Skift Take

The Hotel Tech Benchmark dashboards and reports respond to a dire need from hoteliers, tech vendors, and investors alike. Understanding the makeup of hotel tech categories, and identifying growth opportunities, will help the industry drive its move towards digitization.

The space of hotel technology is booming, but also often misunderstood.

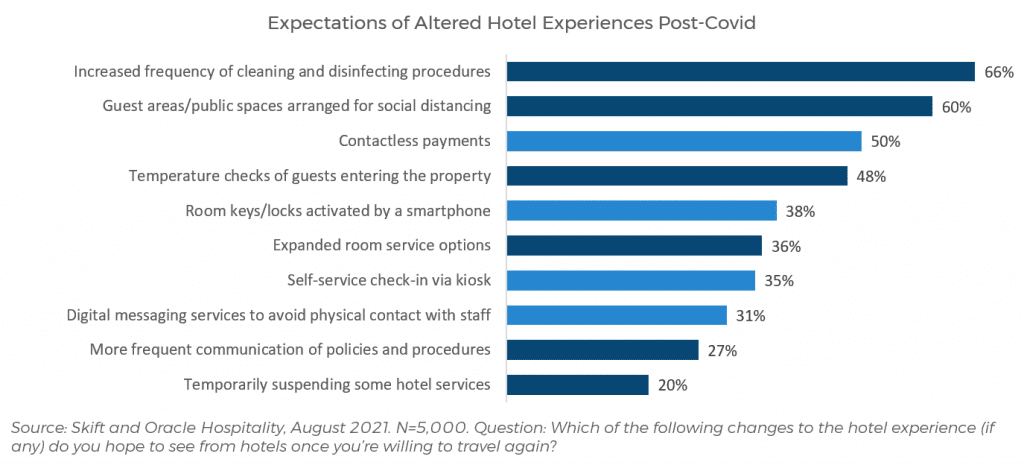

Booming because the pandemic has driven home once again the need for hotels to have first rate technology to enhance the guest and staff experience. The beginning of the pandemic saw a run on the adoption of contactless technology like messaging services, in-room ordering, and online check-in, which also boosted keyless entry systems. According to a recent survey by Skift and Oracle Hospitality, these technologies are now expected by many hotel guests.

But as said, the hotel tech space is also often misunderstood. It is a space where well-known legacy brands compete with hosts of start-ups, where each vendor is trying to find its niche by offering a set of solutions that needs to fit into the hotel tech stack. The hotel industry is extremely fragmented and immensely varied in the service levels and amenities offered, which require bespoke tech stacks for almost every hotel. Many hotels use anywhere from 10 to 50 tech vendors and systems to be able to operate effectively.

A new data tool by Skift Research, called the Hotel Tech Benchmark, is launched today to offer clarity in this convoluted space. Skift Research has done extensive outreach to hotel tech vendors to participate in this new tool.

The data dashboard will answer some critical questions:

- What is the annual revenue generated from each hotel tech category?

- How many hotels utilize particular technologies?

- How valuable is the total current and addressable market?

- Where do growth opportunities lie?

- What are the most important revenue streams for tech vendors?

- Which are the largest vendors in each category, and what market share do they have?

- How do vendors differentiate themselves from their competitors?

Today we are launching the first dashboards, which include data for the Property Management Systems (PMS) and Revenue Management Systems (RMS), exclusively available to Skift Research subscribers. More tech categories will follow.

Understanding the PMS Tech Category

Skift Research will also be publishing individual reports for each category, which are available for individual purchase. The first report, Hotel Tech Benchmark: Property Management Systems 2021, providing data insights into the PMS category, is now available.

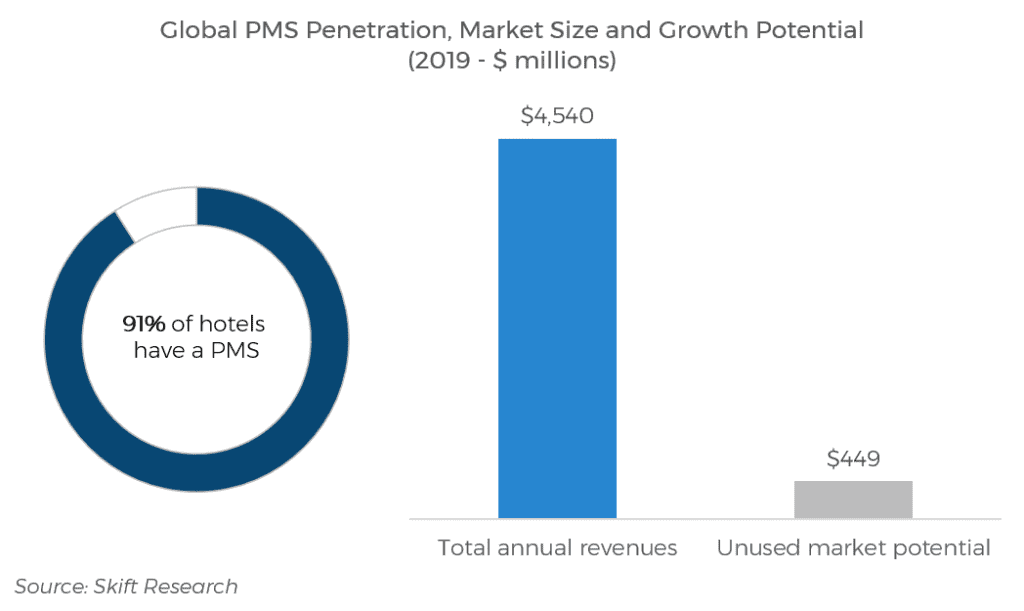

The report is the most complete vendor landscape and market sizing for the PMS sector. With annual revenues of $4.5 billion, this is the largest hotel tech category, but it is also extremely fragmented. There is a lot to fight for.

Our analysis covers the largest 87 PMS vendors. There are a few large players, with the top 10 vendors accounting for 34 percent of the total market in terms of rooms, but after that, market shares become much more fragmented. The next 15 vendors add another 12 percent of market share, and the 25 vendors after that (making up the top 50) only add another 7 percent market share.

Many more insights can be found in the report, including market shares for all 87 PMS vendors, based on the amount of hotels and rooms they service, market share splits by third party and hotel brand proprietary systems, and a breakdown of revenue streams for third-party vendors.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hotel technology, hotels, pms, skift research