Skift Take

Publicly traded hospitality companies need to show shareholders signs of growth and expansion. Travel + Leisure Co.'s message of multibillion-dollar sales growth from existing clients isn't as far-fetched as the price tag may sound.

There’s a lot of upside in the timeshare industry — that is, if you can make that first sale.

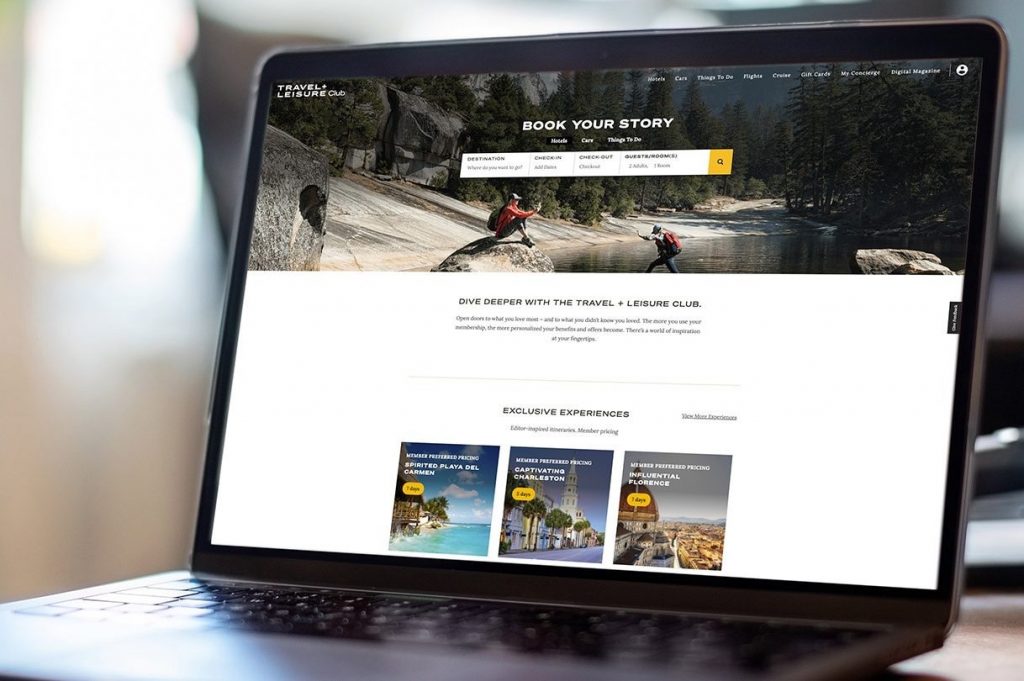

Executives at Travel + Leisure Co., formed earlier this year when vacation rental and timeshare company Wyndham Destinations acquired Travel + Leisure for $100 million, see opportunities in vacation clubs and other revenue streams. The company’s investor day this month generally focused on how Travel + Leisure Co. can grow exponentially by tapping into consumer-facing travel clubs as well as corporate accounts.

But what might shock some is how much money the company thinks it has sitting on the table from its existing base of members. Travel + Leisure Co. estimates there is $12.5 billion in owner upgrade potential from current members over the next decade.

The number creeps even higher to $19.3 billion when factoring in other revenue streams like management and resort fees and interest payments. They just need travelers to get that first taste of timeshares to get the upgrade momentum moving.

“It’s not about marketing. It is about owner occupancy,” Travel + Leisure Co. CEO Michael Brown said in an interview with Skift. “The more owners we get back to our resorts on an annual basis, the more they enjoy it, [and] the more they buy.”

The Travel + Leisure takeover and accompanying branding overhaul continued Wyndham Destinations’ push into showing it is a company that has far more to offer than the stodgy timeshare reputation of yore.

Going to the same condo in the Bahamas the same week every year was how older generations enjoyed this sector. Travel + Leisure Co. is supposed to be about flexibility. The more people come to that realization, the more they’ll want to travel that way, the thinking goes.

“The average length of vacation time in America is somewhere between 25 and 28 days, and, when you’re first learning about a timeshare ownership, there’s a lot of education and thinking of, ‘You know, I’m not sure that this is right for me, and I’m willing to commit five or seven of my 28 days to this product, so let’s see how it goes,’” Brown said. “That’s the initial dollar, so to speak, and then, as time goes on, usually in the first five years, they’ll spend another dollar because they’ve experienced it.”

Companies like Travel + Leisure Co. as well as competitors like Hilton Grand Vacations have been able to market themselves to potential customers around the ideas of having more space. Members end up spending 2.6 times their initial purchase over the span of a lifetime, according to Travel + Leisure’s investor documents.

Upgrades and upselling aren’t unique to the timeshare business. Low-cost air carriers Allegiant, Spirit, VivaAerobus, and Wizz Air all made more money last year from add-on charges than they did off their base airfares, Skift reported this week.

While $12.5 billion in timeshare upselling may seem like a stretch, analysts don’t think it is outside the realm of possibility. Travel + Leisure Co. had 867,000 owners in its membership base at the end of last year and a 98 percent annual retention rate of owners over the last decade.

But all those offers of free Broadway tickets and other incentives aimed at getting travelers to sit through a lengthy timeshare presentation play a massive role in hitting that financial target.

“The first sale is the most difficult sale for a timeshare,” said Patrick Scholes, managing director of lodging and leisure equity research at Truist Securities. “To get the person in the door, you’ve got to give them lots of luau tickets, Disney tickets, dinners, ski tickets, free hotel room nights, etc.”

First sales in the timeshare orbit are typically low in margin due to all the accompanying sales incentives. The second and third sales or upgrades are where the profit margins really begin to kick in. That upgrade food chain can even chart a path to billions of dollars in untapped sales.

“They find, once you buy the product, the vast majority of customers are extremely happy with it and it’s much easier to get to,” Scholes said. “They actually want to just buy more, and they don’t need to be incentivized by the freebies and whatnot.”

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: timeshares, travel + leisure, wyndham

Photo credit: Travel + Leisure Co. executives see more than $12 billion in upgrade sales potential from its existing timeshare owners. Travel + Leisure Co.