Skift Take

Slower supply growth and high demand aren't always necessarily bad, quite the opposite: They translate into high occupancy rates, and more revenue per booking.

We’re down one quarter this year so far, and demand for short-term rentals keeps inching up.

According to data from various sources tracking the sector, short-term rental has grown, and occupancies are longer despite to rising nightly rates.

Experts warned us that changing consumer preferences towards short-term rentals will cause the blending and merging of different players in the accommodation industry.

Consolidation in the sector is the proof: Accor acquired luxury rental brand onefinestay in 2017, and Marriott launched Homes and Villas in 2019. There have been lots of other mergers.

“If you look at hotel owners and operators, you see a lot of investment in hotel residences and service apartments,” Merilee Karr, CEO at UnderTheDoormat Group said at Skift’s Future of Lodging Forum in March. “There is now a muddled middle, where operators born in the short-term rental space as well as hotels are coming to the middle ground.”

Remember at the beginning of the year, we said this would be the year blended travel comes of age?

Data confirms this: Analysis by Key Data indicates a strong year for the industry if the momentum built up in the first quarter of 2023 can be sustained. Nightly rates so far have remained flat in the UK and the U.S., and occupancy rates are higher, leading to higher revenue per room.

Globally, average daily rates were up 3.4 percent annually, and occupancy climbed 17.6 percent, while revenue per available room is 21.6 percent ahead of last year, analysis from KeyData found.

Sluggish Supply and Longer Occupancies

Demand for short-term rentals jumped 16 percent annually, while supply — measured by the number of available listings — has shrunk.

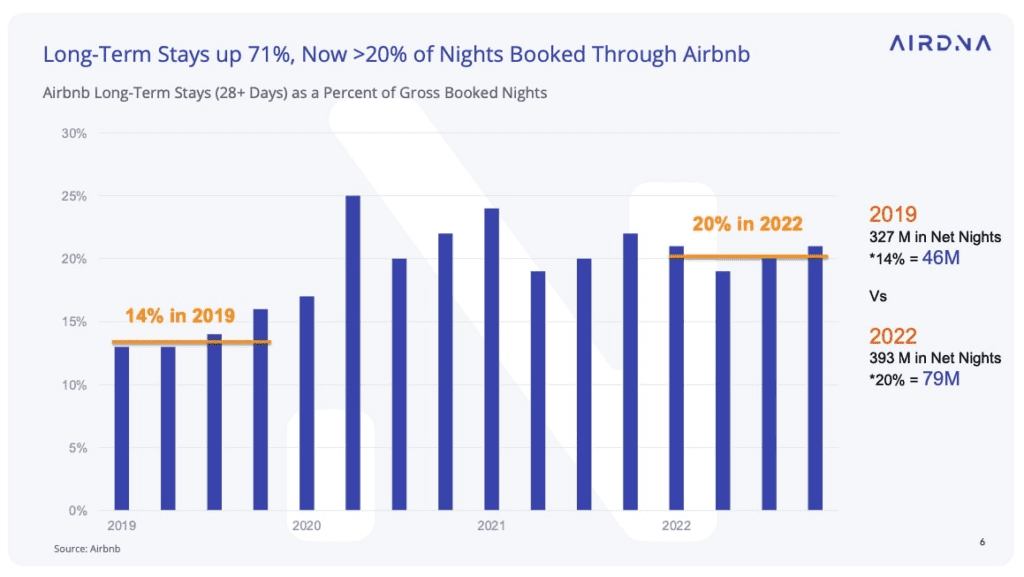

Fewer available listings and higher demand can indicate longer stays and more revenue. For reference: High supply in 2022 contributed to declining occupancy levels for most of the year. This year, we could see some of that supply differential leveling off with a steady occupancy rate. Recent data from research firm AirDNA found that longer stays are up 71 percent and account for more than 20 percent of nights booked on Airbnb, compared to 14 percent pre-pandemic. And the stays are over 28 days long.

“This was a promising start to the year but the outlook for 2023 remains on a knife edge. With ADRs (Average Daily Rates) weak, it is occupancy that is currently rescuing returns for owners and operators,” Melanie Brown, executive director of Data Insights at Key Data said.

Short-term rentals’ share of demand may be less than the pre-pandemic trend, but it’s still on the increase, and part of that can be attributed to more blended travel for the blended traveler.

Big Players, Small Share

There is a reason why supply cannot meet higher demands: Just 22 percent of vacation rentals are listed across multiple top online travel agencies.

Europe has over seven million listings compared with 3.7 million in North America. Latin America and Asia are both home to just under 1 million, while Oceania is growing from 300,000 listings, according to data analysis firm Transparent.

Of this, only six percent is listed on all three of the main online travel agencies while only one percent is listed on just Booking.com and Vrbo. This means 73 percent of global short-term rental properties are listed on Airbnb, Booking has 32 percent of the listings and Vrbo at 23 percent. The majority, 52 percent, of current global vacation rental inventory are listed solely on Airbnb. Many properties are listed on multiple online travel agency websites.

“While the picture can easily change, these initial readings of the market indicate greater demand and higher confidence among the majority of consumers who may be withstanding cost of living pressures better than expected. However, any economic shocks this year could change the picture quite dramatically,” Brown noted.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, airdna, KeyData, the future of lodging, vacation rentals

Photo credit: A living room of a short-term rental in Lisbon, Portugal. Source: Airbnb.