Airbnb CEO's 10-Year Pay Package Could Turn Into $1 Billion or More

Photo Credit: Airbnb CEO Brian Chesky speaking with Skift CEO Rafat Ali At Skift Global Forum in September 2022. Source: Skift Skift

Skift Take

The net proceeds of Brian Chesky's 10-year pay package — which he said would be donated to host programs and to charities — would really soar if Airbnb's share price breaches tough-to-reach targets.

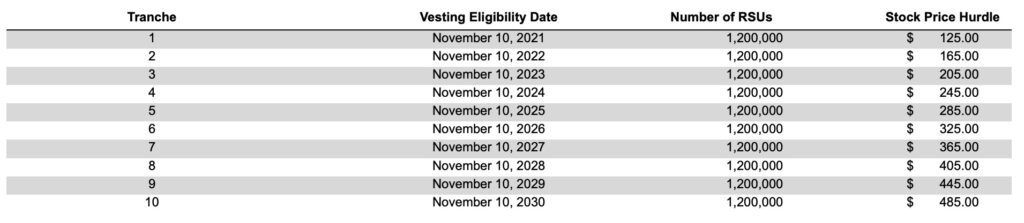

Airbnb turned heads in 2021 when it announced chairman and CEO Brian Chesky had been awarded a $120 million pay package the previous year that potentially included earning 12 million restricted stock units over the following decade.

The $120 million figure was for accounting purposes. However, the fair value of those stock units was estimated to be $430 million on the grant date of November 10, 2020, when then-privately held Airbnb's share price was $35.81.

But that was a month before the Airbnb IPO. By year's end 2020, the stock traded above $145.

It may turn out that the 10-year package for Chesky could soar to $1 billion or more if Airbnb's share price hits certain price targets during each of the 10 years, and he remains CEO.

$1.3 Billion Value for 2023-2030

In a proxy statement issued late last month that included its executive pay figures, Airbnb noted that the potential value of Chesky's eight remaining tranches of unearned shares at the end of 2023 was $1.3 billion. [See update below.]

That's the value at the end of 2023 of the remaining 9.6 million shares in the 12 million share package that haven't already vested. These would be for years 2023-2030.

But Chesky's actually receiving them is far from a sure thing. Let's look at what Chesky has received so far, and the hurdles he needs to clear to hit that potential payout.

Payouts come two years after the vesting eligibility date.

- Tranche 1: These vested in November 2021 with a stock price hurdle of $125. Airbnb cleared that and Chesky netted around $136 million in November 2023. That payment was based on the share price in November 2023.

- Tranche 2: Chesky earned this tranche in late 2021, and the shares vested in November 2022 with a hurdle of $165. Chesky won't receive the shares until November 2024. Based on Tuesday's closing share price of $156.66, that tranche would be worth about $188 million before taxes.

- Tranche 3: These vested in November 2023 and were included in the $1.3 billion fair value estimate. But they had a stock price hurdle of $205 per share in 2023, and Airbnb shares didn't hit that mark.

So the two tranches already earned could potentially inflate the $1.3 billion figure because they weren't included in the estimate, but the unmet third tranche for 2023 may lower it.

That highlights the difficult nature of estimating the potential payout because it is based on whether Airbnb's share price hits the designated thresholds, and the actual share price on the date an earned award settles.

10 Tranches of Potential Stock Awards to the Airbnb CEO

Tough to Achieve

Future stock awards will be even tougher to achieve than the ones already earned. For example, the stock price hurdle is $245 per share in 2024, meaning the stock would need to average $245 over a 60-day trailing period. That stock price hurdle is $365 in 2027, and $485 in 2030.

If Airbnb hits those share price marks, Chesky and fellow shareholders would be making a lot of money.

When the board initially awarded the pay package to Chesky, it made the following statement: "In designing the compensation program for Mr. Chesky, our board of directors was cognizant of Mr. Chesky’s intention to contribute shares of our common stock worth over $100 million to support the Host Endowment Fund and to donate the net proceeds from the Multi-Year Award to community, philanthropic and charitable causes."

So the payout after Chesky's taxes get paid could ultimately go to programs to benefit Airbnb hosts — such as educational grants or emergency funds during pandemic-like crises — and various charities. Skift could not confirm if any contributions had already been made.

What Chesky Already Owns

Even if Airbnb doesn't hit the stock price hurdles over the next seven years, he still owns a lot of shares.

Chesky directly owned more than 14.3 million Class A Airbnb shares and another 187,000 indirectly through trusts, according to a February financial filing. Based on Tuesday's closing price of $156.66, those holdings would be worth nearly $2.3 billion.

In addition to the Class A shares, Chesky and co-founders Nathan Blecharczyk and Joe Gebbia held 88.4% of the company's Class B shares, and wielded 79.4% of the company's voting power as of March 15, 2023.

The Airbnb CEO's base salary in 2023 was $1, and the company paid $295,124 for his personal security costs that it labeled "all other compensation."

The median employee pay last year at Airbnb was $243,757.

Update: Airbnb pegged the fair value of Chesky's remaining eight unearned tranches at $1.3 billion based on the closing share price of $136.14 on December 29, 2023. But if Airbnb granted Chesky each tranche at the designated stock price milestone as each tranche was earned, then they would be worth nearly $3.3 billion.

Accommodations Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of hotels and short-term rental sector stocks within the ST200. The index includes companies publicly traded across global markets, including international and regional hotel brands, hotel REITs, hotel management companies, alternative accommodations, and timeshares.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more hotels and short-term rental financial sector performance.

Read the full methodology behind the Skift Travel 200.

Note: Skift updated the story to reflect the potential value of the eight unearned tranches if Airbnb granted the shares at each stock hurdle as each tranche was earned.