MGM's Race to Diversify Beyond Casino Resorts Shows Early Strength

Skift Take

The coronavirus pandemic continues to be catastrophic for Las Vegas casino resort operators, but an expansion into online gaming at least gives MGM Resorts International another option in its recovery toolkit.

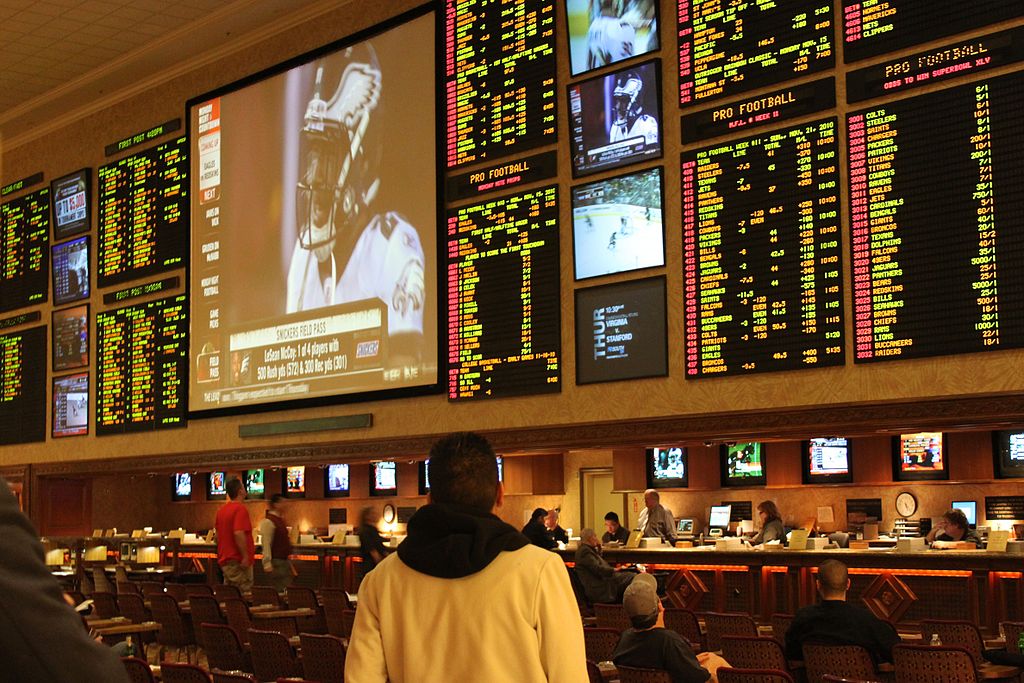

MGM reported Wednesday a $448 million fourth quarter loss, tied to revenue being down 66 percent at its Las Vegas resorts and down 58 percent in Macau. But there wasn’t a lot of talk about hotel room performance on an investor call shortly after the financial results posted. Instead, the company’s leaders touted future growth around online gaming and sports betting — a rapidly growing division of the company that doesn’t require customers to fly to resorts in Las Vegas or Macau.

“We do want to diversify our revenues,” MGM Resorts CEO Bill Hornbuckle said on the call. “[Online gaming and sports betting] has already proven itself. We think this is where the industry is going, and we want to be a larger part of it.”

MGM Resorts continues to double down on the online gaming and sports betting sector, despite its rebuffed $11 billion offer earlier this year for British gaming company Entain PLC, the owner of online gaming site Ladbrokes. MGM and Entain already work together in a joint partnership on a U.S. online betting platform, BetMGM.

BetMGM launched in seven new states over the span of 2020 and is expected to be in 20 markets by the end of this year. Hornbuckle indicated in a statement ahead of the investor call that MGM Resorts was “very pleased” with the January launches in Iowa, Michigan, and Virginia. BetMGM’s gross gaming revenue from Michigan even eclipsed that of New Jersey, where MGM was more established in the sector.

“We are engaged on pandemic response while staying focused on the future,” Hornbuckle said. “This includes maintaining a strong balance sheet to seize opportunities and continuing to drive BetMGM.”

MGM’s focus on the burgeoning sector even attracted new investors in 2020. Barry Diller’s IAC/InterActive took a $1 billion, or 12 percent, stake of MGM Resorts last year with the intention of beefing up its online gaming presence.

The BetMGM platform has a 17 percent market share of the online gaming and sports betting revenues in the U.S. states it is active, according to an investor presentation.

But the online gaming division is still relatively small compared to traditional casino gambling. An IAC shareholder letter last year claimed MGM’s online gaming revenue was “so small that it rounds down to zero.”

Analysts have expected the American online gaming market to explode since the U.S. Supreme Court lifted a ban on sports betting, and casino companies have turned to more established European operators to advance their growth. Caesars Entertainment is in the process of a nearly $4 billion acquisition of UK-based gaming platform William Hill.

Hornbuckle wasn’t saying much Wednesday about MGM’s stalled takeover bid for its JV partner Entain, saying he was limited in his remarks due to UK takeover rules.

“We’re in a quiet period. We’ll have to see what happens,” he added. “I will say this: It is MGM’s intent to play in this space on a substantive and significant level on a global basis. Whether this is the avenue or route to do it on, time will tell.”

What About the Rooms?

While MGM is bullish about the future of online gaming, it also has to grapple with its present reality and ownership of tens of thousands of hotel rooms that are well below their normal performance levels.

Fourth quarter occupancy rates at MGM’s Las Vegas resorts averaged to 38 percent, with 52 percent averages on the weekends and 31 percent during the week. Room revenue was down 70 percent. There were even mid-week closures for part of the quarter at the company’s Mandalay Bay, Mirage, and Park MGM resorts.

October was the strongest month of the year since the beginning of the pandemic, but bookings slid the remainder of the year due to the winter surge in new coronavirus cases.

Hotel operators across Las Vegas are grappling with a tanked convention business, which typically drove high rates in the middle of the week while leisure travelers came in for weekend business. Overall visitor volume to Las Vegas was down more than 55 percent last year while convention attendance was down 74 percent, according to the Las Vegas Convention and Visitors Authority.

Group business typically accounts for about a third of room revenue at upscale U.S. hotels, according to McKinsey & Co. research.

But MGM isn’t waving a white flag on the convention sector. The company sees strong convention bookings ahead in the third quarter, and Hornbuckle claims the fourth quarter of this year actually looks better than the fourth quarter of 2020 looked at this point last year — which was pre-pandemic. He even predicts MGM will reach 90 percent of its 2019 convention business levels by the end of 2022.

Company leaders are also optimistic they have been able to hold onto 82 percent of advanced deposits for entertainment features like Lady Gaga’s residency at the Park MGM.

“I think what that says is, when available, people are going to want to come back,” Hornbuckle said.

A New Face of Gaming

Hornbuckle signaled optimism around the recovery of Las Vegas and Macau as well as future resort growth in Japan. However, he didn’t offer any indication of what MGM's push into online gaming and sports betting would mean for the company's hotel room performance in the long-term.

But MGM leaders made it abundantly clear the future of the gaming industry is about having as many options possible to reach customers rather than relying on them walking through the front door of a resort.

“Once engaged, we know omni-channel customers have vastly more value to our company than single-channel customers,” Hornbuckle said.