Skift Take

Not everyone can afford to stay at the Wynn.

Demand for hotel stays will be greater than supply in Ras Al Khaimah, according to Tatiana Veller, managing director of Stirling Hospitality Advisors, a subsidiary of state-owned RAK Hospitality Holding.

She said interest in the emirate has skyrocketed since the announcement in 2022 that a Wynn resort would be opening.

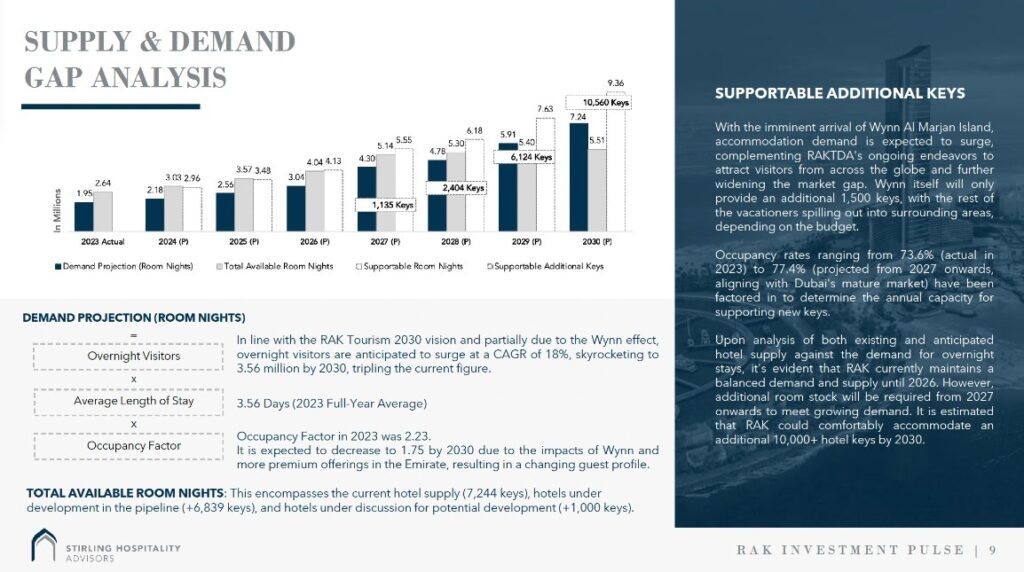

“Doubling the inventory in four years isn’t quite enough,” she said during the “RAK Investment Pulse” webinar. “Right now, we [RAK] are roughly even with demand and supply. By the time Wynn opens in 2027, the demand for additional room nights is overtaking supply.”

At the end of last year, the emirate had around 7,250 hotel keys. By 2027, it looks to double that to 14,000 and then reach more than 15,000 by the end of the decade.

This is still not enough, Veller said. “The gap will start to grow. By 2030, we could be about 10,000 hotel keys short [to meet demand]. We are quite certain in these numbers.”

Ras Al Khaimah brought in 1.2 million overnight visitors last year and wants to increase that number three-fold to 3.6 million by 2030.

Stirling shared the below slide to illustrate its point, showing “demand projection” outweighing available supply.

With the Wynn ‘only’ having 1,500 rooms, RAK Hospitality Holding said more hotels are needed to capitalize on a “spillover” from the Wynn.

Veller said: “All of that demand [from the Wynn] will be spilling out into neighborhood hotels. Guests will be selecting their hotel based on their budgets.”

The average daily rate to stay in Wynn Las Vegas was $513 in 2023. By comparison, the average daily rate across RAK’s entire hotel sector was $141 in 2023.

Opportunities Outside of Wynn

Addressing the high price point of the Wynn and other hotel projects, RAK Holding told investors there is a wide-open opportunity to build more mid-scale hotels in the emirate.

RAK Hospitality Holding COO Donald Bremner said on the call: “Some near-term opportunities are a layer off the beach, into land a bit more. Look at mid-scale hotels or lifestyle hotels. If you can get the land and get a plan in that second layer, it’s a good opportunity.”

Bremner noted that much of Ras Al Khaimah’s hotel business right now comes from package deals and all-inclusive stays. One of the city’s best-known hotels is the Rixos Bab Al Bahr – an all-inclusive brand under Ennismore.

“Where those customers will want to go is another opportunity. They want sun, sea and sand but perhaps want more traditional package holidays further away from the Wynn,” Bremner said.

By 2027, RAK is projected to have just eight three-star hotels compared to 25 five-star and eight four-star hotels.

Marriott has announced four five-star flags so far, including Le Meridien, a JW, a Westin and a W hotel. Smaller, more exclusive operators such as Nobu are also landing on the island. On the more affordable end, Emaar-backed Rove will open on Marjan Island and a home-grown brand called Earth, originally co-founded by the emirate’s now-tourism chief, will open its own resorts as well.

Bremner explained: “Wynn is our game changer. It causes an investment into infrastructure that lets us appeal to a wider audience. Off the back of Wynn, our tourism sector has flourished. Lots of opportunities are here now and a lot of partners want to be here in RAK.”

Have a confidential tip for Skift? Get in touch

Tags: ras al khaimah, wynn al marjan island, wynn resorts

Photo credit: Overlooking Al Marjan Island in Ras Al Khaimah. Used for illustrative purposes. Credit: Unsplash