure travelers.

In Asia, LCCs had nearly 10% year-on-year capacity growth, outgrowing mainline carriers by approximately 3%.

In Europe, they grew by nearly 9% year-on-year, while mainline carriers increased by about 6.5%.

The Middle East, a significant market for large network carriers such as Emirates, Etihad, and Qatar Airways, also saw budget airlines outgrowing their mainline competitors.

The strong market share and growth of low-cost carriers (LCCs), especially in Europe and Asia, have encouraged these airlines to launch routes in the profitable intercontinental markets that were once dominated by major carriers. The bigger question is: Will passengers continue to choose them over mainline carriers for long and ultra-long-haul flights?

Read my full report to find out more about it.