Skift Take

Tours and attractions companies are the most behind technologically in the travel industry, and RocketRez wants to change that.

Travel Startup Funding This Week

Each week we round up travel startups that have recently received or announced funding. Please email Travel Tech Reporter Justin Dawes at [email protected] if you have funding news.

Four travel tech startups raised $65.7 million this week.

>>RocketRez has raised $15 million in Series B funding from investor Level Equity.

RocketRez is a ticketing and business operations software platform for mid-market tours and attractions companies. Large operators have had the resources to build their own platforms, so that’s why the target market for RocketRez is mid-sized operators with revenues between $2 million and $200 million.

RocketRez products include ecommerce ticketing, point-of-sale and contactless kiosk channels, revenue management, business intelligence, customer management, and retail and food sales. The company can also integrate with other services for payments, hardware, channel management, and more.

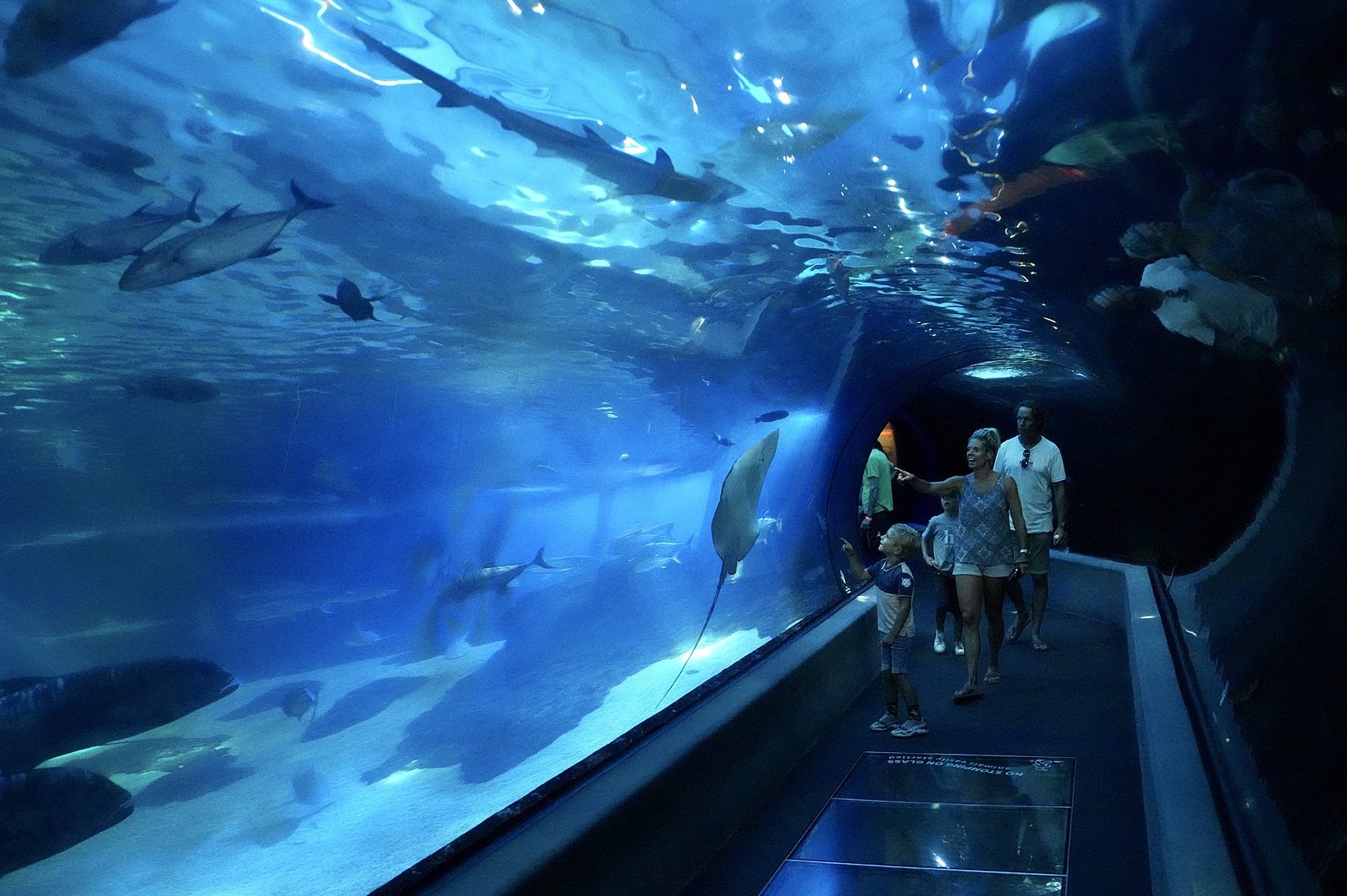

Based in Canada, the company primarily operates in North America and is expanding into Europe. Companies using the RocketRez platform include Maui Ocean Center, Xtreme Xperience, Aquarium of the Bay, and Governors Island.

The startup said that data it gathers from throughout the customer journey allows operators to enhance their on-site guest experience. That data comes from online and on-site ticket purchases, mobile ticket scanning, retail and food purchases, email and text communication, and more.

“The ability to capture data from multiple digital touchpoints gives operators more robust insights into customer behavior that cannot be achieved with disconnected sets of technology services,” said RocketRez CEO John Pendergrast. “Level Equity’s investment into RocketRez will help us accelerate more fulsome digital solutions that will deliver even better guest experiences for our customers and will enable us to expand our geographic reach.”

RocketRez said it has more than doubled capacity in several areas over the past two years. The funding will go toward strengthening the tech product, adding key leadership positions, and expanding business sales in existing and new market sectors, along with developing partnerships and integrations.

>>Portside, a software platform for business aviation operations, has raised $50 million in Series B funding. The round was led by Insight Partners, with participation from existing investors including I2BF Global Ventures.

The Portside platform includes products for a number of business aviation operations: flight and crew scheduling, dispatch, and compliance; communication with aircraft owners, passengers, and crew; sharing of various data points between users; reporting and analytics; customer billing; crew recruiting; and the booking of crew accommodations.

Business aviation covers the flights that a company or organization completes for their own business needs.

San Francisco-based Portside provides services to more than 700 clients in 30 countries within a number of industries, including charter, fractional, corporate, medical, industrial, government, military and cargo aircraft, and helicopter operators. Some customers include Airshare, Jet Aviation, Priester and Wheels Up.

The funding will go toward accelerating software development, expanding the startup’s customer base and product portfolio, and strengthening customer service. Some of that will go toward strengthening the software from two companies that Portside acquired in 2022 — Professional Flight Management and BART — which provide scheduling and dispatch software primarily for corporate flight departments.

The company also plans to explore additional opportunities for acquisitions in the business aviation ecosystem.

“Our customers often come to us with challenges they need help solving. We are here to find a solution, whether by deploying an existing product in our portfolio, building something new or acquiring capabilities that we do not currently possess,” said Alek Strygin, co-founder and chief operations officer of Portside.

>>CaptainBook has raised $273,000 (€ 250,000) in pre-seed funding led by SeedBlink, the European platform for co-investing in tech startups. CaptainBook is a Greece-based online platform that connects local tour and activity operators with local resellers such as hotels, short-term rental hosts, and travel agencies. Clients and partners include GetYourGuide, Project Expedition, Viator, and Civitatis.

The funding will go toward product development and accelerating expansion in Spain, Italy, and Easter Europe, particularly in Romania and Poland.

>>Stippl, a consumer travel planning app, has reportedly raised $437,000 (€400,000) from investors including Volve Capital. The Amsterdam-based app allows travelers to build and map itineraries, share travel plans, and book accommodations through third-party sites. The funding will go toward expanding internationally.

| Company | Stage | Lead | Raise |

|---|---|---|---|

| RocketRez | Series B | Level Equity | $15 million |

| Portside | Series B | Insight Partners | $50 million |

| CaptainBook | Pre-seed | SeedBlink | $273,000 |

| Stippl | Unspecified | Volve Capital | $437,000 |

Skift Cheat Sheet

Seed capital is money used to start a business, often led by angel investors and friends or family.

Series A financing is typically drawn from venture capitalists. The round aims to help a startup’s founders make sure that their product is something that customers truly want to buy.

Series B financing is mainly about venture capitalist firms helping a company grow faster. These fundraising rounds can assist in recruiting skilled workers and developing cost-effective marketing.

Series C financing is ordinarily about helping a company expand, such as through acquisitions. In addition to VCs, hedge funds, investment banks, and private equity firms often participate.

Series D, E and, beyond These mainly mature businesses and the funding round may help a company prepare to go public or be acquired. A variety of types of private investors might participate.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: aviation, business travel, funding, itinerary management, software, startups, tour operators, tourist attractions, travel tech, travel technology, vcroundup

Photo credit: The Maui Ocean Center in Hawaii is a client of RocketRex. Richard Horne / Wikimedia Commons