Skift Take

Liquidity was the lifeline for the strongest travel companies coming out of the pandemic, and the best managements could financially engineer their ways through the crisis. Weaker companies with fewer resources sold assets at steep discounts, and dropped out.

We recently released our annual travel industry trends forecast, Skift Megatrends 2025. Because of the havoc that the pandemic triggered, we wrote Travel Megatrends 2025 as a vision of how travel industry dynamics could play out five years from now. You can read about each of the trends on Skift, or download a copy here.

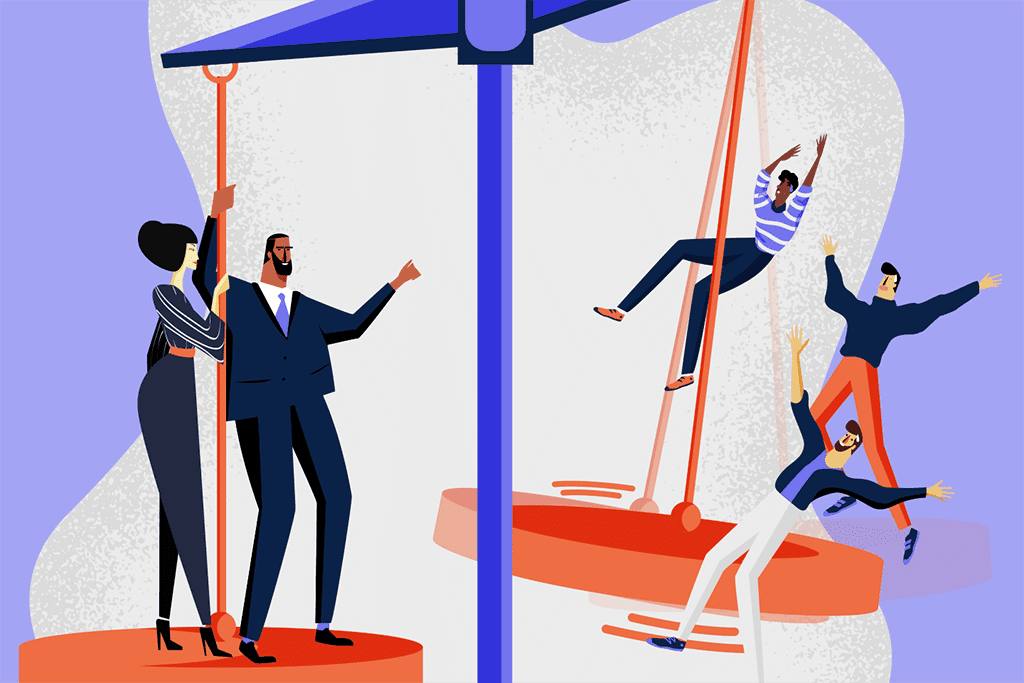

There are winners and losers coming out of any crisis, and by 2025, many of these are evident. But it isn’t always a yes or no, clearly defined thing because there are nuances, too.

More generally, In the online travel competitive sweepstakes in 2025, the clear winners are Booking Holdings, Airbnb, and China’s Trip.com Group, formerly known as Ctrip. In these instances, the strong clearly get stronger.

These companies emerge from the pandemic with ample cash, and leap-frog competitors, carried by a wave of consolidation, and the failures of and liquidation sales at smaller online travel agencies like BookIt.com and short-term rental firms like Stay Alfred. Both of these booking sites — like countless others in every travel sector — fell by the wayside in the early stages of the pandemic like forgotten footnotes in a college term paper.

Many of the big online travel players are still competing vociferously among themselves in 2025 while also partnering with one another in typical frenemy fashion, although these relationships ebb and flow. For example, given Trip.com Group’s joint venture in China with Tripadvisor and other factors, the long-time ties between Trip.com Group and Booking Holdings loosen.

Drafting on a Digital-First Mindset

Asia had already been gaining strength in travel over the last decade. Trip.com Group, which controls Chinese short-term rental business Tujia and India’s MakeMyTrip in everything but the official paperwork, and fellow Chinese hotel-booking and delivery company Meituan gain market share by 2025. Given that the vast majority of travel-selling was still offline in China in 2020, these two companies deftly position themselves to take advantage of the pandemic-induced digital buying spree. In China, this turned into increased online adoption, meaning people booking more travel from smartphone screens rather than calling or stopping by a travel agency.

The backyard travel Megatrend, which found travelers taking more frequent trips and feeling more comfortable about vacationing domestically and regionally, strengthens Asia’s, and particularly China’s, global market share in travel.

On the losing end of things, despite their status as industry leaders, Airbnb and Booking.com, as well as Google, Facebook and Alibaba, become subject to more stringent regulations and restrictions on their growth in many parts of the world.

Despite regulatory focus on Google, which had the largest travel business among big tech coming out of the Covid crisis, you couldn’t say that the travel industry has clearly emerged triumphant over Google in 2025. Yes, there is some relief from Google blatantly favoring its own travel products over those of competitors, and regulators pressured Google into giving travel search results more free daylight on its pages. But antitrust regulators are more focused on reversing big tech’s acquisitions and alleged political bias than on democratizing Google’s travel business specifically. And Google’s army of lawyers and lobbyists found ways to maneuver, and dilute the potentially harshest consequences.

Download Your Copy of Skift Travel Megatrends 2025

Hotels chains had leaned into online travel agency distribution in 2021 because many consumers were still feeling city-averse, and favored the relative solitude of short-term rentals in bucolic locales. But these impulses fade as vaccine needles penetrated billions of arms, and the Marriotts, Hiltons, Accors, and InterContinentals recaptured direct bookings, and do much to regain profitability in 2025.

Alternative accommodations are even more mainstream as a vacation option in the five years since Covid-19 arrived. But the short-term rental versus hotel market imbalance in the early days of pandemic recovery revert toward the hotels’ favor.

And let’s not forget issues of diversity and inclusion. The Black Lives Matter protests that accelerated globally in 2020 led over the next few years to a healthy uptick of people of color and women ascending in travel’s corporate board rooms. Even airlines, long a bastion of old boys clubs, see a smattering of women CEOs ordering new aircraft, and making capacity and route network decisions. But the challenge for diversity and inclusion activists within travel businesses — and the movement at large — is to keep up the pressure year after year, and to acknowledge that the mere appointment of diverse C-Suite executives and mid-level leadership is only an initial win.

Counterpoint: Business travel roared back much quicker than most people had imagined starting in late 2021, as vaccines breathed confidence into most parts of the world, and cities recovered. Commercial real estate brokers in urban centers around the world signed deals to reopen huge office campuses and remote and scattered workers returned to their desks and cubicles.

This meant that airlines, hotels that catered to business travelers, and travel management companies pick up where they left off in the heady days of 2019, and elite flyers resume their mileage-runs anew just because they could.

Covid-19 had been stopped in its tracks, and although there was always concern, so far there has been no such thing as Covid-25.

Download Your Copy of Skift Travel Megatrends 2025

Skift Megatrends 2025 is made possible by our parters: Abu Dhabi Convention & Exhibition Bureau, Accor, and American Express.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch