Why Japan's Vacation Rentals Are Hiring Tech-Savvy Management Companies

Skift Take

The Japanese market for travel accommodation — including hotels, ryokans (traditional inns), minpaku (short-term rentals), and vacation rentals — is mostly run by independent operators. Yet these family businesses and small lodging companies are often behind the times in technology, at least when it comes to adopting the latest software for operations and marketing.

Japan contrasts starkly with the U.S., which is dominated by chains. One appeal of flagging with a chain is that the chain can make sure every property is run with up-to-date technology. Yet the uniform look and experience of nationally branded lodging have turned off many consumers. Some of these travelers are switching to alternative accommodations instead.

Amusingly, the short-term rental segment is now being professionalized, too, and for a similar reason of seeking cost-efficiency through technology. Companies like Sonder are seeking to operate short-term rentals under their brands. The companies use technology to more efficiently handle guest management, inventory, housekeeping, furnishings, and online sales. They believe scale gives them an advantage.

However, many Japanese lodging owners are looking for a different, "unbranded" fix. They want to fill the gap in technology they're missing without losing their own signature flair and control.

Enter, H2O Hospitality, a company that manages travel accommodation on behalf of owners with a tech-led system. H2O [which stands for second-generation hospitality, through digital transformation] offers its service usually on a white label, or unbranded, basis. It promises to reduce fixed costs up to half while also raising sales revenue.

CEO John Lee founded the company in Seoul, Korea, but H2O Hospitality only gained traction when it entered Japan in 2017. It now operates 7,320 guestrooms in Japan and claims to be the largest vacation rental management company in the country.

H2O Hospitality matters less for its size, which is tiny, than the trend it represents, which is significant. The startup has only raised $16 million (about 18 billion South Korean won) to date from investors such as Samsung Ventures, Stonebridge Ventures, and 500 Startups. Samsung is a notable investor not only because of its technology expertise but also because it owns a chain of hotels in South Korea under the Hotel Shilla and Shilla Stay brands.

Filling a Tech Gap

To grasp the potential significance of the trend of unbranded, tech-led management companies, you need to get a picture of what the tech gap is in lodging. Skift Research offers subscribers in-depth analysis of the issue, but the following is a short version.

Here's a typical flow for a small lodging operator today in Japan: A guest makes a reservation. An agency either emails or faxes the information to the property. Someone manually sends it through an extranet to the front desk team, which manually assigns a room for the guest. When the guest arrives, the front desk manually checks them in. Housekeeping schedules are manually managed, too, sometimes with clipboards and walkie-talkie radios.

Here's the next-generation workflow, instead: A reservation digitally flows into a property management system, which assigns a room. Computers send an online-check in form digitally to the guest before the guest arrives. After check-in, a computer sends a passcode to access the room so that the guest can bypass the front desk. Computers manage the schedule of housekeeping contractors. After a housekeeper cleans a room, they take photos of their work for faster, more centralized, Uber-like monitoring.

H2O Hospitality strives for a more digitally savvy path. The startup shares revenue or profit with the building owners of between 15 to 30 percent of what guests pay. In the case of a walk-in guest, the startup has a kiosk in the lobby where that guest can book a room at the last minute.

Independent operators make up a lot of the startup's customers. But it also has some customers who are associated with bigger brands. Rakuten, one of Japan's largest e-commerce companies, has a motel brand Rakuten Stay and a Vacation Stay short-term rental brand. A few of these properties use H2O Hospitality's services.

The same goes for a few of the franchisees of Oyo Hotels in Japan. Franchisees have H2O Hospitality run operations but leaving the branding and direct sales to Oyo.

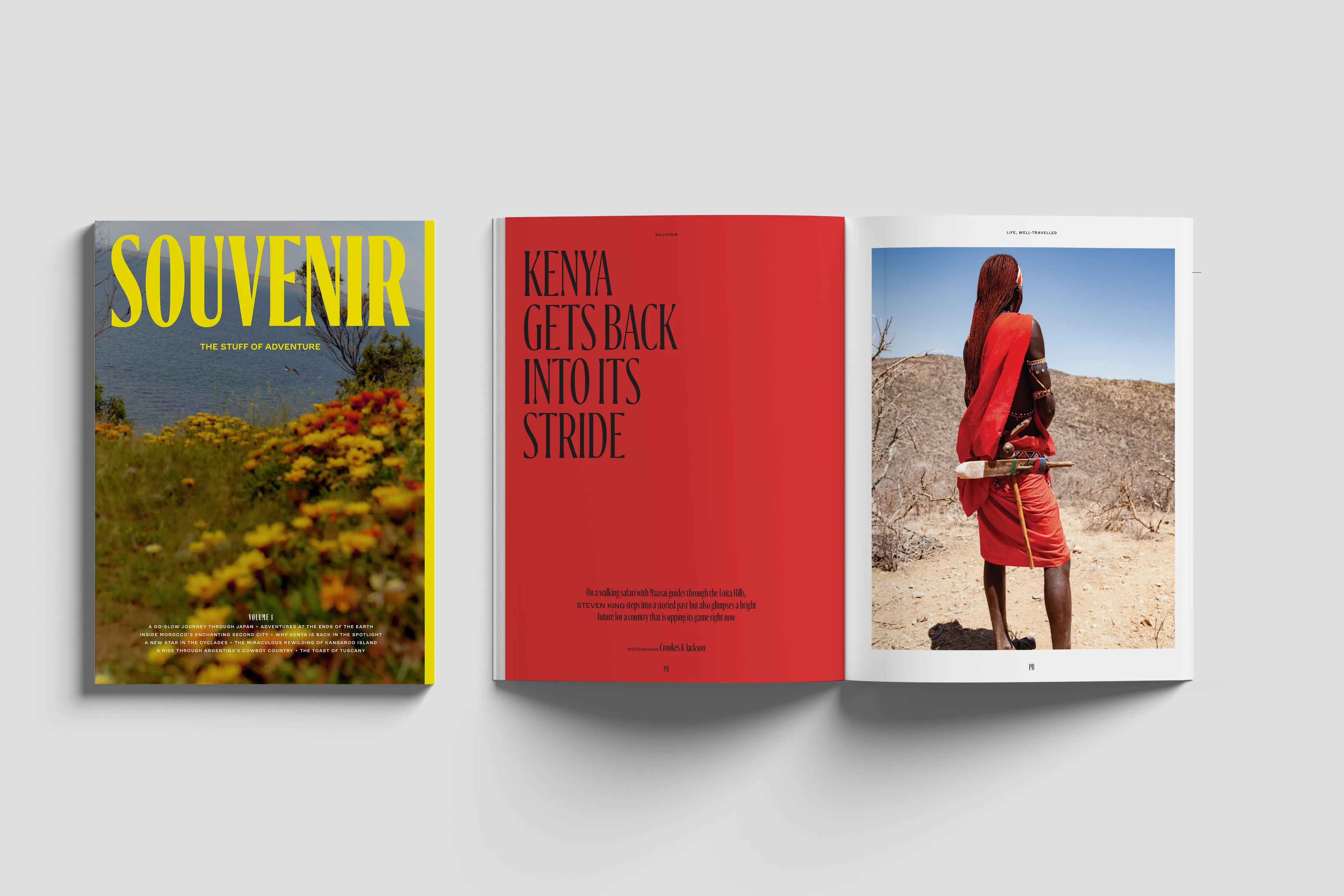

A one-bedroom short-term rental managed by H2O Hospitality as the property management company is in Tokyo's commercial district Shibuya. Source: H2O Hospitality

H2O Hospitality concentrates on small geographic areas to maintain efficiency, serving contiguous units within the same building or complex where possible.

"We want to keep the properties we serve close together to reduce the travel time of our housekeepers, facility managers, concierge people, trash removal people, and emergency people so that we can decrease the fixed cost," said Lee. "We do all size companies, but we prefer the 100-key to 700 unit range. That's our sweet spot."

The startup's pipeline is mostly inbound leads from real-estate developers that tell it of their upcoming projects. The vendor does feasibility tests and makes a proposal about which units it will offer management contracts for.

Looking ahead, H2O Hospitality plans to expand more in South Korea, Thailand, and other parts of Southeast Asia. But the model it has championed is likely to inspire more than a few imitators, as the problem it attempts to solve is widespread.