Skift Take

There is still some weakness in the recovery of the airline sector, particularly in flight search levels and the pricing power of airlines. However, data from the Skift Recovery Index shows that flight bookings and capacity are making major strides toward pre-pandemic levels.

In Skift Research’s latest report, Skift Recovery Index: October 2021 Highlights, we see the travel industry come another few points closer to recovery. The global index now stands at 64, which indicates that the global travel performance is 64 percent compared to October 2019.

Most regions moved into black numbers again after a few disappointing months, indicating that fears over the Delta variant might be waning. The aviation industry has been underindexed for most of the recovery period, but we are finally starting to see some positive developments, despite some weakness remaining. Below is an extract from the latest report which dives into the latest performance of the aviation industry.

Aviation Industry Finally Sees Positive Movement

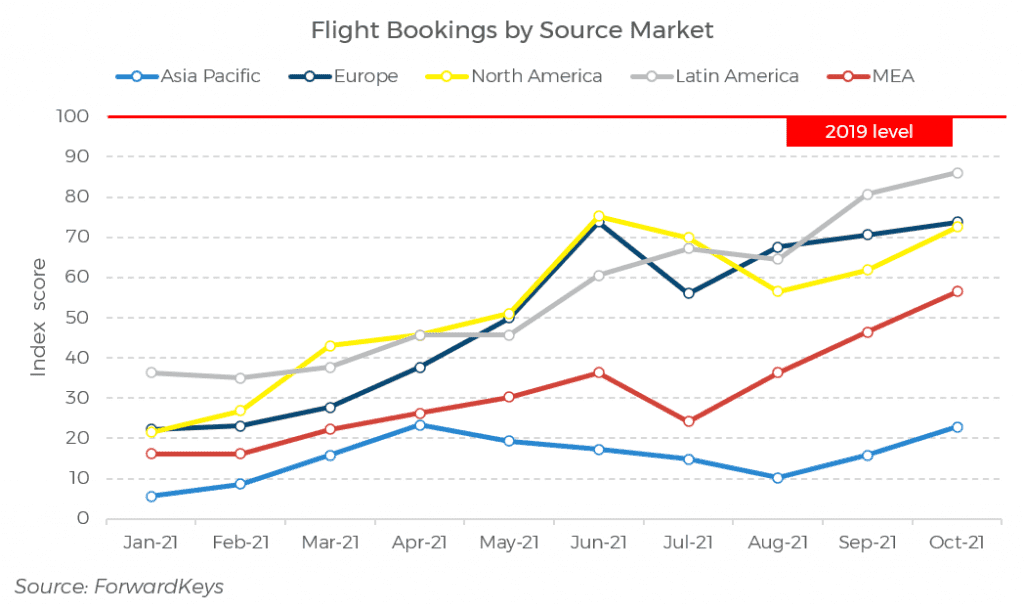

Flight booking data from our data partner ForwardKeys shows that booking levels have increased significantly since the beginning of the year, and in Europe and the Americas levels are nearing pre-pandemic levels.

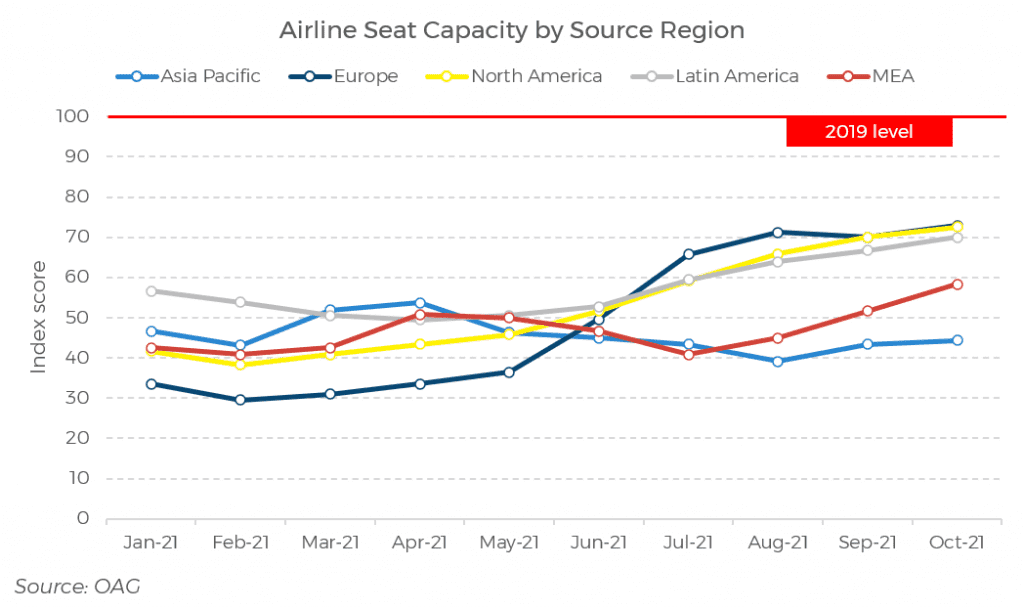

Also when we look at seat capacity data from OAG, the same regions are showing the strongest performance, with capacity levels in October back to 70 percent of pre-pandemic levels in Europe, North and Latin America.

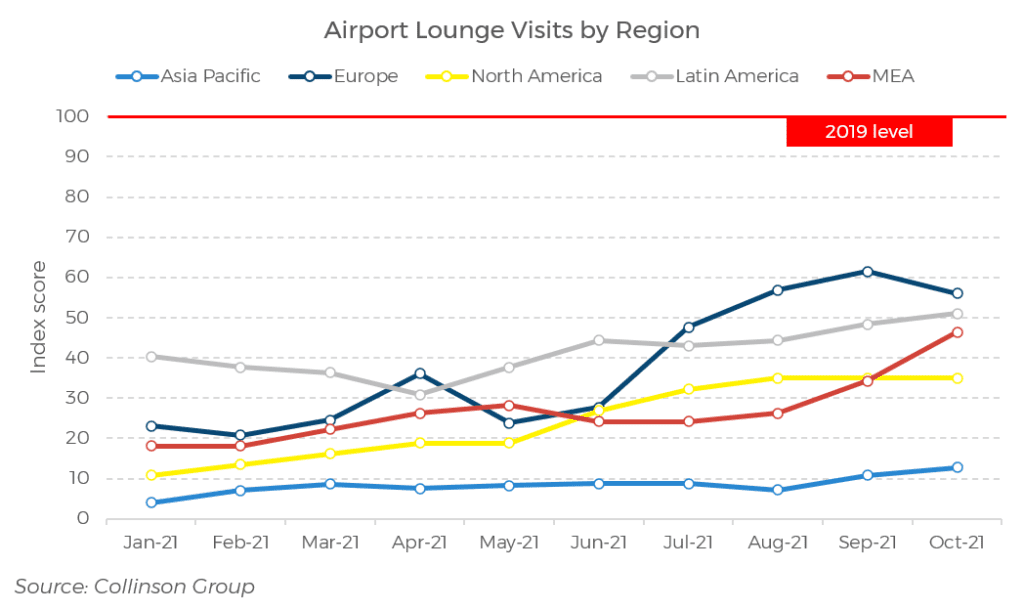

The Index also includes airport lounge visit data from Collinson, which has seen a steady increase in visits since the beginning of the year. This very likely signals the return of business travel demand and high-end leisure demand. Europe stands out here, which is mainly driven by Russia, where airport lounges have been open all year (not the case in many other countries) and demand has been back to pre-pandemic levels since July 2021.

Despite these improving indicators, there remains weakness in other areas which highlight that the industry continues to operate in uncertain times.

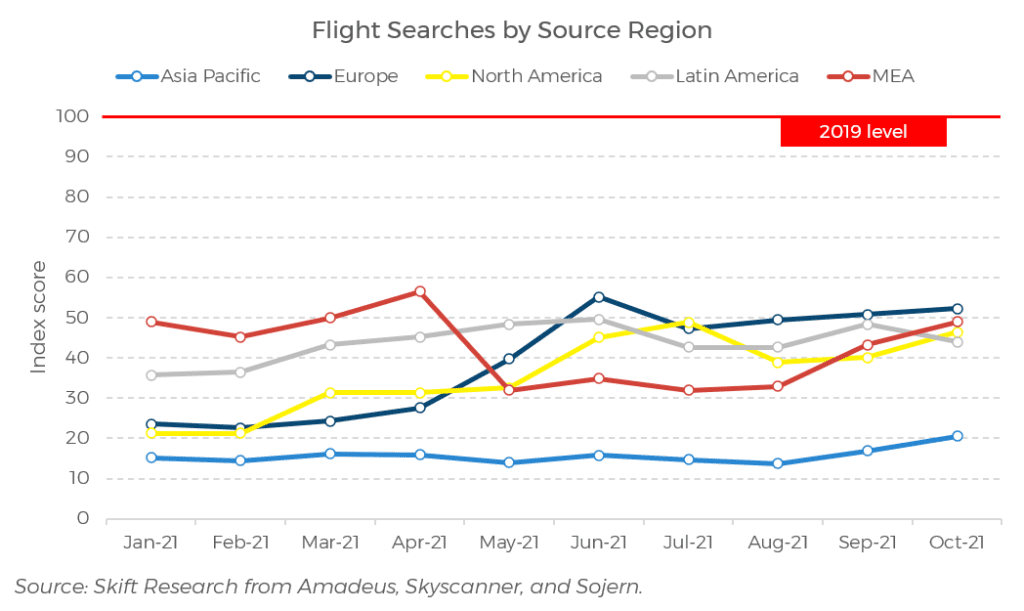

Firstly, the amount of flight searches that our data partners Amadeus, Skyscanner and Sojern are seeing remains suppressed. Europe is performing best at still only 52 percent of pre-pandemic levels, and there has been very little upward movement since the beginning of the year. The situation clearly doesn’t call for people to shop around and dream about their next trip just yet.

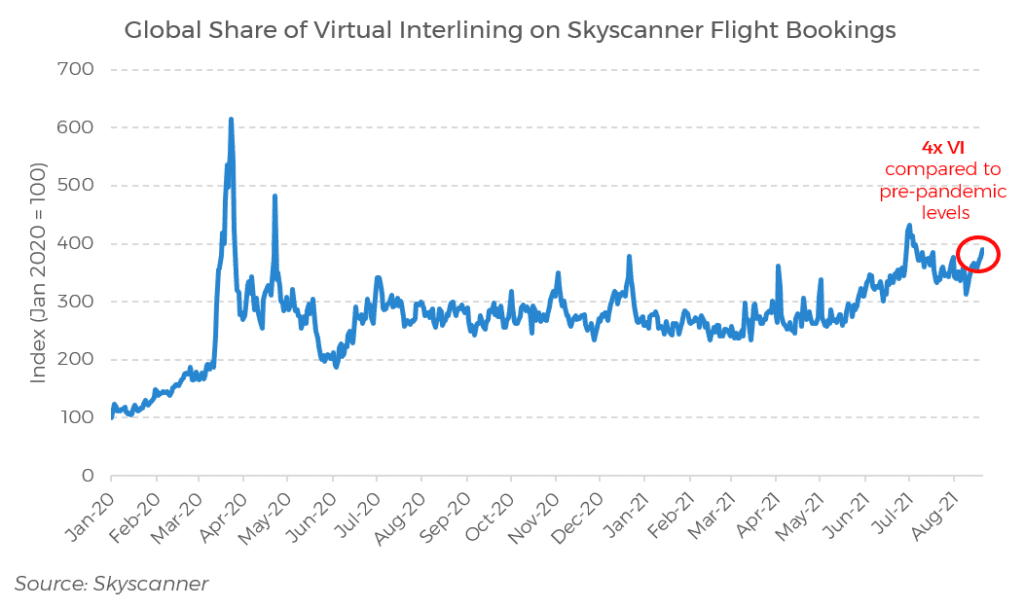

Secondly, according to data from Skyscanner, virtual interlining or self-connection, where people have to book two separate flights to get to their destination, has been up considerably since the start of the pandemic, but there has been little improvement in this. Route networks are clearly not back to optimal levels yet.

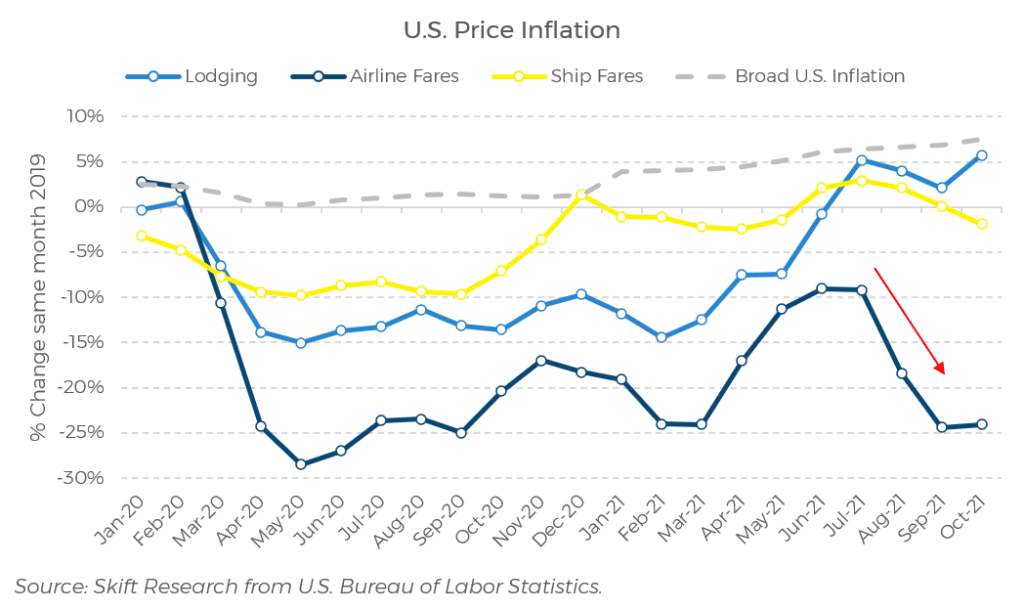

And finally, if we look at the latest publication from the Bureau of Labor Statistics in the U.S., we see that inflation rates are at the highest they’ve been for 30 years, but airline fares are bucking the trend by seeing strong declines in pricing. This highlights that airlines continue to lack pricing power and that capacity continues to outstrip demand.

Weighing up all these renewed strengths and some continuing weaknesses, there does seem to be a real sense in the industry that it will see a real boost next year, putting the industry in a prime position to achieve pre-pandemic volumes and revenues by 2023 or 2024. In other words, things will return to normal, sooner than many had expected.

Skift Research’s latest report, discussing the October 2021 Highlights from the Skift Recovery Index is now available to our subscribers, containing more insights into the recovery of specific countries and sectors.

Have a confidential tip for Skift? Get in touch

Tags: airlines, aviation, skift recovery index, skift research