Skift Take

Last year wasn't the runaway success the travel industry anticipated — or needed.

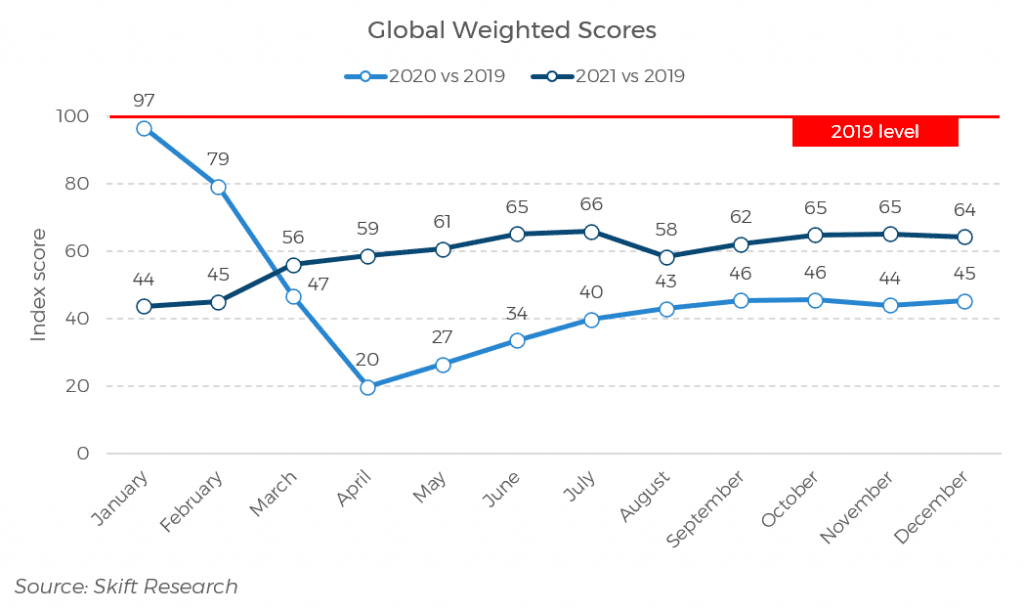

As we close the books on 2021, the Skift Recovery Index stands at 64 points. This indicates that demand for travel, which we gather from a range of data indicators capturing the entire traveler journey from exploration to post-stay, continues to be suppressed and in December sat at 64 percent of 2019 levels.

This is much higher than performance at the beginning of the year, but when in March the Index jumped from 45 percent to 56 percent, we were hopeful that it would be the start of a major turnaround for the travel industry’s fortunes. This has not fully materialized, with the Delta and Omicron variants putting a damper on performance.

For two years now, the Skift Research team has analyzed the performance of the travel industry in 22 countries with the help of data from 19 travel partners.

Uncertainty Prevails in 2021

As analyzed in our latest December 2021 Highlights report, 2021 was a much more uncertain year than 2020, with local lockdowns having less of an impact on travel’s performance than they did in 2020, as did surges in Covid cases.

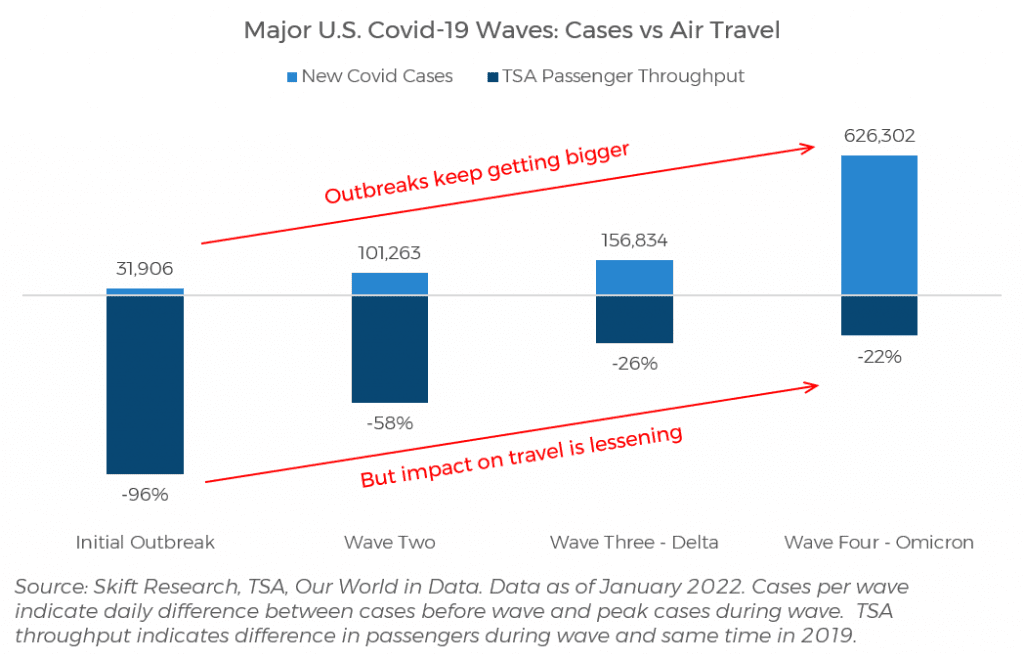

The current Omicron outbreak, for example, which is seeing record numbers of new cases, has only limited impact on U.S. travel performance. The certainty that new outbreaks will lead to a travel downturn, then, no longer exists.

Vaccinations, however, have also not been the golden ticket to travel’s recovery, although we did tout them as such at the beginning of 2021. We will continue to track how travel recovers as we move into 2022.

Top Trend of 2021: Vacation Rental Weakness Seeped In

In our monthly analysis for the Skift Recovery Index, we have spent considerable attention to the interplay and fight for dominance between hotels and vacation rentals.

Looking back now at the performance of both, we can state that hotels are back.

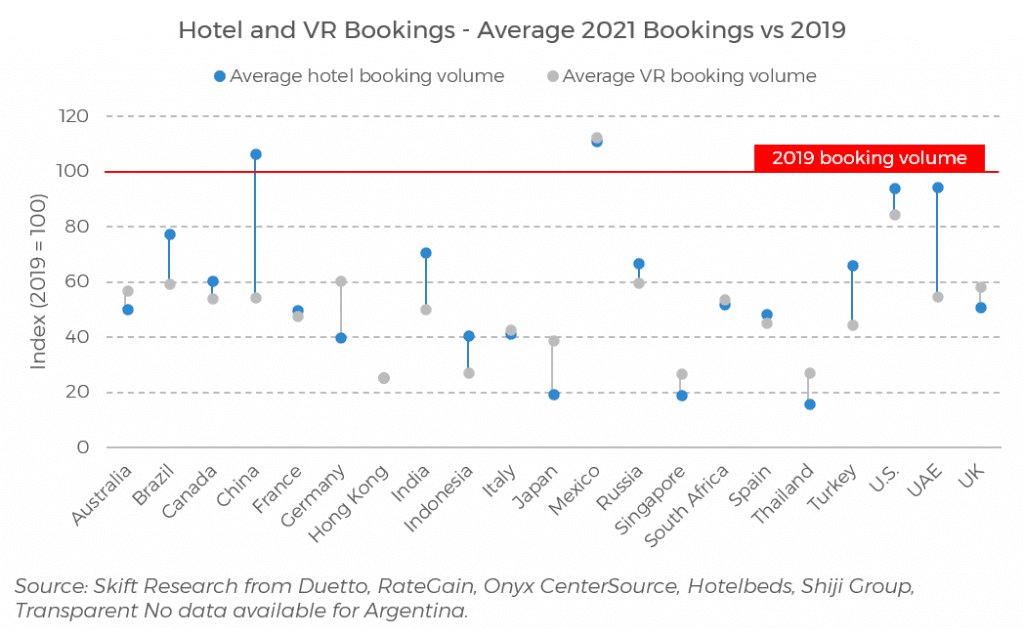

If we compare the average volumes of bookings made in 2021 for hotels and rentals in each country, we can see that most countries still fell well below 2019 levels, with Mexico hotels and rentals, and China hotels as the only exceptions.

There is not a clear winner between the industries, with hotels performing better in some countries, while in others rentals have seen stronger booking levels. If we take a simple average for the entire year for all 22 countries, we see booking volumes at 57 percent for hotels, and at 51 percent for rentals compared to 2019.

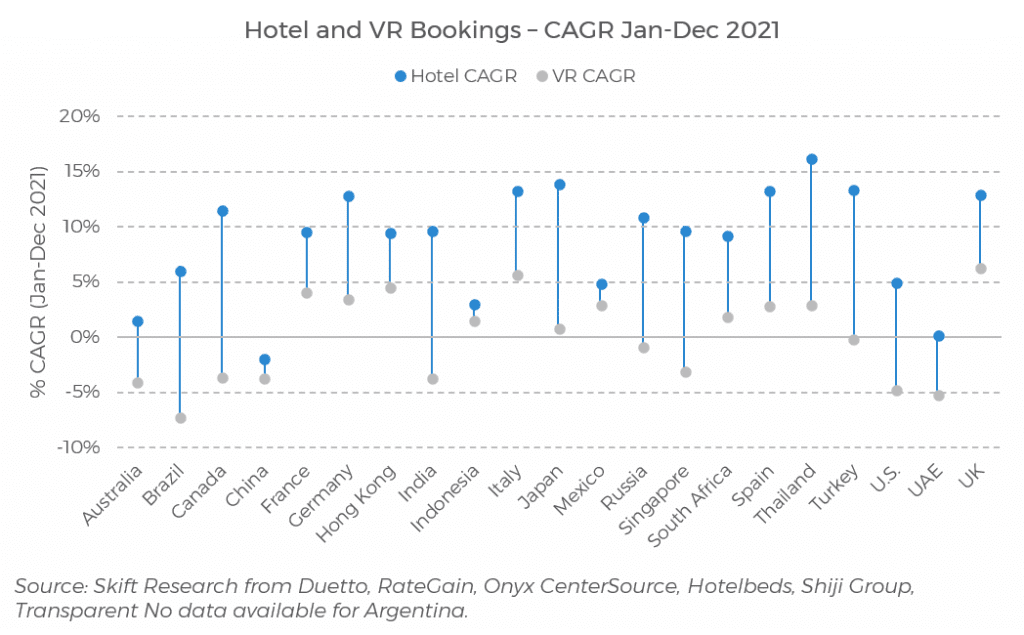

Where we do see a major difference between hotels and rentals is how booking volumes have evolved during 2021. At the beginning of the year, January 2021, the average volume of bookings for hotels was at 30 percent of 2019 levels, while this was 52 percent for vacation rentals.

When we compare the booking levels in January 2021 with December 2021, however, we can see that hotels have caught up with vacation rentals across the board with stronger growth rates. The average volume of bookings for hotels was higher than for vacation rentals in December 2021.

This provides strong evidence that hotels are back to competing with vacation rentals for demand.

We are working hard to bring you a revamped and better Index in 2022. You will start to see changes to the Index from next month. Stay tuned!

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: skift recovery index, skift research, skift research estimates, tsa