Skift Take

Dubai shows no signs of slowing down when it comes to building new hotels. Even if the emirate runs out of prime plots along the beach, it can simply resurrect man-made projects previously brought down in the '08 financial crash.

Size matters in Dubai, home to the world’s tallest building, the largest water park, and just because it can, the world’s largest “frame.” Already chief among the other six emirates in hotel development, Dubai is charging ahead with yet more rooms.

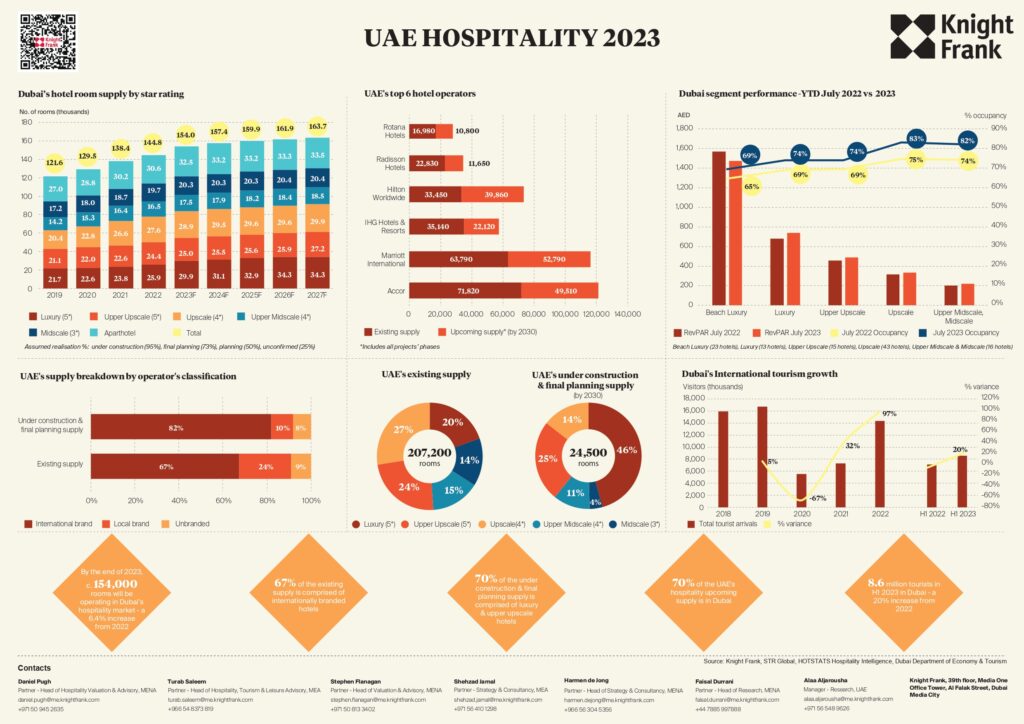

By the end of this year, the city will have more than 154,000 keys on offer to travelers, according to data from Knight Frank, surpassing Las Vegas.

Las Vegas has 151,771 hotel keys, according to the city’s Convention and Visitors Authority.

For Dubai, this increase marks a 6.4% supply boost compared to last year, Knight Frank said. A handful of international operators lead Dubai and the UAE’s hotel development: Accor, Marriott, IHG, Hilton and Radisson. Regional player Rotana rounds off the top six operators building in the UAE.

Largest operators in the UAE by hotel keys:

- Accor accounts for 71,820 existing rooms and has 49,510 more in the pipeline expected for completion by 2030.

- Marriott International: 63,790 existing rooms and 52,790 planned.

- IHG: 35,140 current rooms and 22,120 in development.

- Hilton: 33,450 rooms and 39,860 upcoming.

- Radisson: 22,830 rooms and planning an additional 11,651.

- Rotana: 16,976 rooms and 10,807 in development.

Supply and Demand

Dubai doesn’t seem afraid of supply outweighing demand. While more and more hotels come into the city, occupancies, RevPAR and ADRs remain level in the city.

According to STR data cited by Knight Frank, the Dubai market as a whole in July 2023 recorded a 0.8% increase in RevPAR compared to July 2022, driven by a 6.8% increase in occupancy but held back from further growth by a 5.6% decrease in ADR. Occupancies in July 2023 reached 82%, up from 74% at the same point last year.

Knight Frank’s analysis also points towards the disproportionate success of luxury and beachfront hotels in Dubai compared to other segments. In July 2023, the RevPAR brought in by Dubai beach hotels was more than triple or quadruple other segments, at approximately 1,500 dirhams ($408).

Building more of these luxury properties is top of the agenda in the emirates. Looking at the pipeline over the next seven years, 46% of the planned 24,500 keys are within luxury properties. Another 25% is for upscale, and just 4% is for 3-star hotel rooms.

Ran Out of Beachfront? Just Build More

Seeing the immense appetite for luxury property, Dubai has awakened its dormant beach developments. In May 2023, the Dubai ruler announced that Palm Jebel Ali island was back in development. Twice the size of Palm Jumeirah – home to the two Atlantis resorts – Palm Jebel Ali is planned to have an area of 13.4 sq km, add 110 km of coast to Dubai and be home to more than 80 hotels and resorts.

Another such island, designed to give Dubai more valuable beachfront development space, is Dubai Islands, also recently revived after being mothballed amid the 2008 financial meltdown. All three of these islands are developed by a local company called Nakheel.

The five-island development, formerly called Deira Islands, aligns with the UAE’s ongoing push to be a global destination of choice for residents and investors, Nakheel said.

Have a confidential tip for Skift? Get in touch

Tags: dubai, Dubai Hotels, las vegas, luxury, marriott

Photo credit: Atlantis The Palm