Consumers Still Have Heaps of Cash, but ‘Old Normal’ Could End Revenge Travel

Skift Take

New U.S. banking data from the JPMorgan Chase Institute, a think tank embedded within the country’s largest bank, suggests that households remain healthier than many economists feared. This could help explain why, in the face of higher inflation, travel spending has remained robust.

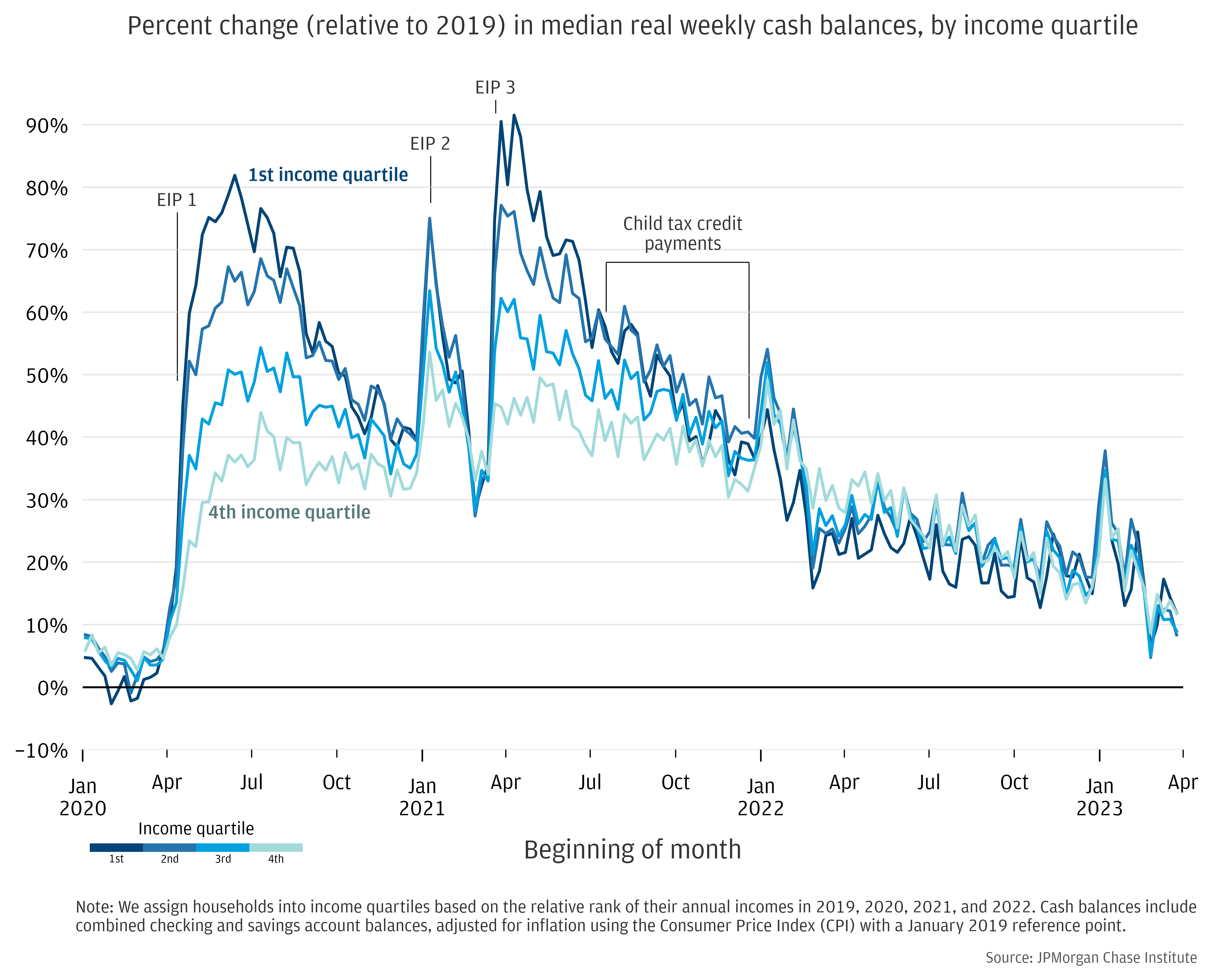

The study looked at cash balances, adjusted for inflation, held in checking and savings accounts across nine million Chase customers from January 2020 through March 2023.

In 2020 and early-2021, cash balances rose by a dramatic 80%+ above pre-COVID baselines as accumulated savings and government stimulus buoyed household balance sheets. But you already knew that – those “excess” savings fueled the revenge travel wave that our industry rode throughout 2022.

What’s most interesting is where we stand today. Cash balances remained elevated by 20-30% relative to 2019 through the first half of 2022 but decreased in the second half of 2022 and the first quarter of 2023.

Even with that decline, the data shows that households across all income brackets recently held 10-15% more cash in their bank accounts than they did pre-pandemic, even after accounting for the higher prices of everyday goods.

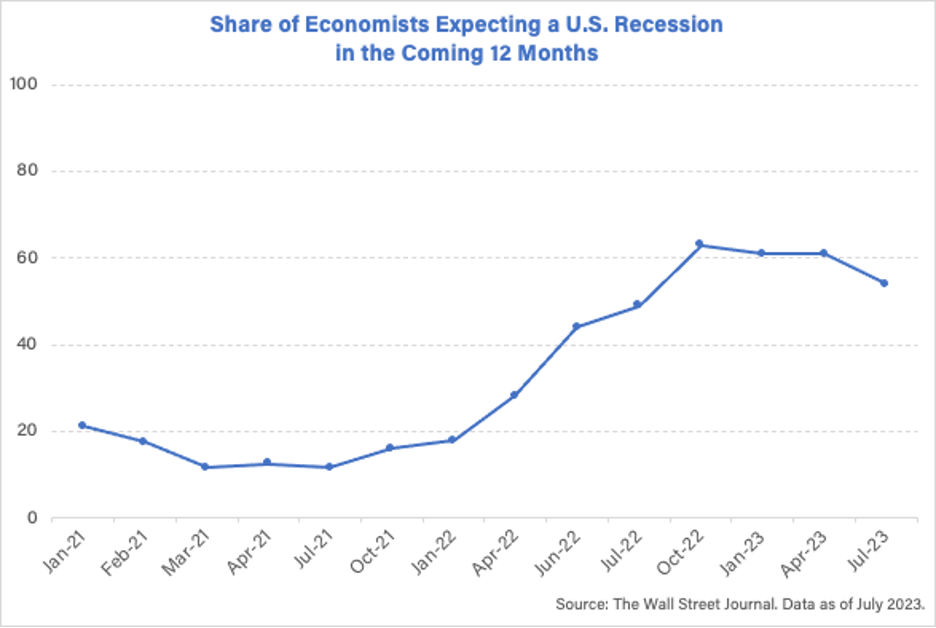

This finding helps explain how the U.S. has avoided a recession despite economists widely calling for one.

It is also worth thinking through the counterfactual: How much better off would Americans have been with no pandemic, no stimulus, and no inflation? The JPMorgan Institute ran the same study over more normal time frames, from 2013-2016 and from 2016-2019. It found that in both of those three-year periods, average U.S. households bank balances increased by 10-15%.

Said another way: Over a typical three-year period, Americans get 10-15% wealthier and today, after three years, Americans are 10-15% wealthier. In sum, we are back to the pre-pandemic trend.

This suggests that revenge travel will come to an end. We may have put off a recession, but this study suggests Americans no longer have ‘excess’ savings.

U.S. Government Data also Supportive

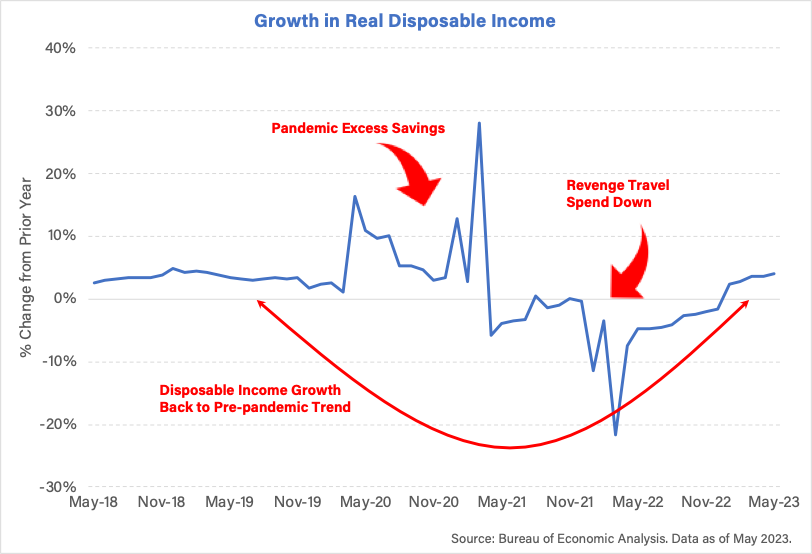

Broader data from the U.S. Bureau of Economic Analysis tells a similar story. Before the pandemic, the disposable income of Americans was growing around 3% a year. That jumped during the pandemic. At its peak in March 2021, Americans had $19 billion of disposable income, up from $15 billion before the pandemic. As the economy re-opened, that extra cash was spent down and disposable incomes fell by nearly 20%.

Americans today are generating around $15.6 billion of disposable income, just a touch more than they had before COVID hit. Disposable income, adjusted for inflation, is growing at some 3% so far this year, which is the same as the trend line before 2020. This suggests that 2023 is back to the old normal in terms of earnings and savings growth.

Are We Out of the Woods Yet?

The JPMorgan Chase Institute study, along with the BEA economic data, seem to point to the same conclusion. The U.S. consumer remains healthy, if more fragile than they were 12 months ago.

We shouldn’t expect much more revenge travel to fuel growth in the next year (at least in the U.S., Asia is a different story). At present, the industry is on track for a travel soft landing where growth decelerates to a more normal pace but doesn’t decline.

Does that mean we can put our recession obsession behind us? The improving economic and inflation data prompted the share of economists surveyed by the Wall Street Journal who expect a U.S. recession in the coming 12 months to decline in July. But despite that silver lining, more than half still foresee an economic contraction.

There are also rising risks from the business side of things. Many travel companies left the pandemic heavily indebted, putting them at higher risk from rising interest rates. For instance, the Financial Times reports that, “ten of the leading airlines in the US and Europe have built up $193bn in gross debt between them over two years, up from $109bn in 2019,” as of July 2022. And hotel owner Ashford Hospitality Trust recently announced plans to default on loans and return the keys to 19 properties.

The risk of a recession has not passed, but the U.S. consumer remains healthier than many feared. That should be the north star for the leisure travel spending. There will always be room for doubt, but banking balances are up and disposable income is growing. That spells good news for the travel industry.