Skift Take

The recent TripActions and Skift report, The State of Corporate Travel and Expense 2022, examined how the sector is rethinking its future. This article explores survey data from that report in more detail, focusing on Germany and the UK to uncover how business travelers and organizations in these markets are navigating the current corporate travel landscape.

This sponsored content was created in collaboration with a Skift partner.

Corporate travel is ramping back up, but the pandemic has created a new playbook for travel policies. As a result, corporate travel decision makers (CTDMs) and their employees are seeking better tools to manage changing protocols around travel expenses, payment methods, corporate duty of care expectations, and policy communications.

So what is the climate for corporate travel now? To seek answers, Skift and TripActions surveyed more than 1,600 global travelers and CTDMs from 19 different industries or business sectors, including six types of travel companies or organizations — aviation, agents/wholesalers, cruise, hospitality, tours and activities, and tourism boards. This article is a deep dive into European trends following the global survey, focusing on two of the largest business travel markets in the region, Germany and the UK. Comparing them with each other and the overall global sentiment allows for a better understanding of trends in the region to expand on key themes from the recent TripActions and Skift report, The State of Corporate Travel and Expense 2022.

Business Travel Takes Off Again

There’s good news as companies look ahead to 2022: The events of the past two years have not dampened demand for business travel. Though the landscape may look different due to ongoing travel restrictions, vaccination requirements, and Covid-19 testing protocols, corporate travelers are back on the road.

Among survey respondents, business travelers from Germany expected to take more trips in the coming 12 months than respondents from the UK. Nearly 70 percent said they would take three or more business trips in the coming year, compared to 56 percent of UK respondents. Among travelers surveyed globally, this figure came in at 65 percent.

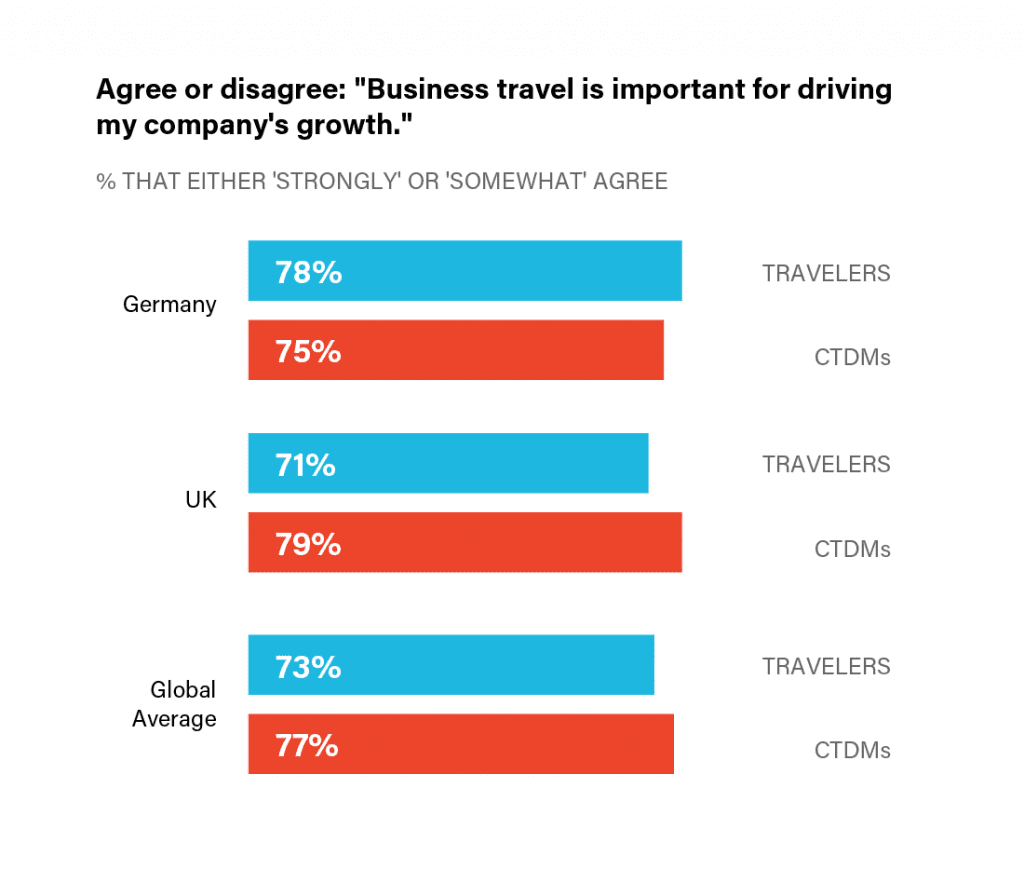

These results may in part reflect the perceived value of travel as an essential component for business success. Seventy-eight percent of travelers from Germany either “strongly” or somewhat” agreed travel was “important to their business” — seven percentage points higher than their British counterparts (71 percent), and five percentage points higher than the global average of 73 percent.

Interestingly, responses from CTDMs showed the inverse. While a majority of all respondents suggested that travel is beneficial to their businesses, in the UK, nearly 80 percent of CTDMs either “strongly” or “somewhat” agreed that “business travel is important for driving my company’s growth” — much higher than travelers in their market. Seventy-five percent of CTDMs in Germany agreed that travel was important to their business, which was a lower response rate than travelers in their market, though the gap between employees and managers in Germany was smaller than in the UK.

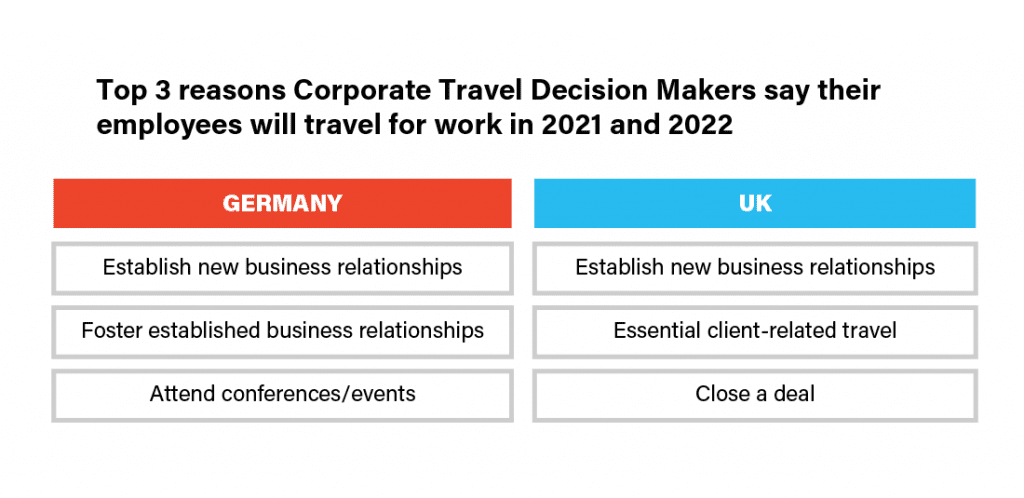

These data points help contextualize the primary reasons for corporate travel in the coming year. CTDMs cited the establishment of new client relationships as the most prominent reason for business travel. From there, the responses differed: UK respondents prioritized essential client travel and closing deals, and those in Germany emphasized relationship-building activities like meetings and events.

This data potentially explains the disconnect between employees and travel decision makers when it comes to travel expectations. If events are slower to revive or capacity limits remain in effect for longer than expected, business travel demand may come on more strongly in areas like the UK, where corporate leaders are more focused on transactional, revenue-generating activities.

In addition, it could also suggest that UK businesses may be able to accomplish more in-person meetings or events through domestic business travel — especially in light of Brexit — whereas companies on mainland Europe may rely more on cross-border travel to do business where there is more uncertainty.

Regardless, the takeaway is that expectations remain high for the coming year. Business travel is coming back strong, even if it doesn’t look exactly the same as it has in the past.

Communications Are the Key to Corporate Travel Changes

As workers return to business travel in greater numbers, many also are facing new challenges and concerns. They will need reassurance, new policies and procedures, better information, and strong support.

During the pandemic, companies were repeatedly forced to adapt their travel policies, whether that was due to travel restrictions, cleanliness procedures, flexible booking rules, evolving expense allowances, or other nuanced rules. Changes during this unusual and uncertain time varied as much as companies themselves.

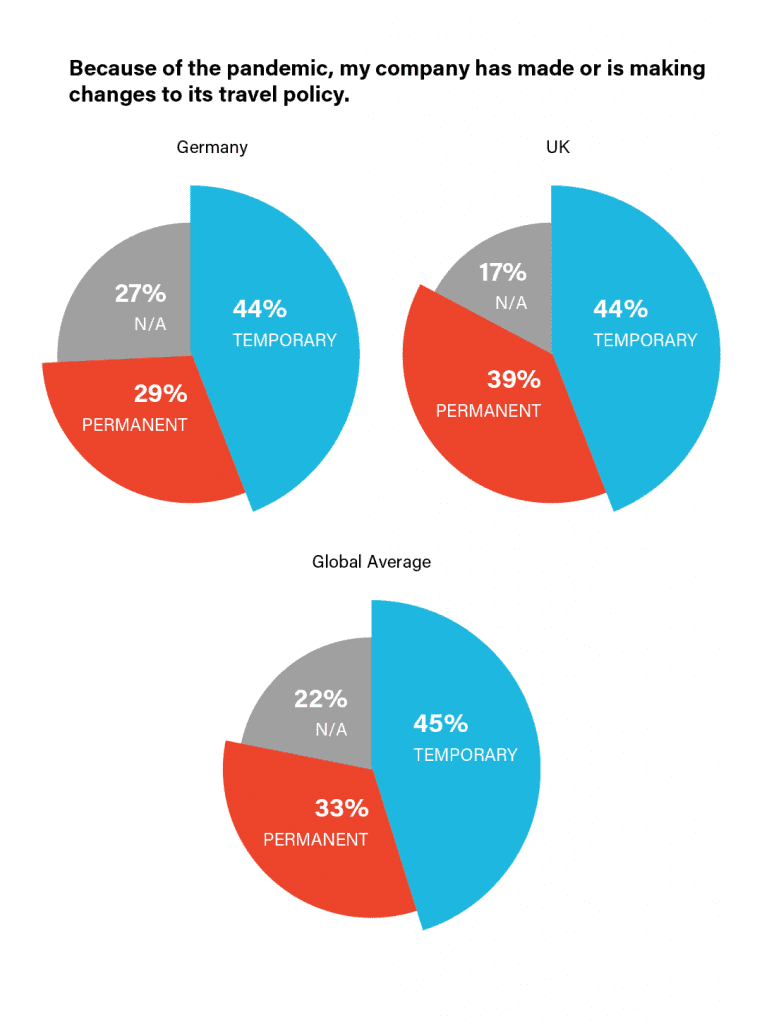

Some of these alterations may end up reverting to business as usual, as Covid-19 becomes a less-dominant consideration in travel planning. However, many of these policies are here to stay. Looking toward the future, travel managers in the UK responded that they would be more likely to maintain or make new changes to their travel policies. Nearly 40 percent of CTDMs in the UK said that changes to their travel policies would be permanent, compared to one-third on average globally, and just 29 percent of CTDMs in Germany.

As these updates remain in place or roll out, travel managers must appropriately disseminate information to ensure travelers are comfortable with the new or altered protocols. Clear communications will be critical in driving compliance, which will lead to employee comfort, safety, and wellness.

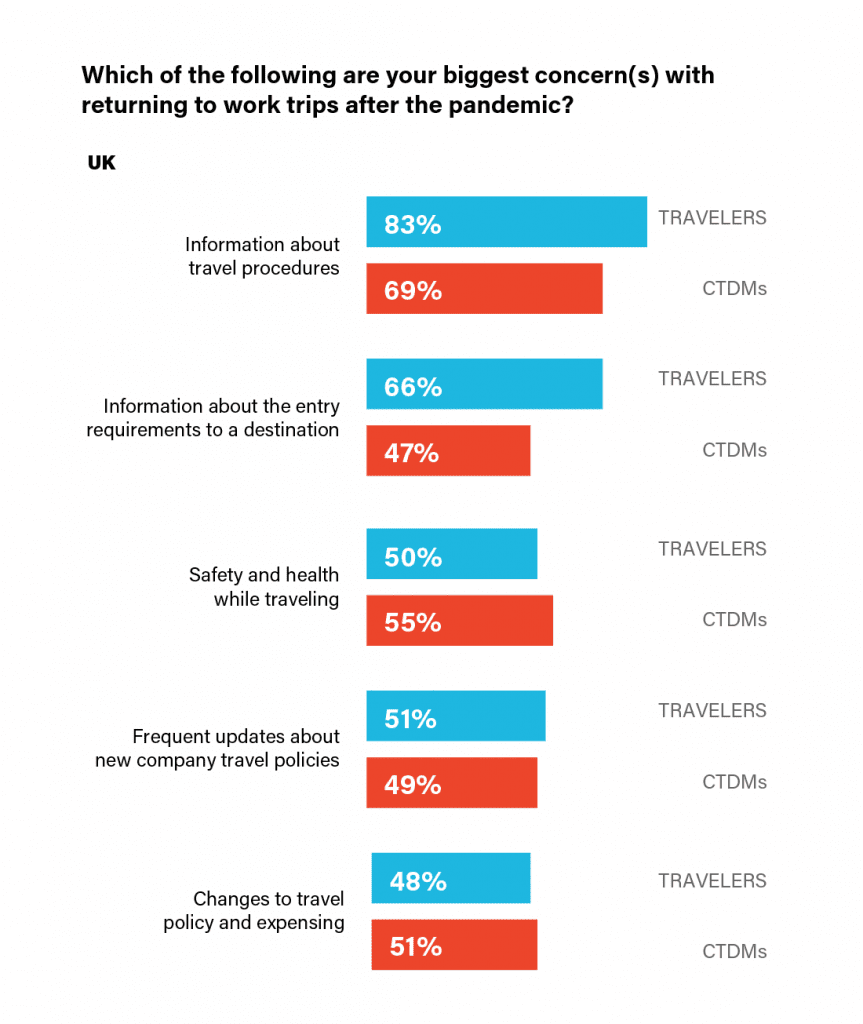

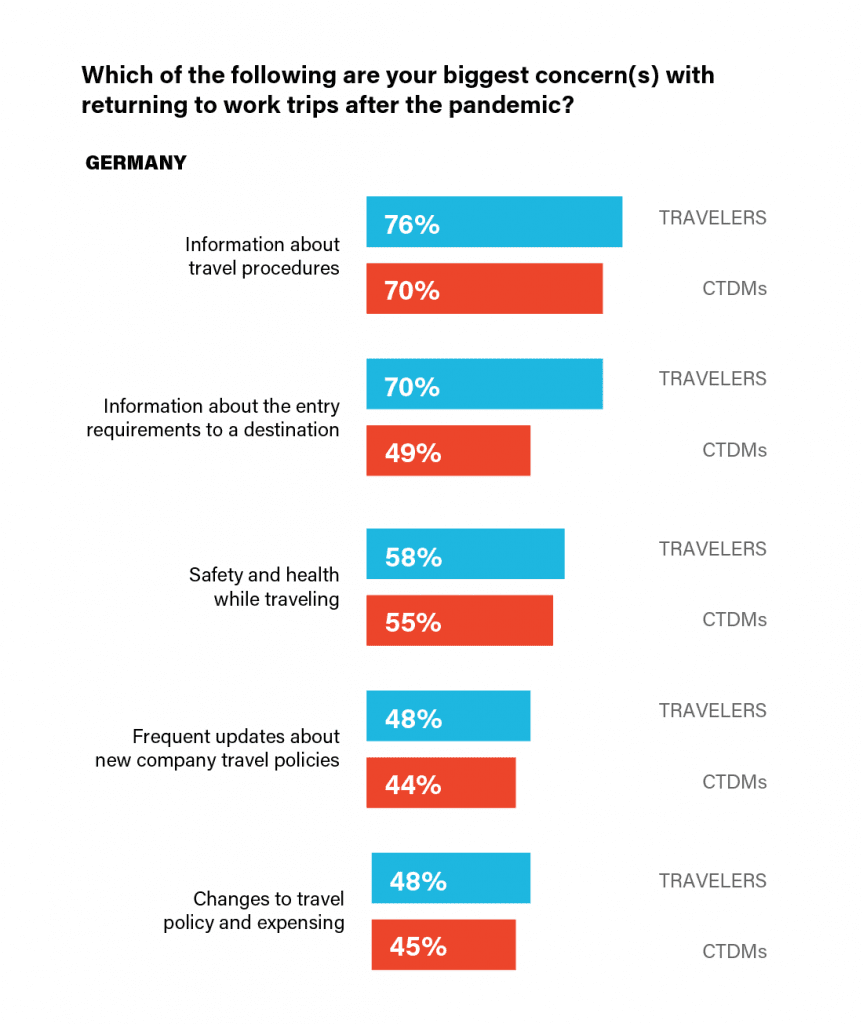

For example, the survey responses show that travelers are far more concerned than CTDMs about information on travel procedures and destination entry requirements as they return to business travel. Eighty-three percent of UK travelers responded that receiving timely information on changing travel procedures was one of their top concerns in returning to work trips after the pandemic, while just 69 percent of CTDMs in the UK noted the ability to provide this information as a top concern.

Meanwhile, there was a 21-point gap in the percentage of travelers and CTDMs in Germany (70 percent to 49 percent) that expressed concern about information on entry requirements to a destination.

These findings may suggest a gap in communications between travelers and program managers, potentially owing to a lack of personal familiarity with, or misperception of, the realities of the in-trip experience. Therefore, it’s imperative that CTDMs have a dialogue with employees, put themselves in the shoes of the traveler, clearly point out where any policies may differ from the past, and create simple and understandable compliance mechanisms.

Creating Better Tools for Travel and Expense Management

The continuous need for communication around changing travel protocols over the past two years may have been taxing, but it provides an unprecedented opportunity for corporate travel. The chance for both travelers and travel managers to take a hard look at their systems and processes, as well as their technology solutions, stands to benefit business travel for years to come.

For example, efficient payments and expense reimbursement systems are a key aspect of business travel. Depending on company policies, individual travelers often pay with their personal credit or debit cards; this practice can cause hiccups or headaches for both travelers and managers if expenses are not properly documented and submitted.

For example, 34 percent of UK travelers said that paying for expenses with a personal credit card was a common problem they face when traveling for work (their third-biggest concern behind flight delays and minimizing the risk of Covid-19 or other infections). Twenty-nine percent of German travelers cited this as a concern, fourth-highest among their top issues while traveling for business. In the UK, just 38% of business travelers said they paid for travel expenses with a corporate card, as compared to 46% of travelers in Germany.

This data could also help explain why 18 percent of UK travelers were dissatisfied with the amount of time it takes for them to be reimbursed for travel expenses, in comparison to just 13 percent of German travelers.

These trends — from new travel strategies and policy changes to payment mechanisms and reimbursement methods — point to the larger opportunity for travel management and expense solutions that streamline these processes and systems.

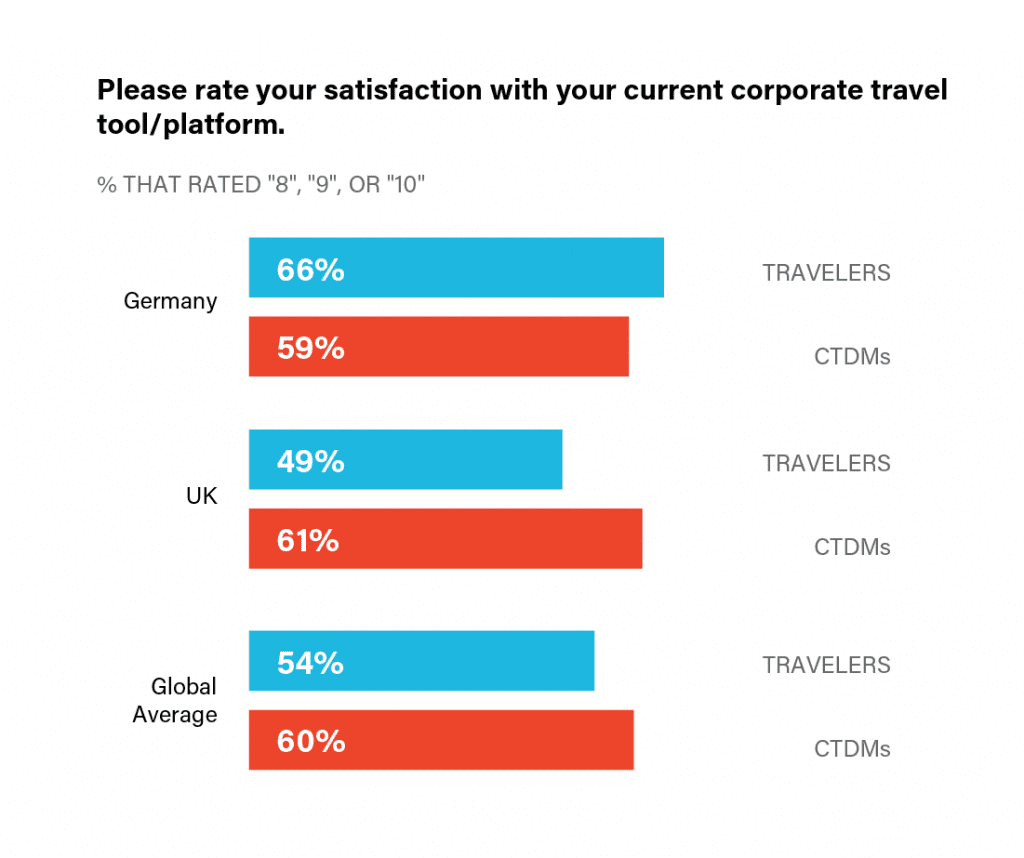

Indeed, these solutions can help allay concerns on several levels. In the UK, for example, where companies were more likely to enact permanent policy changes, travelers also expressed higher levels of concern about personal payments and reimbursement times. The combination of these disruptions may in part point to why UK business travelers rated their current corporate travel solutions lower than both their German counterparts and the global average.

In fact, less than half of respondents from the UK (49 percent) gave their current tools above an “8” on a scale of 1 to 10, while nearly two-thirds of Germans (66 percent) offered this lofty ranking.

On the other hand, 61 percent of CTDMs in the UK were highly satisfied with their current travel and spend management solutions. (It’s worth noting that only 9 percent of UK managers were dissatisfied with expense reimbursement time — half the amount of travelers in their market.) Though a similar percentage of CTDMs (59 percent) in Germany expressed high levels of satisfaction with their current tools, their responses were collectively lower than the travelers in their market.

In all cases, challenges and concerns that the survey uncovered provide further justification for companies to consider consolidation into a single tool that manages all aspects of corporate travel and expenses. Unified solutions that have clear processes and instructions for travelers and CTDMs alike have the capabilities to ease the shared concerns, offering one place to enter information (for managers) and one place to look (for travelers).

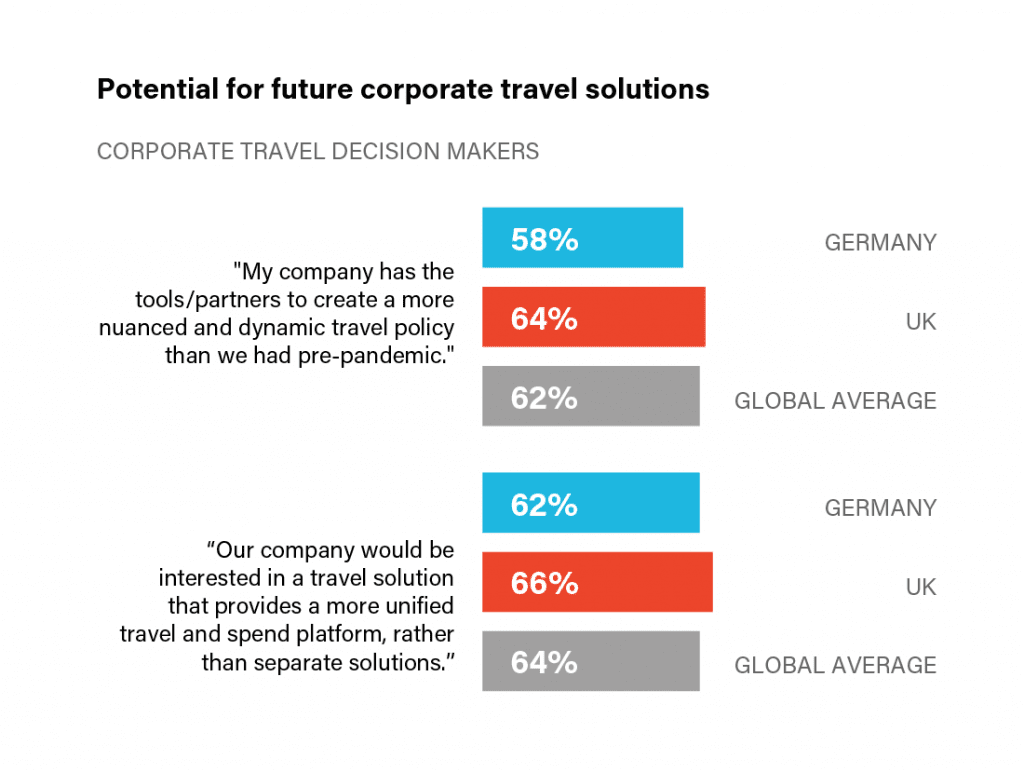

Interestingly, however, CTDMs from the UK expressed more confidence in their travel management tools and seem to be more interested in an all-in-one approach than other respondents. Sixty-four percent agreed that they already had the necessary tools and partners to create a more nuanced policy, and 66 percent said they would be interested in an all-in-one solution. Among their counterparts in Germany, those numbers were 58 percent and 62 percent, respectively. In both cases, the global average fell in between these two markets.

The ability to create higher satisfaction levels for travelers and managers alike through a single unified solution are clear. Advantages include greater transparency and ease of communication, as well as more streamlined and efficient business travel planning and management. Unified solutions also provide financial leaders with much-needed context, helping to better understand what expenses they may be able to automate versus those that require closer scrutiny.

“In short, you should obviously be able to book, manage, and support travel all in one place online,” said Ciara Govern, chief customer officer at TripActions. “Expanding that, to also include expense and spend management is the natural next step for corporations. Automating expenses with built-in spend policies for quick reconciliation and reimbursement drives multiple efficiencies and saves businesses and employees a considerable amount of time.”

The trends driving the business travel rebound may be slightly different from market to market, but the mandate is the same: Companies need efficient, user-friendly, digital solutions that consolidate and streamline their travel and expense management.

“Corporations are embracing the end-to-end solution of combining and automating the travel and expense, and employees appreciate that trawling through paper receipts is no longer necessary to expense reimbursement,” Govern added.

The bottom line: The future of business travel relies ever more heavily on the seamless integration of future-focused technologies. That’s necessary to support the German travelers who responded that they’ll soon be returning to the road, as well as the UK corporate leaders who said they recognize the importance of travel to close deals.

The year ahead will be critical. As companies continue to evolve their policies and navigate the continuously changing travel landscape, they will increasingly recognize the need to explore solutions that offer the flexibility and support to serve their needs now and in the future.

To learn more about key corporate travel and expense trends worldwide in 2022, please download the full Skift and TripActions report. This content was created collaboratively by TripActions and Skift’s branded content studio, SkiftX.

Have a confidential tip for Skift? Get in touch

Tags: business travel, business traveler, corporate travel management, expense management, expense technology, payments, travel policy, tripactions