Skift Take

In a surprising twist, Alaska wants to buy Hawaiian.

Alaska Air Group reached a deal to buy struggling Hawaiian Airlines in the latest round of U.S. airline consolidation.

The deal would have the Seattle-based group buy Hawaiian for $18 per share in an all-cash transaction valued at $1.9 billion including Hawaiian’s debt. Alaska Air Group, which owns Alaska Airlines and regional Horizon Air, will continue to operate Hawaiian as an independent brand and airline within the group. It will remain based in Seattle and led by CEO Ben Minicucci.

“This combination is an exciting next step in our collective journey to provide a better travel experience for our guests and expand options for West Coast and Hawai’i travelers,” Minicucci said in a statement Sunday.

Hawaiian CEO Peter Ingram added: “With the additional scale and resources that this transaction with Alaska Airlines brings, we will be able to accelerate investments in our guest experience and technology, while maintaining the Hawaiian Airlines brand.”

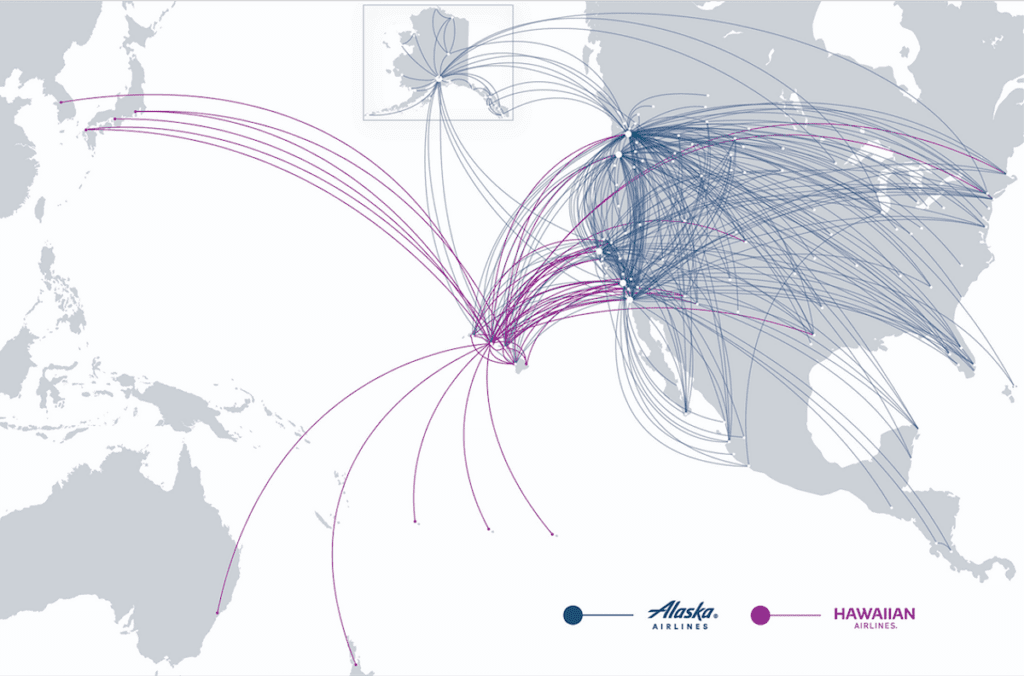

Alaska said it plans to expand Hawaiian’s Honolulu hub to enable “greater international connectivity for West Coast travelers throughout the Asia-Pacific region.”

Alaska is the sixth-largest U.S. airline by seats, and Hawaiian is the 10th-largest, according to Cirium Diio schedule data. Together they would be the fifth-largest carrier behind American Airlines, Southwest Airlines, Delta Air Lines, and United Airlines. And, if JetBlue Airways and Spirit win court approval of their proposed merger, they’d be the fifth-largest and Alaska-Hawaiian would be the sixth.

Whether the Alaska-Hawaiian deal can win U.S. Justice Department approval remains the be seen. The regulator has taken a firm stance against consolidation in the airline industry. It successfully sued to unwind the American and JetBlue alliance in the northeast, and has gone to trial to block JetBlue’s proposed takeover of Spirit.

Hawaiian has struggled to return to profitability since the pandemic. The airline has faced a number of challenges, including the slow recovery of the important Japanese visitor market to Hawaii and, more recently, the issues with Pratt & Whitney geared turbofan engines that power its Airbus A321neos. The latter has forced Hawaiian to ground as many as four aircraft at a time — nearly a quarter of its A321neo fleet — for inspections.

The expanded Alaska Air Group would operate 365 aircraft — including Airbus A330s and A321neos, and Boeing 717s and 737s — and have firm orders for another 119 planes, including 737s and Boeing 787s. It would serve 138 destinations and be part of the global Oneworld alliance.

Alaska plans to seek approval from Hawaiian’s shareholders in the first quarter. Deal close, which requires Justice Department approval, will take 12-18 months — or by as late as June 2025.

Alaska-Hawaiian Analysis

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airlines, alaska airlines, hawaiian airlines, mergers and acquisitions

Photo credit: Alaska plans to buy operate Hawaiian and operate it as a separate brand. Eric Salard / Wikimedia Commons