Skift Take

Hotels were the bright spot in an otherwise disappointing jobs report, but there’s no time for a victory lap. Hiring has to maintain April’s strong momentum, at the very least, to meet summer demand. That’s a tall task in such a tight labor market.

A disappointing April jobs report in the U.S. is the latest reminder many businesses are staring down the upcoming peak summer travel season with nowhere near the staffing levels needed to accommodate demand. But hotels still have some reasons to celebrate, even as anxiety over that labor shortage in travel grows.

The hotel industry added 54,000 jobs — the biggest monthly gain since last September — and hotel unemployment dropped to 13.8 percent from the 19.9 percent seen in March, the U.S. Bureau of Labor Statistics reported Friday. The U.S. overall added 266,000 jobs last month, well below economist expectations the number might eclipse 1 million.

What’s more, hospitality wage increases are back to pre-pandemic trend lines. Average hourly wages for a non-supervisor hospitality job increased more than 7 percent during the pandemic.

Hotels have run well above the national unemployment rate average for the duration of the pandemic, but this is the narrowest gap between the two figures since the start of the health crisis.

The leisure and hospitality sector — which includes restaurants as well as hotels — added 331,000 jobs. This was the sixth-highest percentage gain for the overall hospitality sector in the last 50 years, Heidi Shierholz, director of policy at the Economic Policy Institute, noted on Twitter.

The gains were noted by economists but with the caveat that more needs to be done.

“It’s great to see some progress there,” said Nick Bunker, an economics research director for North America at the Indeed Hiring Lab. “That being said, hospitality employment is still down about 17 percent. It’s great to see progress, but there’s a ways to go there.”

Hospitality’s improved employment is a strong boost to the economy. But the sector is still 2.8 million jobs shy of where it was in February of 2020, and travel demand this summer is widely expected to be at record levels.

The hotel job gains come a month before summer travel picks up, and analysts say it is vital the growth continues for months ahead.

“It’s not bad news, but we need to maintain this kind of growth, maybe even accelerated to some extent, if we want to get back to where we were,” said Bram Gallagher, a senior economist at CBRE Hotels. “It’s a good first step.”

While Gallagher isn’t worried by the hotel jobs report, industry executives and analysts this week emphasized swelling labor shortages will be a concern this summer. U.S. hotels are about 600,000 workers short of pre-pandemic levels, and operators are scrambling to call workers back from furlough.

“It is constraining recovery at certain times because you just can’t get enough people to service the properties,” Hilton CEO Christopher Nassetta said on an earnings call this week. “I do think in the short term there’s going to be wage pressure [and] wage inflation.”

There are a variety of factors at play for why workers are staying away when there is so much demand for them to come back. Nassetta chalked it up to health concerns, children continuing to learn remotely from home, and the $300 extra in federal unemployment benefits that runs through early September.

“[The federal government] did all these things to support people who were in harm’s way, all of which made sense at the time,” he added. “Maybe some of it makes a little bit less sense now in the sense that the demand is there and the jobs are there, yet people don’t have as much of a need to come back to it.”

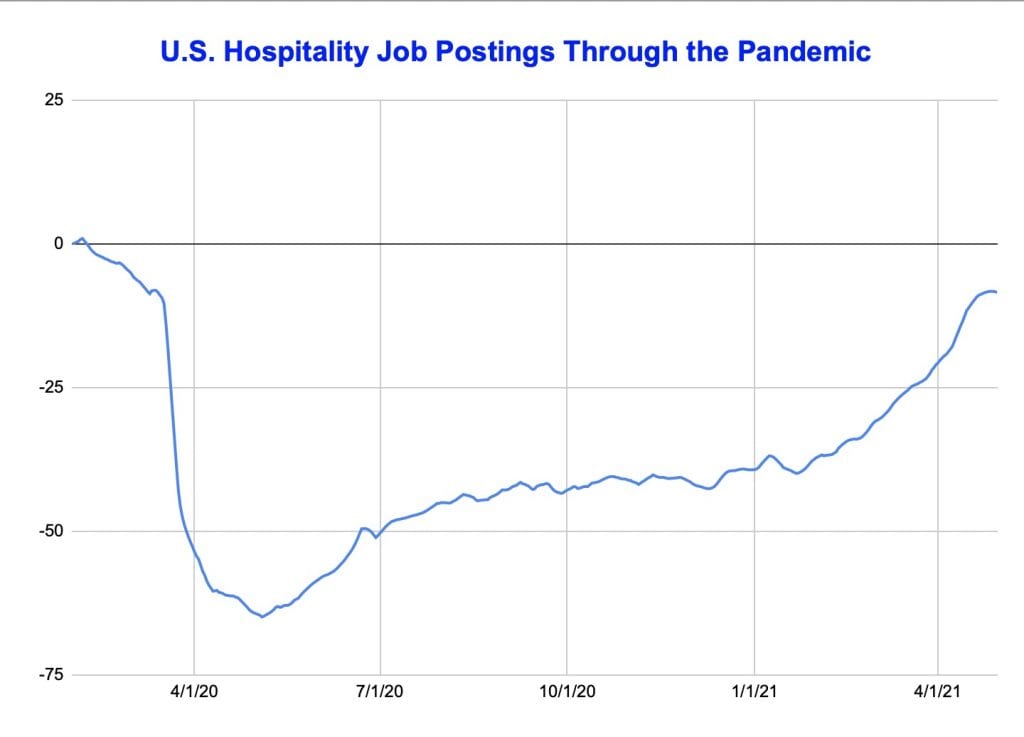

Hospitality companies clearly want workers back more than they have at any other point in the pandemic. Job postings for the sector fell as much as 65 percent from pre-pandemic levels last May but have since recovered to where they were only off by about 8 percent at the end of April, according to data from Indeed. It isn’t yet clear how many of those jobs will get filled.

Some economists see a tightening hospitality labor market but not at the panicked levels described by various company executives.

Wage increases are back to pre-pandemic trends, but if things are so bad in the pandemic, they would be even higher, Shierholz tweeted. Some of the worker shortages may have more to do with the lower wages associated with hospitality compared to other industries.

CBRE’s recent “U.S. Hotels State of the Union” report highlighted the long-term impact of other industries pulling in laid-off hotel workers during the worst of the pandemic: They may never come back to their prior jobs.

The retail industry has a 17.5 percent, or $2.68 per hour, wage premium for frontline hotel workers, according to the CBRE report. Even before the pandemic, there was a 14 percent wage premium.

Hourly wages increased nationally across April, which the Labor Department noted Friday was a signal demand for workers outstripped supply. Hotel operators will have to similarly raise wages to remain competitive in such a tight labor market, and many already are.

“I think there’s going to be some creativity this year. I think there’s going to be new ideas about service levels and how thin of a crew [a hotel can run],” Gallagher said. “But, yeah, if you need to get more people, then the traditional way to do that is to raise wages.”

Have a confidential tip for Skift? Get in touch

Tags: coronavirus, coronavirus recovery, labor

Photo credit: Hospitality can't afford to lose its current job gains heading into what many expect to be an extraordinarily busy summer. pasja1000 / Pixabay