Skift Take

Expect most travel sectors to shed their defined borders, with convergence running wild. But a handful of companies will choose to focus instead on their core services as an elixir for growth.

In January 2021 we released our annual travel industry trends forecast, Skift Megatrends

. Because of the havoc that the pandemic triggered, we wrote Skift Travel Megatrends 2025 as a vision of how travel industry dynamics could play out five years from now. You can read about each of the trends on Skift, or download a copy here.

Looking back from 2025, we see that the pandemic catalyzed and sped up a sector convergence that had been simmering for years. Fierce competition from superapps like Grab, WeChat, Line, and Rappi fueled the cross-selling spurt.

Another factor: Making the most of marketing money. Many companies ran direct booking campaigns to optimize their marketing expenditures. So corporate investors pushed the brands to add more products and services, hoping to boost the average number of transactions per customer.

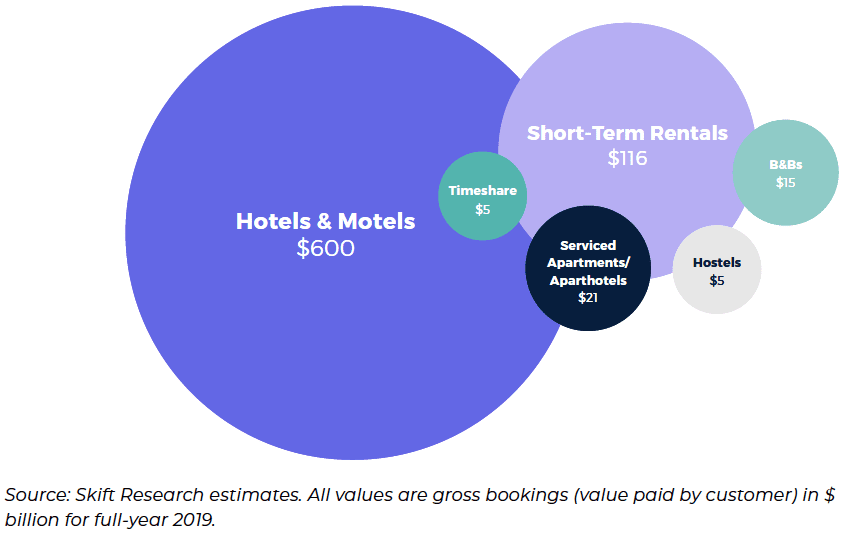

Asset-light businesses, such as hotel groups and online booking services, found the shift straightforward to make. Showcasing the trend, Accor entered the ski resort and operation business via acquisition with a deal it saw fitting into its Live Limitlessly campaign. Marriott, for its part, acquired a significant fitness and spa franchisor to increase how often consumers interact with its brands. Even before the pandemic, as seen in the chart on the right, the accommodations sector had expanded way beyond traditional hotels.

Online travel sellers fattened up. After Facebook spun out WhatsApp in response to trust-busting regulators, Booking.com acquired it as part of “its mission to make it easier for everyone to experience the world.” Trip.com Group snapped up a major tour bus operator and began running tours where its customers can use the Trip.com mobile app to listen to the voice of a recorded guide in their native language. Indonesia-based online travel agency Traveloka’s first move after going public on the stock market was to buy a cruise line from Genting, given the surging interest among China’s seniors in gambling-themed cruises.

Convergence of Accommodation Sectors

Global Market Size ($B) of Travel Accommodations Sectors 2019

For years, the travel sector locked itself into siloed thinking, with executives from, say, hotels, living in a bubble and not adapting an expansive mental framework to see related opportunities elsewhere. But a wave of developments in computer programming has made it easier to aggregate products. This trend can make it shrewd for a brand like Hilton Worldwide, which has millions of loyalists, to use its heft to upsell guests on vacation homes, experiences like a diving excursion, or perhaps even glamping. It’s better to flex your brand’s muscle than wait and watch as some platform players like Amazon, Google, or Alibaba sweep in, and steal your customers with some travel offering.

Counterpoint: In 2025, corporations rethought mission creep and portfolio sprawl, which had been reflexive reactions among some growing out of the revenue crisis five years earlier. Executives were reassured that in the midst of the Covid crisis, Airbnb’s hot initial public offering validated its choice to focus on its lodging and experiences. Airbnb had abandoned its pre-pandemic ambitions of becoming an all-in-one travel booking provider by adding flights and more. Other companies in 2025 rehabbed their way to simplicity, jettisoning distracting business lines.

Asia embraced the conglomerate model more than much of the world did. Yet pre-pandemic wind-downs at HNA and post-crisis financial at heavily peers tarnished the model’s reputation.

Leveraging a brand by adding more offerings and types of operations can sound good in theory. But it often created a complex beast that was hard to manage in practice in 2025. Managers found it too hard to comprehend the drivers of operational excellence or fully grasp the levers that affect marketing performance when an enterprise became diversified into multiple business models. Consolidation of traditional competitors to strengthen or hold market share often proved a safer bet.

Five years after the unprecedented revenue crisis of 2020, perhaps one of the lasting lessons was it is difficult to make an elephant dance. Better to be a lynx.

Download Your Copy of Skift Travel Megatrends 2025

Skift Megatrends 2025 is made possible by our parters: Abu Dhabi Convention & Exhibition Bureau, Accor, and American Express.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch