We've Done Revenge Travel and Normalization. Here’s What to Expect in 2025

Skift Take

New year, new travel plans. If 2023 was the year of revenge travel, and 2024 was one of normalization, what will 2025 bring for the travel industry? Likely a slow and steady baseline of growth. But there will also be plenty of challenges and changes.

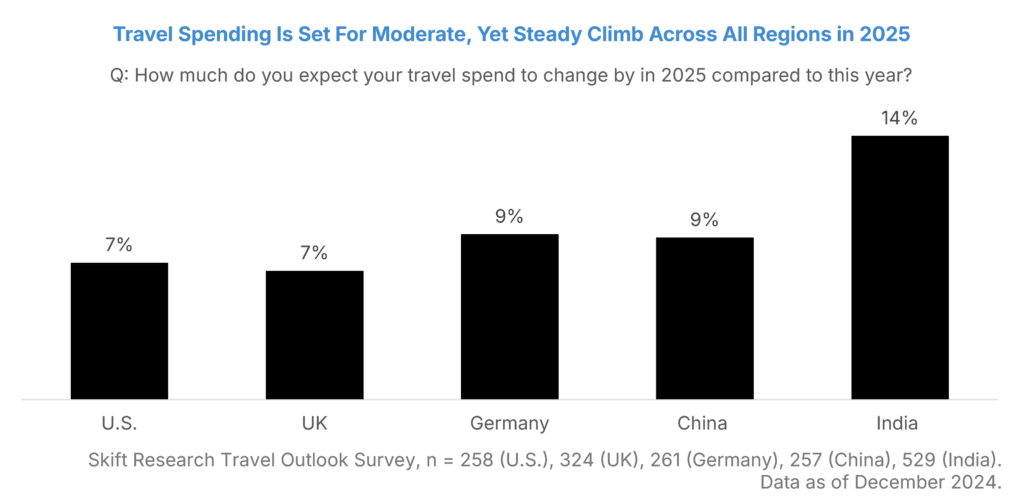

Skift Research’s new Global Travel Outlook 2025 takes a closer look at what the coming year has in store for the business of travel. New to the outlook is a five-country survey: We asked travelers in the U.S., UK, Germany, India, and China how they’re thinking about travel and what their budgets look like. Results from these ~1,600 global travelers bode well for the industry. On average these respondents intend to spend 9% more on travel this year. Travelers in India are particularly ready to hit the road – they expect to spend 14% more, the biggest increase in our survey.

These consumer-led survey results are consistent with our sector-by-sector revenue estimates for online travel, hotels, airlines, cruise, and short-term rentals. Both methods point to high single-digit revenue growth for the travel industry in 2025. That is below the revenge travel era, but in a world where the IMF expects global GDP to increase by 3.2%, it still makes travel a “GDP-plus” growth industry.

That’s not to say that everything will be smooth sailing. In the U.S., there is a massive change in power underway with Donald Trump set to head back to White House. It’s unclear how it will play out, though travel leaders are mostly optimistic. In Europe, slow growth remains the order of the day. China, too, is facing economic challenges while the Middle East continues its tourism investment full steam ahead. These disparate trends mean that region-specific expertise will likely be rewarded over a one-size-fits-all approach.

Overtourism and sustainable travel were put on the back burner by the pandemic. No longer in 2025. Regulators are on the move with junk fee rules, Airbnb bans, and emission mandates all being enacted. These old standbys will be joined by new challenges in 2025. Brands will have to fight to stay relevant in the face of new entrants and an increasingly jaded audience of travelers. Artificial Intelligence and other new tools will require investment in data and technology platforms. Inflation and labor costs remain top of mind.

But don’t mistake these many challenges for defeatism. Skift Research is still optimistic. That brings us back to our north star – the traveler.

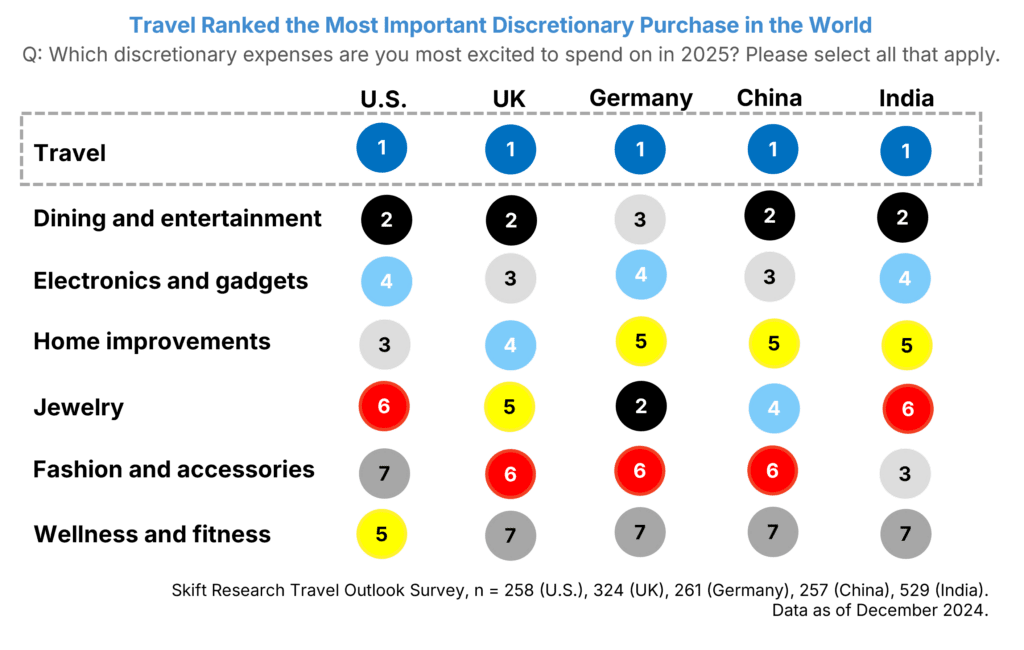

And on this front our survey work makes clear that the shift to spending on experiences over things remains strong. Travel is the discretionary purchase that people are most excited to splurge on. It outranks dining, electronics, jewelry, and more.

In the new year, the consumer intends to travel more often and spend more on travel. They want to explore new destinations, and, where possible, indulge in luxury rooms and experiences. Travelers are crafting a 2025 full of travel that balances exploration, responsibility, and indulgence. I’ll drink a new year's toast to that!

Read the Skift Research Global Travel Outlook 2025 for more insights.