Skift Take

We could have filled a multi-volume encyclopedia with everything that has happened in the past 12 months. Instead, we settled for 12 telling charts.

This year has thrown 12 long and often challenging months at the travel industry. To recap the year, Skift Research has pulled together 12 charts that explain how the travel industry was impacted by, and responded to, the Covid pandemic.

Most of the charts in this overview are taken from our report Skift Research Global Travel Outlook 2022, with a sprinkling of additional insights we produced throughout the year.

Save 20 percent on any Skift Research report mentioned in this article. Use code BESTOF2021 at checkout to save.

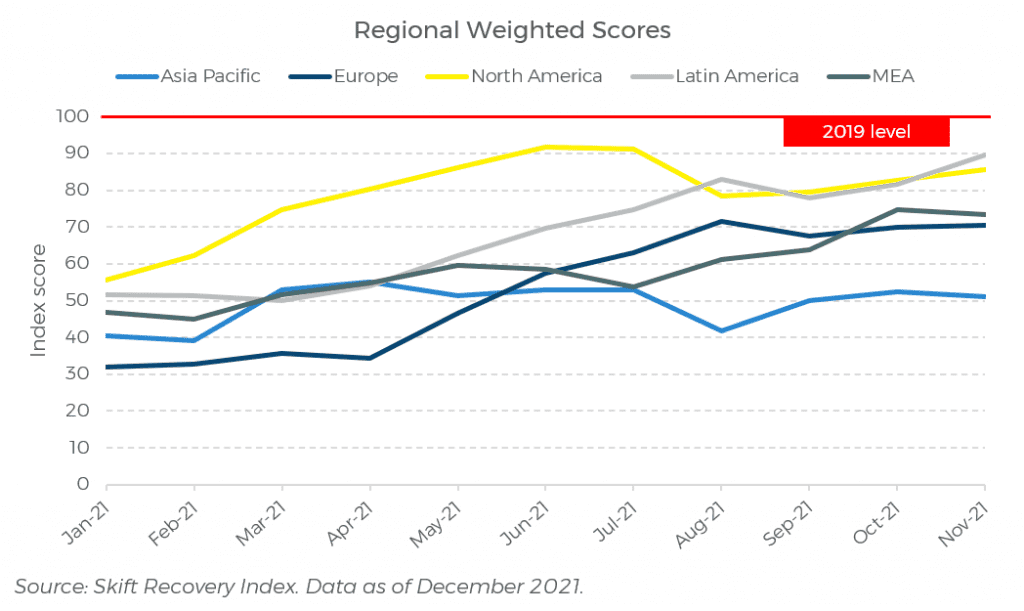

Recovery Has Been Uneven

Skift Research has been tracking the recovery of the flight, hotel, short-term rental, and car rental sectors in 22 countries since the start of the pandemic. One continuing truth is that recovery is extremely unequal, with the latest November 2021 data showing that North and Latin America are close to full recovery, while Asia Pacific lingers around 50 percent of pre-pandemic performance levels.

For more information about travel’s recovery, check Skift Research’s Recovery Index.

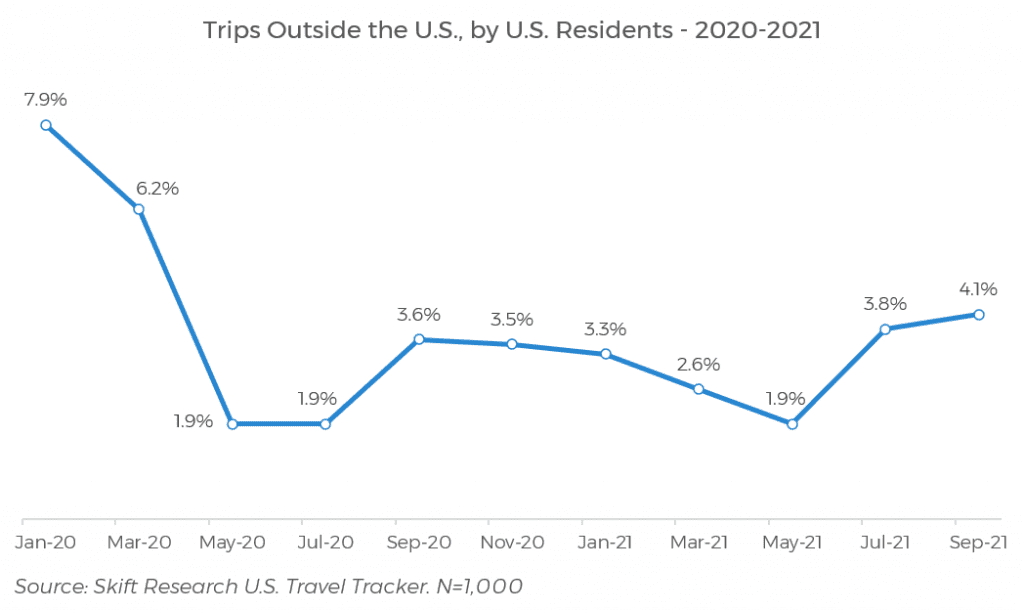

Domestic Travel Remained Strong

While the travel industry is clearly still impacted by the Covid pandemic, there are certain areas where we did see strong recovery in 2020. Dometic tourism is one of those areas, and Skift Research survey data shows that this strong performance continued. While we saw trip participation increase in 2021, international trip share barely increased, with domestic travel still preferred amongst U.S. travelers.

To better understand U.S traveler behavior and sentiment, check the latest U.S. Travel Tracker.

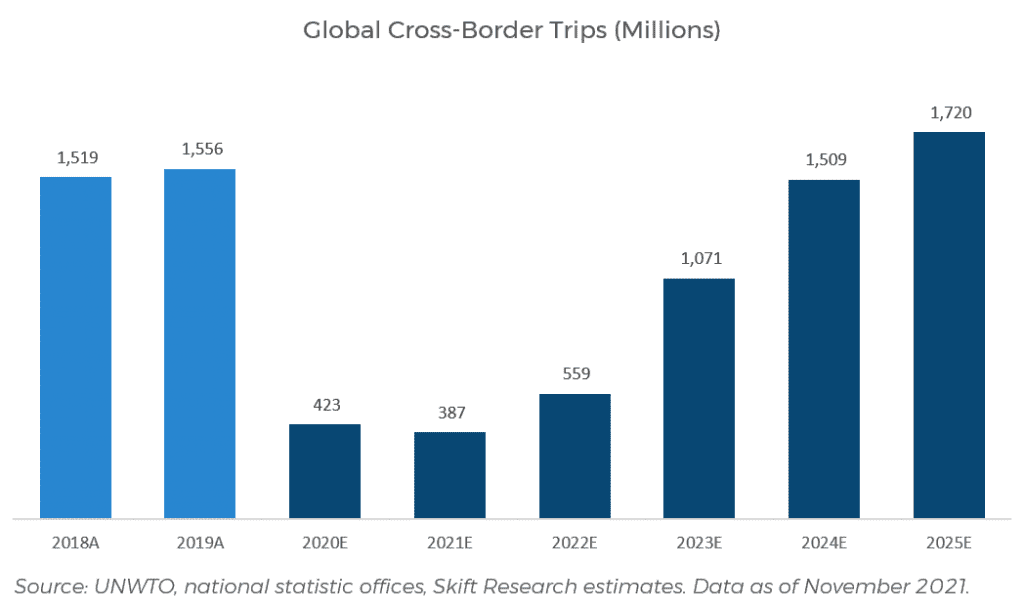

International Trips Will Not Recover Until 2024

Despite a significant rollout of the vaccine in 2021, albeit unequal, cross-border travel dropped even further than 2020 levels. The first quarter in 2020 was, of course, strong, while 2021 did not see a single quarter which came even close to 2019 levels. According to our estimates, 2022 will see the first annual increase in international travel since the pandemic began. We don’t see a full recovery of cross-border travel until 2024 at the earliest.

Our Global Travel Outlook 2022 has many more forecasts, with regional travel numbers and revenues for the main travel verticals.

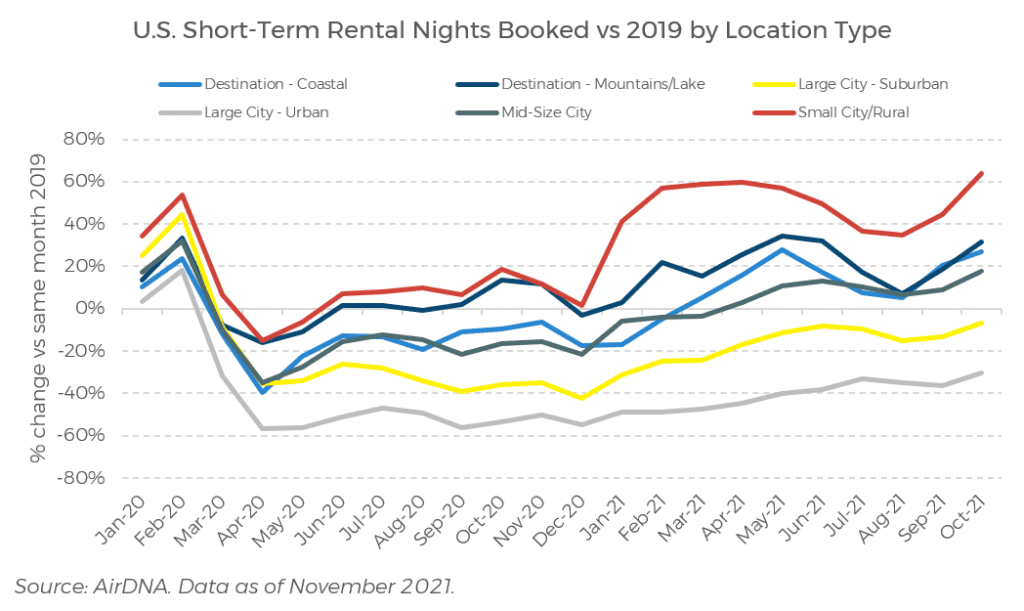

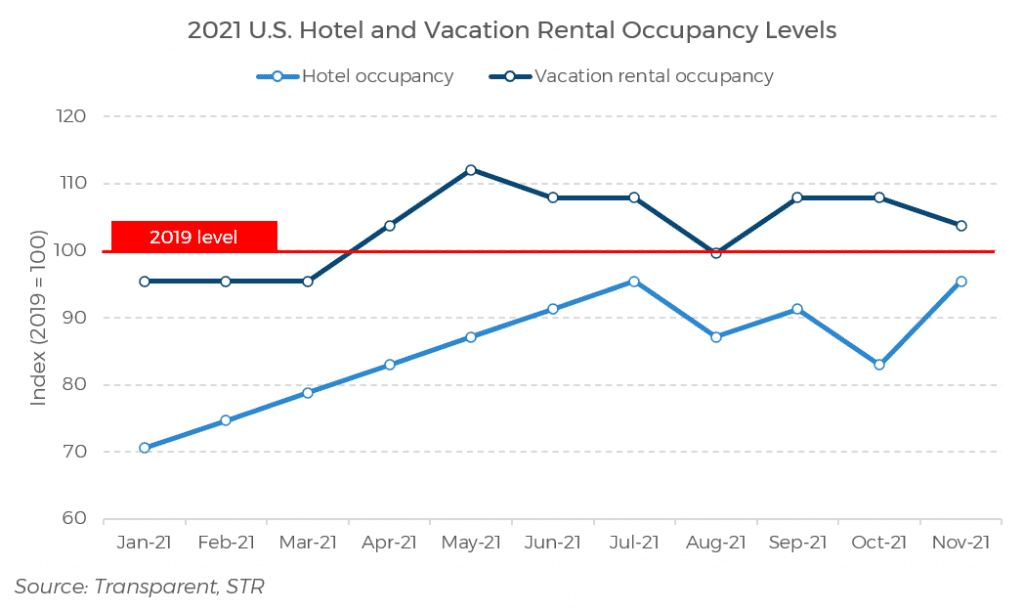

Short-Term Rentals Continue To Win

Short-term rentals have performed well in 2021, especially when compared to hotels. We are speaking in average here, of course, as urban rentals have been hit just as hard as hotels, while rural and coastal/nature-based rentals have pulled up the average with a bumper year. Data from AirDNA shows that urban and suburban rental demand is now also increasing in the U.S. While it might be hard for rural and destination rentals to achieve the same levels they did in 2021, urban rentals will likely pick up some speed and make 2022 another strong year for the overall rental sector.

Read more about the Impact of COVID-19 on the Short-Term Rental Market.

Hotels Are Coming Back

Data from Transparent and STR shows that vacation rentals still outperform hotels in the U.S.. Occupancy levels in vacation rentals have been above 2019 levels for much of the year, but hotels are now also close to full recovery, and our analysis of Recovery Index data shows that hotel bookings have outperformed vacation rental bookings for the first eight months of 2021 in 20 of the largest tourism economies worldwide. Don’t write hotels off just yet.

Find our analysis of hotel vs rental bookings in our August 2021 Highlights report of the Skift Recovery Index.

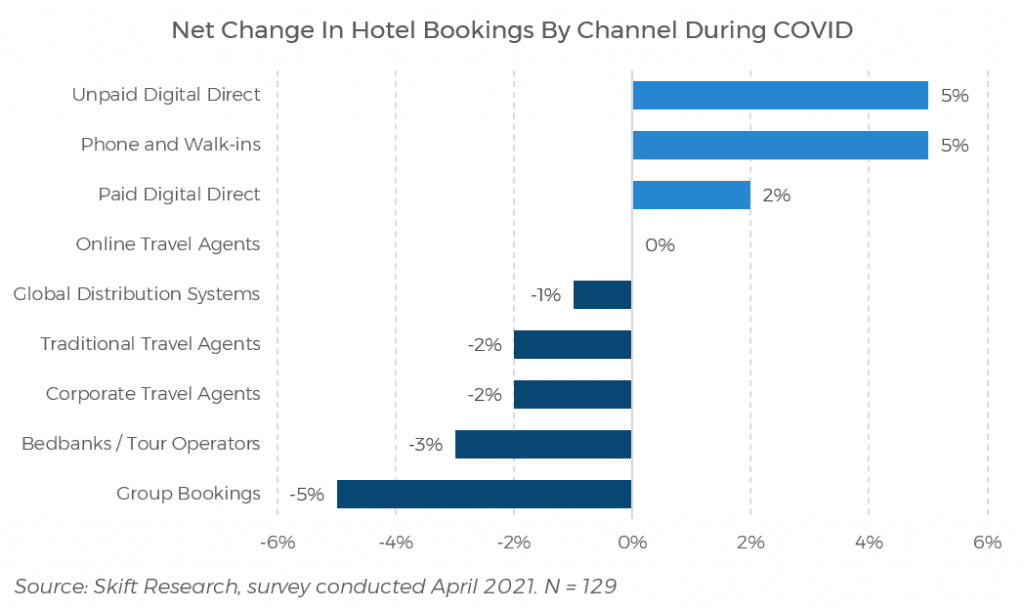

Hotel Booking Behavior Has Changed

In a Skift Research survey we found that hotel booking behavior also changed. Covid drove hotel direct bookings, but not always for the right reasons. While a rise of bookings through unpaid online channels are desirable, an increase in bookings through phone and walk-ins likely indicate that online information is insufficient and uncertainty drives travelers to require additional information from the hotel. Hotels will want to try to convert those phone bookings into unpaid online bookings moving forward, which won’t be easy as online travel agents are looking to gain share coming out of the pandemic.

More findings of our hotel booking survey can be found in the Hotel Direct Booking Outlook in 2021.

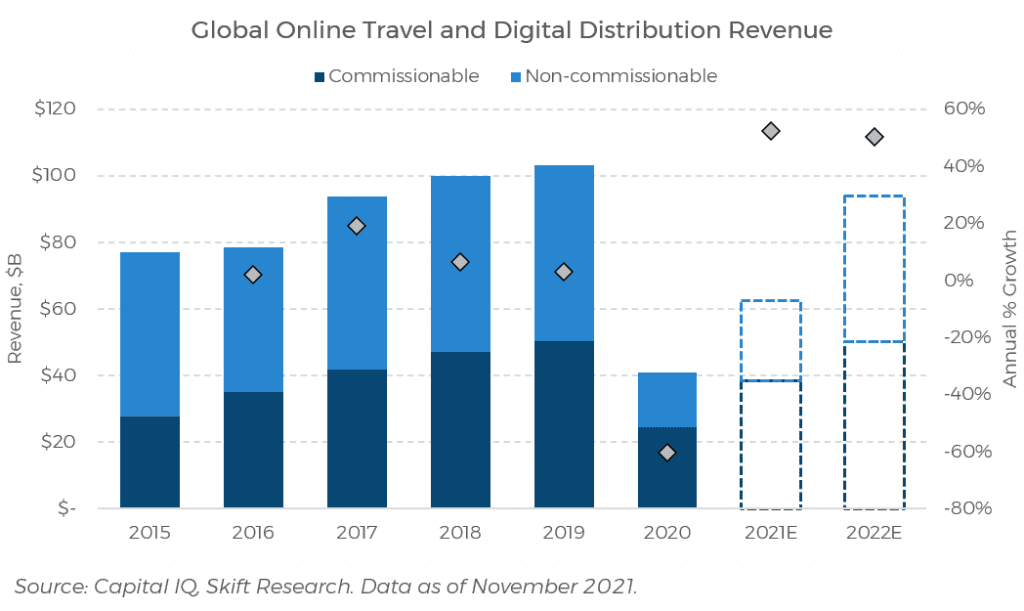

OTAs Returning Strong

Based on past trends, online travel agencies, or OTAs, are often winners in the first stages of a travel recovery when demand is weak and booking sites can put ‘heads in beds.’ But the traditional OTA strategy of value pricing is not as effective this time around because many consumers increased savings during lockdown, and as noted, hotel direct bookings have increased. That said, Skift Research sees revenue from digital travel distribution businesses, which include OTAs, metasearch, and global distribution systems (GDS) growing at 50 percent in both 2021 and 2022.

To understand more about the performance of the largest OTAs worldwide, read our latest Online Travel Agency Factbook 2022.

Airlines Had Another Turbulent Year

One travel sector that continues to be significantly challenged is airlines. The uncertainty around border closures and additional entry requirements directly hits airlines’ bottom lines. While domestic seat capacity and load factors have been largely restored in countries like the U.S. and Russia, international flight performance remains down on all counts. According to estimates from the International Air Transport Association (IATA), global commercial airline passenger revenue is expected to grow by 67 percent in 2022, still 38 percent below 2019 levels.

In the Global Travel Outlook 2022 we provide a considerable analysis of the performance of the airline industry.

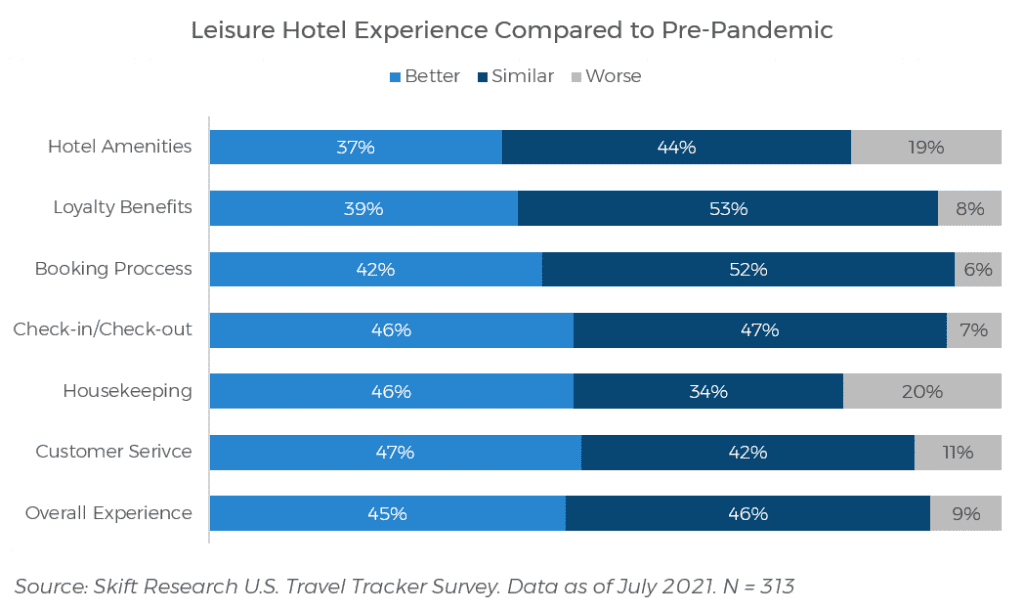

Travel Satisfaction Remains High, Right?

Beyond the trends that we are seeing in the performance of different travel sectors, a number of consumer trends have emerged or have been strengthened during the pandemic. As all sectors have dealt with fluctuating levels of demand, ever changing local regulations, and changes to traveler demands, it will have been challenging for travel professionals to offer the level of service they did pre-pandemic. So far we have not seen a major impact on traveler satisfaction with their airline or hotel stay, but as we have argued in a recent report, the bar is rising fast as countries reopen.

Skift Research, in partnership with McKinsey & Company, wrote Rebooting customer experience to bring back the magic of travel, highlighting the importance of refocusing on the user experience as we move out of this pandemic.

Work From Anywhere, Also Beyond 2021

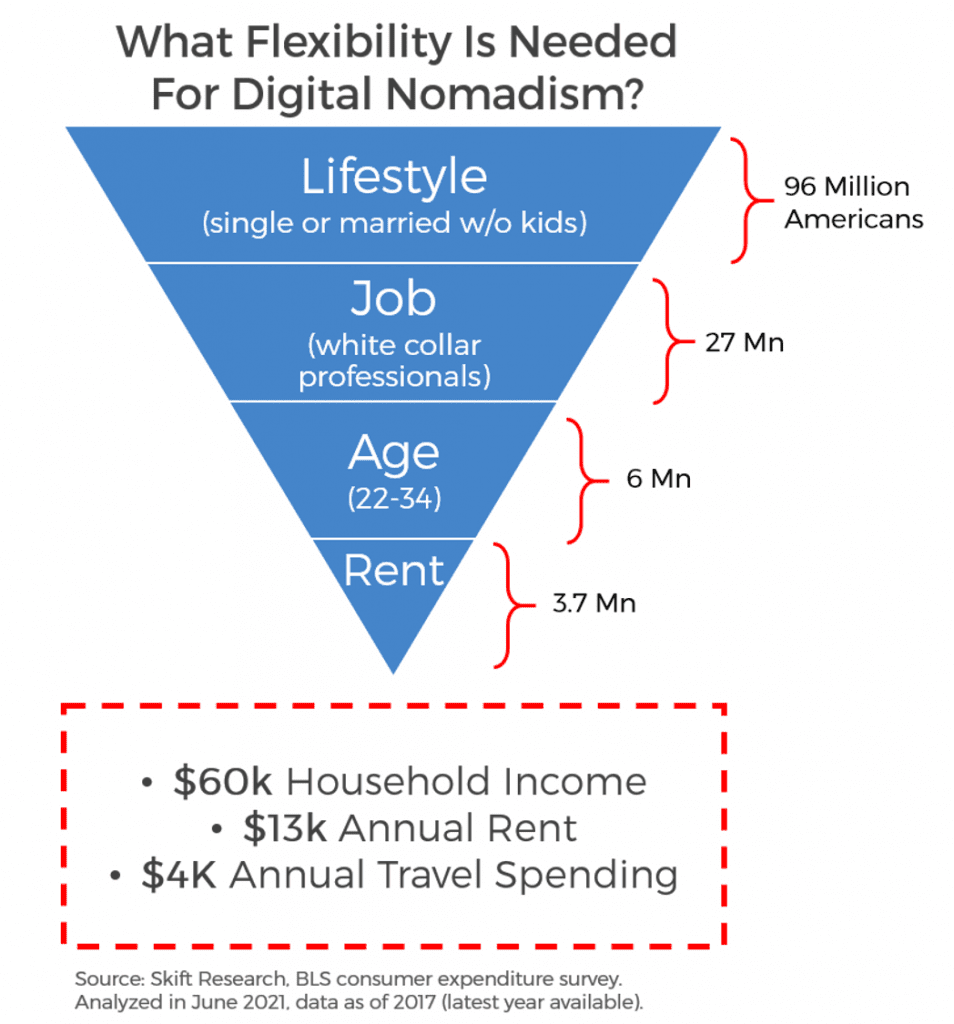

We have seen major changes to working culture, and a trend towards more working from home. Every company and institution is forging its own path forward, but undoubtedly working from home is here to stay. This also offers opportunities for an increasing group of professionals to work from anywhere.

Skift Research believes that the remote office is here to stay and that this will have dramatic ripple effects across the travel industry. Our analysis shows that, based on a number of parameters, 3.7 million Americans could become digital nomads. All considered, this could result in American digital nomads purchasing 33 million room nights, instead of spending their earnings on rent. This is a total addressable market of $972 million a year.

Understand the impact of digital nomads on the travel industry by reading our U.S. Digital Nomad Market Analysis 2021.

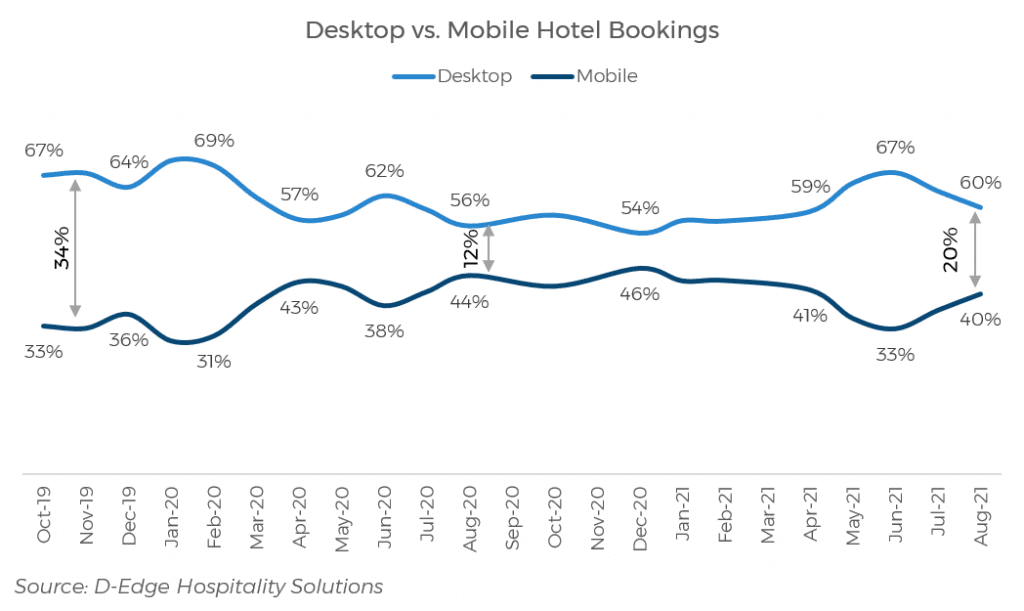

Mobile Sales Are Boosted

Improving the traveler’s user experience should be an all-encompassing exercise, which starts at the exploration and booking stages. Covid has increased mobile usage in a lot of ways, and people are getting more comfortable using mobile devices to complete online transactions, also for big purchases like travel.

For more information about the impact of m-commerce on the travel industry, read our Mobile Commerce in Travel report.

Sustainability: Uncomfortable Decisions Ahead

A final trend, although probably with one of the most far reaching impacts, is the growing interest in sustainability (and particularly environmental sustainability) by travelers, local communities, governments, pressure groups, and the travel industry alike. The Covid pandemic has pushed this topic even more to the fore. One positive side of the pandemic-induced pause in travel was to make clear the environmental impacts that travel creates.

The entire travel industry needs to step up in setting strong targets, being transparent in reporting on them, and better communicating the impacts of their choices to consumers. At Skift Research we believe that, as the industry looks to return to pre-pandemic levels, it should try not to fall back into its old habits. Companies need to look at all their processes to improve sustainability moving forward.

This also includes, for example, loyalty programs, which are generally tied to high volumes of usage and therefore encourage extremely polluting behavior. Are there ways to look at this differently in 2022?

Gain a deeper understanding of the issue of sustainability in the travel industry, by reading our sustainability report series, focusing on hotels, airlines, destinations, and loyalty programs. We will continue to focus on this as a key topic in 2022.

Here’s to a successful and brighter 2022.

Save 20% on any Skift Research report mentioned in this article. Use code BESTOF2021 at checkout to save.

Or if you are interested in subscribing to Skift Research, use code endofyear2021 to save 20% off your subscription.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: covid-19, skift research, skift research estimates

Photo credit: Longing to travel again after lockdowns. Önder Örtel / Unsplash