Skift Take

Vacasa is a leader in brand building within the short-term rental space, but Skift Research estimates it still relies heavily on third-party booking sites, like Airbnb, for the majority of sales. Management surely hopes to become a majority first-party business – and to earn the margin benefits that follow.

Vacasa’s public debut in December 2021 was a big deal for the short-term rental market. As the largest branded property manager in the U.S., it touches nearly every part of the short-term rental sector and is an important bellwether for the space.

That’s why its stock market performance, down a staggering 94% since that debut, is such a disappointment. True, except for a few blockbusters, the entire stock market has been shaky. But with Vacasa’s losses of $17 million over the past 12 months and an outlook for slowing revenue growth, it’s hard to blame the market.

Skift Research recently conducted a deep dive into Vacasa and the future of branded short-term rentals to explore these issues.

The below excerpt focuses on Vacasa’s sales and marketing strategy. This is a critical piece of its business since it is so closely tied into the company’s distribution strategy. As Vacasa strives for profitability, is the company’s branded direct-to-consumer strategy paying off?

The full report digs deeper into the rest of Vacasa’s business, including its inventory, occupancy, pricing power, and overall cost structure. It also take a broader look into the current state of the short-term rental industry and how it will grow in a more normal environment after the pandemic-era boom.

Understanding Vacasa’s Sales and Marketing Costs

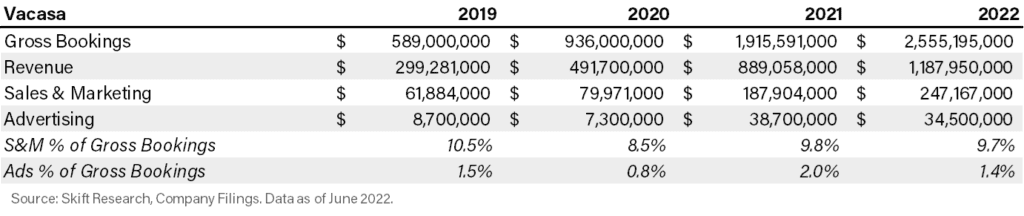

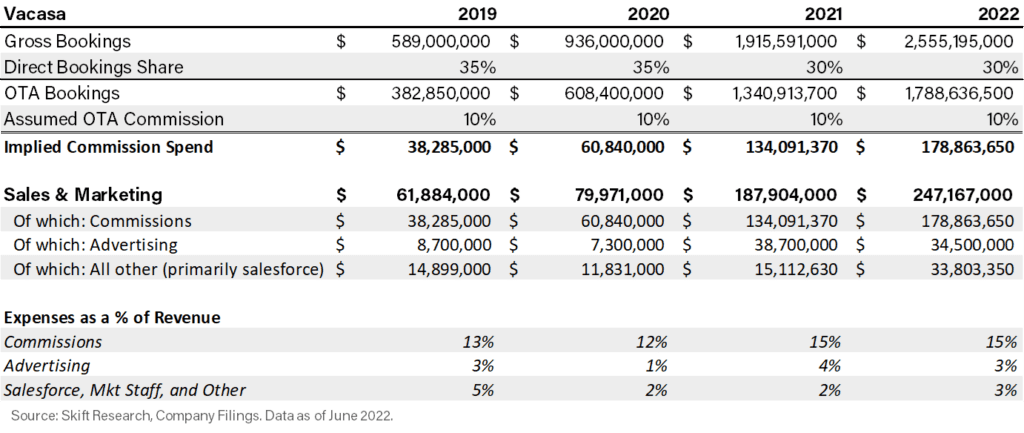

One of Vacasa’s major expense items is sales and marketing, at an average cost of 19% of revenue.

This line item include spending on advertising and salaries for salespeople and marketers as you’d expect. But it also includes its third-party distribution costs, the commissions that Vacasa pays to Airbnb, Vrbo, and other online booking sites.

While many think of Airbnb as a peer to Vacasa, we think that is misleading. Airbnb is a distribution channel and competes more directly with Expedia Group’s Vrbo. Rather, in our opinion, Vacasa’s nearest comparison is Marriott. Both are the largest branded operators in their respective space. Both invest significant resources in building a consistent, branded experience. Both benefit from large scale and nationwide reach.

Vacasa spent $35 million on advertisements and promotional materials in 2022. That was 1.4% of its gross bookings, about in-line with other major players. For example, Marriott spends 1% of its annual room revenue and Airbnb spends 1.2%. However, both of those businesses drive higher direct traffic for that spending.

What’s surprising is that out of a total sales & marketing budget of $247 million, advertising is just 14% of that. For context, Expedia earmarked 64% of its sales & marketing budget toward advertising and Airbnb allocated 52%. In fact, we believe that the large majority of Vacasa’s sales & marketing is going towards paying OTA commissions.

Vacasa is rare in the short-term rental space in that it has worked to establish a direct-to-consumer reputation and drive first-party bookings. Most STRs are undifferentiated and rely on online travel agencies, like Airbnb and Vrbo, for distribution. This makes them a commodity product. Additionally, the STR market as a whole suffers from inconsistency, which breeds distrust amongst travelers. Vacasa has tried to break out of that cycle and carve its own niche as a national brand with reliable and consistent quality standards.

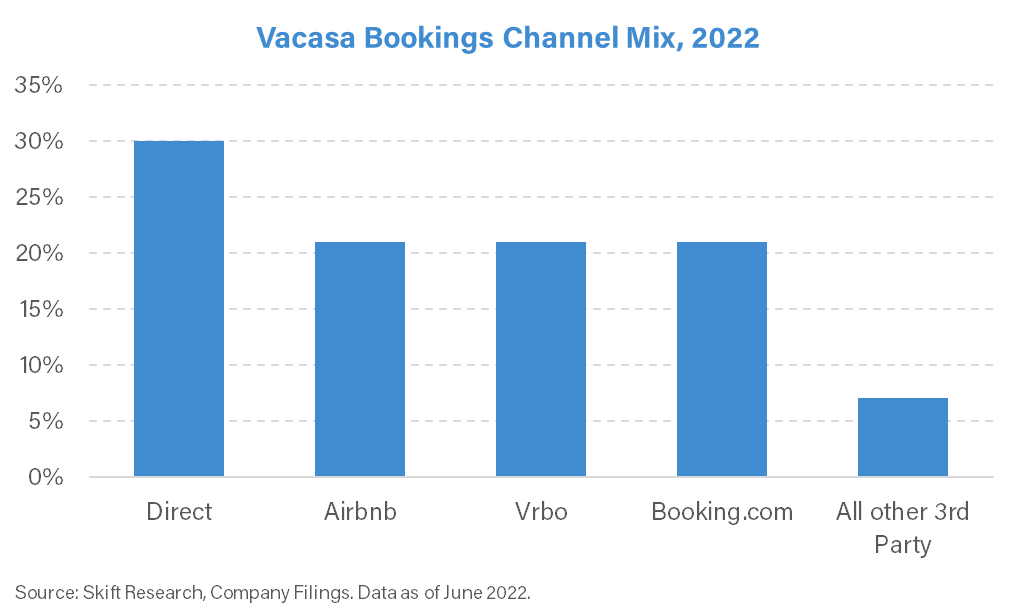

The goal of these efforts is to drive lower-cost direct traffic and in 2022 Vacasa earned 30% of its gross bookings from first-party channels. This is industry-leading in the vacation rental space where the median property is probably an Airbnb listing and therefore drives almost exactly 0% of bookings direct.

However, compared to a fully scaled hotel chain, Vacasa is still lacking. In 2022, Marriott earned about half of its room night bookings via first-party channels, with a slightly higher share of revenue contribution coming from loyalty members (since some Bonvoy customers will still book via a third-party). The numbers vary by brand, but at Marriott properties (not the parent company), marriott.com and call centers drove 47% of room nights while Bonvoy members contributed 60% of room night revenue.

Vacasa has disclosed that 70% of its gross bookings came from third parties in 2022. Of that, 90% came from a mostly even split of the big three channels, Airbnb, Vrbo, and Booking.com. This lets us break down Vacasa’s channel mix and implies that Airbnb generated around 21% of gross bookings vs. 30% direct.

Vacasa also drove a 30% direct share in 2021, but both years are actually below 2020 when the company generated 35% direct. We don’t have data for 2019 but assume it was similar to 2020. If we assume an average OTA commission of 10%, Skift Research estimates that Vacasa paid $179 million in OTA commissions last year; that represents the vast majority of its sales and marketing spend and 15% of revenue.

The shocking conclusion of this analysis is that despite being one of the largest STR brands, Vacasa’s spending on third-party commissions was 5 times its spending on advertisements to drive first-party bookings.

Perhaps this is unfair: One could argue that tech spend to develop its first-party booking platform also goes to support direct traffic. But technology development was 6% of revenue last year. This means that even if all of the firm’s tech spend was earmarked towards driving direct business (it wasn’t), then Vacasa still spent 9% of revenue on first-party vs. 15% on third party.

While Vacasa is a leader in brand building within the short-term rental space, these figures show that it still has a long road ahead if it hopes to flip these trends and become a majority first-party business; and to earn the margin benefits that come along with a direct to consumer business.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: short-term rentals, vacasa, vacation rentals