Outdoor Economy Grows Across U.S., But Urban Giants Like New York Lag

Skift Take

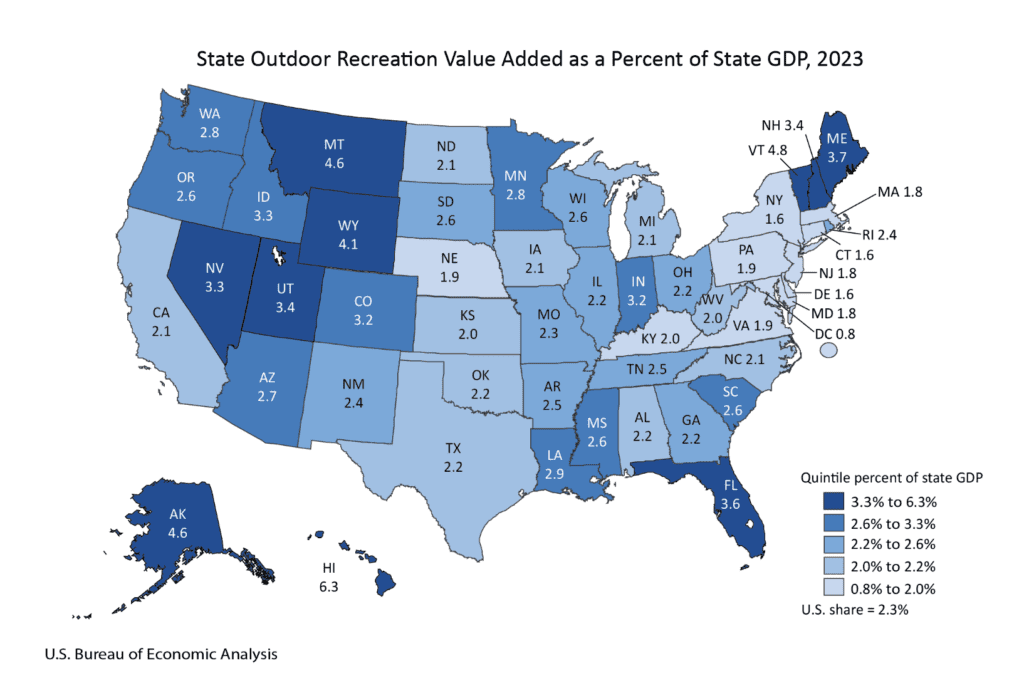

In a year when outdoor recreation contributed a record $639.5 billion to the U.S. economy, accounting for 2.3% of the nation's GDP, one surprising outlier stands out: New York. Despite its iconic parks, proximity to nature, and reputation as a cultural hub, New York’s outdoor recreation economy contributed only 1.6% to its state GDP in 2023. That's one of the lowest in the country, according to the U.S. Bureau of Economic Analysis' (BEA) latest Outdoor Recreation Satellite Account (ORSA) report.

New York stands in stark contrast to leading states like Hawaii, where outdoor recreation comprised a staggering 6.3% of its GDP. Even smaller states like Vermont and Montana saw significantly higher contributions, emphasizing the importance of rural landscapes and outdoor tourism in driving the sector’s growth.

New York’s relatively small contribution raises questions about urban states' challenges in capturing the economic potential of outdoor recreation. While the state offers iconic outdoor destinations like the Adirondacks, Catskills, and Central Park, much of its economy remains dominated by finance, real estate, and other urban industries. Additionally, the cost of living and accessibility barriers may deter some residents and visitors from engaging with outdoor activities.

National and State-Level Trends

Nationally, the outdoor recreation sector grew by 3.6% in real GDP, outpacing the broader economy’s 2.9% growth. Employment in the sector also increased by 3.3%, reflecting heightened demand for outdoor activities during a time when Americans continue to prioritize travel and leisure. Alaska stood out with the highest employment growth in the sector at 7.5%, while Indiana saw a decline of 4.8%.

Among other states, Colorado, Utah, and California performed well, thanks to their vast networks of national parks, ski resorts, and outdoor adventure offerings. However, urban-centric states like Connecticut, Delaware, and New York consistently lagged behind in outdoor recreation’s economic impact, despite hosting significant green spaces and tourism infrastructure.

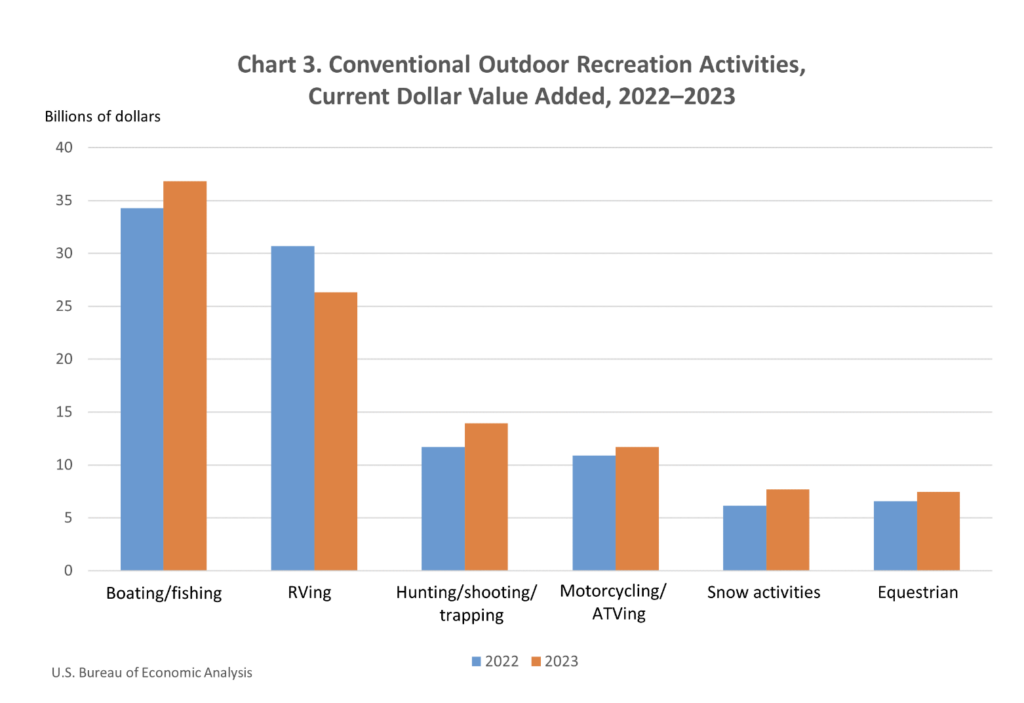

Breakdown of Activities

Conventional outdoor activities such as boating, fishing, and camping remained the largest contributors, making up 31.4% of the sector’s total value added. Supporting activities like transportation, accommodations, and dining—which reflect spending tied to outdoor trips—accounted for a substantial 48.5%. This demonstrates the interconnected nature of outdoor recreation and the broader travel and tourism ecosystem.

The arts, entertainment, recreation, accommodation, and food services industry emerged as the leading contributor, adding $165.2 billion to the outdoor economy. Retail trade followed with $156.3 billion, driven by robust spending on equipment, apparel, and other goods.

The BEA’s data underscores outdoor recreation’s growing economic importance but also highlights regional disparities. For states like New York, the challenge lies in finding ways to better leverage their outdoor assets to compete with nature-rich states driving the sector’s growth. As Americans continue to prioritize outdoor experiences, the opportunity for states to rethink their approach to outdoor recreation remains significant.

Below, the full data: Real Outdoor Recreation Value Added by Activity