Skift Take

While business travel platforms go after the expense market, expense platform Coupa’s move in the other direction would give it plenty of cross-selling opportunities.

Business expense management company Coupa is no stranger to acquisitions.

In January last year, it acquired Yapta, a price tracking rebooking tool. As Skift noted at the time, more travel tech company acquisitions could be on the cards to help it catch up with Germany’s SAP, which owns Concur.

Later in 2020, Coupa bought Bellin, a treasury management software provider; LLamasoft, an artificial intelligence-powered supply chain design and planning platform; and supplier management software ConnXus.

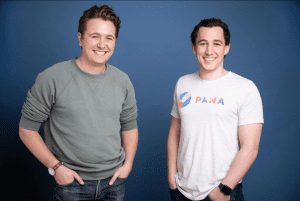

Skift has learned from sources that Coupa is considering acquiring business travel platform startup Pana, which is itself on a major growth trajectory, having just raised an extra $3.6 million in funding.

Coupa did not respond to Skift’s request for comment. Pana could not be reached for comment.

Denver, Colorado-based Pana provides an on-demand mobile app, which acts as a travel concierge for booking flights, hotels, cars and dining and saves travelers’ preferences and personalizes suggestions.

In the past six years it has built travel management tools for hundreds of companies, and partnered with several travel management companies, including CWT and BCD Travel. Such a deal would give Coupa more inroads to embed its spend management services in more corporations.

Messaging is also where it’s at, with more travel agencies looking to tap into platforms like Slack and Microsoft Teams.

“I am not surprised were Pana to be acquired,” said Scott Gillespie, CEO of consultancy tClara.

“It has such a strong grasp on the guest traveler market, which makes it attractive to many a player. From here, it’s easy to see Pana extending its services to small group meetings … this would give Coupa an even bigger footprint in the early spending decision cycle.”

Despite only being February, there’s been a significant level of activity in the corporate travel space, including American Express Global Business Travel’s acquisition of Ovation Travel, and TravelPerk’s move into the U.S. after buying NexTravel.

However, if such an acquisition were to materialize, Coupa would be playing the long game, with business travel spending not expected to return to its pre-pandemic level of $1.4 trillion until 2025.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: american express global business travel, bcd travel, concur, coupa, cwt, sap, travel management

Photo credit: Chicago O'Hare International Airport. Nicola / Flickr