What Will the Next Phase of Travel Look Like? 4 Insights From the Industry’s Decision Makers

Skift Take

This sponsored content was created in collaboration with a Skift partner.

What will the travel industry look like as the world re-emerges from the Covid-19 pandemic over the coming months and years?

We asked our Skift Global Forum audience of more than 950 travel industry executives to help us understand what’s top of mind for decision makers when it comes to recovery and what comes next. Here, we look at four key insights from those responses.

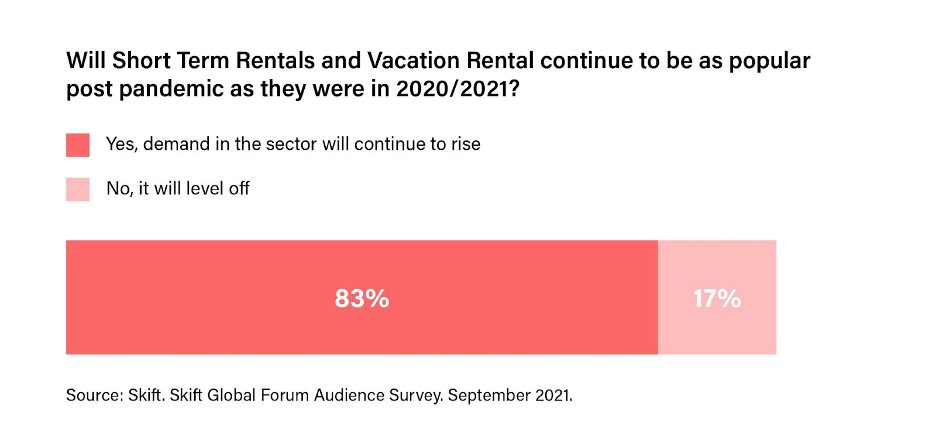

Short-Term and Vacation Rentals Will Keep Getting More Popular

Short-term vacation rentals were extremely popular in 2020 as travelers sought out getaways that avoided congregating with others in hotels and resorts. The professionalizing of the short-term rental field means consumers can have increasing confidence in choosing this option above the more standardized hotel sector.

We asked travel industry executives how they think this trend will play out. Answers show an overwhelming belief among travel leaders that interest in short-term and vacation rentals will continue to be strong — and get stronger — in the coming months and years. Some 83 percent of executives surveyed think demand will continue to rise, while 17 percent predict interest will level off. No respondents predicted that hotels will surge as travel returns to pre-pandemic levels.

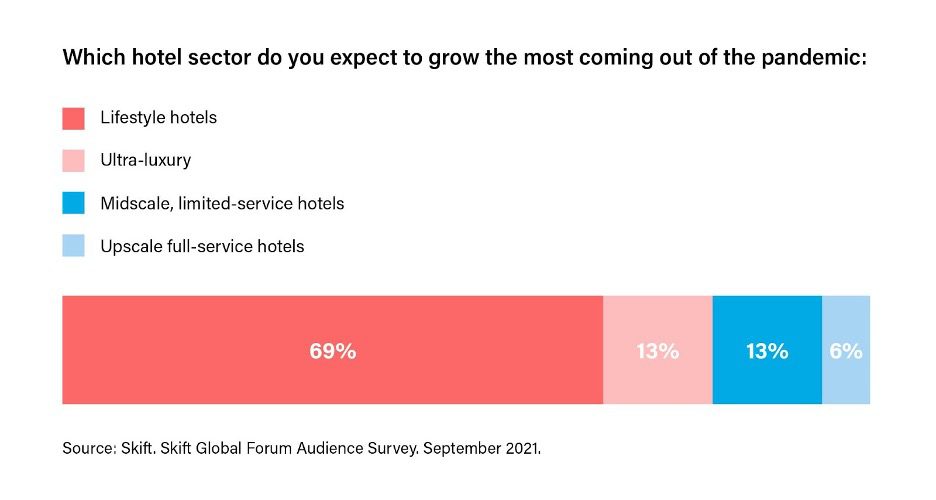

Lifestyle Hotels Will Continue to Boom

While answers to the previous question made clear that hotels might now be the “runners up” of the accommodation sector during the pandemic — at least compared to short-term rentals — some hotel categories have been faring better than others. Lifestyle hotels have been on the upswing lately, providing unique, experiential offerings that attract pandemic-weary travelers looking for something different at an affordable price point.

We asked executives what type of hotel they expect to attract the most interest coming out of the pandemic. The vast majority of respondents — 69 percent — predict that lifestyle hotels will keep a position of strength. Ultra-luxury and midscale limited-service hotels tied for second in the vote, at 12.5 percent each, followed by upscale full-service hotels, with 6 percent. No one put their weight behind economy hotels.

The Travel Industry Will Focus on Social Issues

One session at Skift Global Forum focused on three core social issues that the industry must address to build back better: climate action, community-minded tourism, and diversifying the tourism chain. Across sectors, consumers are demanding that companies embrace social responsibility and embody their values. This is a particularly strong imperative in travel, as there are many global social and environmental implications to this sector’s activities.

Executives surveyed on the question feel an imperative to address multiple social issues at the same time. We asked which of the three core social issues the travel industry should focus on to build back better, and by far the strongest response — with 48 percent of the vote — was “all of them.” Building community-minded tourism was the most-selected individual issue, chosen by 26 percent of respondents, followed by climate action and diversifying the tourism chain, each with 13 percent.

Some brands are already looking to address these critical issues in their day-to-day operations. For example, last year Hopper launched its Hopper Trees carbon offset program. With every booking, Hopper will plant up to four trees for free, which will be donated directly to its partner, Eden Reforestation Projects, which has planting locations all over the world, including Madagascar, Mozambique, Indonesia, Kenya, Haiti, and Nepal.

Companies Will Get Serious About Payment Innovations

Recent years have seen the travel industry embracing payment innovations like buy-now-pay-later, contactless payment options, fraud protection, and virtual wallets. The pandemic turbo-boosted the adoption of payment technologies in many sectors, including in hospitality. The ubiquity in demand for these innovations have made them must-haves for many travel industry players. For example, developing its own travel fintech technology, Hopper has seen a nearly 500 percent jump in revenue growth since 2019. Now through its B2B initiative, Hopper Cloud, the company is providing that fintech to brands that want to sell travel or enhance their travel offering.

There’s a significant shift happening in payments right now, which was accelerated by the pandemic. Consequently, we want to know how your company is thinking about it. Click below to add your voice about what you’re seeing in payment tech. All responses will be anonymous.

It’s clear that the industry is entering a moment of dynamic change, with fintech in a unique position to revolutionize how people buy and sell travel. Learn more about what to watch for in the coming months and years from Hopper Founder and CEO Frederic Lalonde in his session at Skift Global Forum.

This content was created collaboratively by Hopper Cloud and Skift’s branded content studio, SkiftX.