Skift Take

Corporate travel planners and event bookers hold the key to the financial fate for much of the hotel industry. But struggling hotel owners who made it to the other side of the pandemic were likely to see greater profits because of supply constraints and many weaker competitors succumbed.

We recently released our annual travel industry trends forecast, Skift Megatrends 2025. Because of the havoc that the pandemic triggered, we wrote Travel Megatrends 2025 as a vision of how travel industry dynamics could play out five years from now. You can read about each of the trends on Skift, or download a copy here.

The hotel industry is back in 2025, but it looks considerably different than it did five years earlier. There is no doubt the pandemic brutally ravaged the sector. Hotel portfolios in large, urban centers or those focused on meetings and events may not have shuttered for good — but they certainly traded hands. Owners and investors who lacked the resources or had no stomach for the turbulence of an extended recovery period, got out early in 2020 and 2021, but those who persisted were in store for a significant upside.

“There’s going to be an opportunistic play for someone willing to carry those hotels for the next year or two,” Acres Capital CEO Mark Fogel told Skift in 2020.

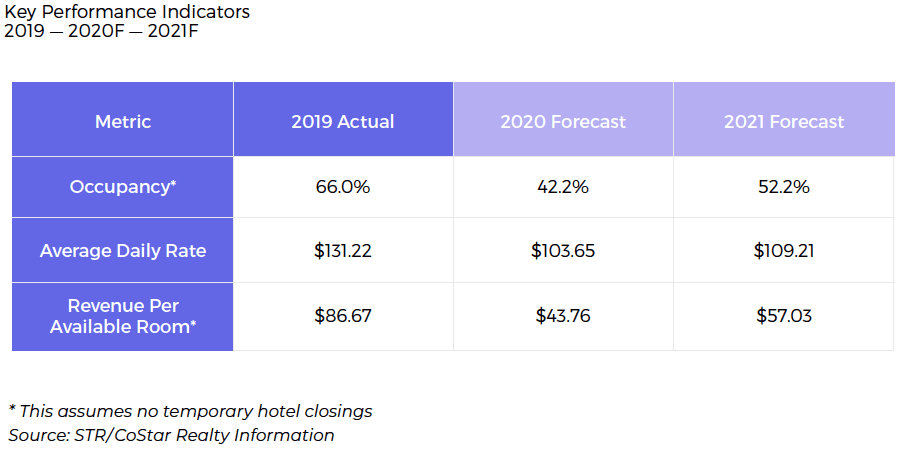

As seen in the chart on the right, U.S. hotel occupancy and average daily rates were severely impacted in 2020. But on the owner side, the recovery’s slog paid off for some. Years of cost cuts, including streamlining operations and reducing employee rosters, delivered an industry with significantly higher profit margins in many cases compared even to those seen in record-setting performance years leading up to the first coronavirus case.

While convention hotels still operate, they are no longer built at the same rate as they were pre-pandemic. Instead, owners of these spaces rely on alternative-use arrangements like work-from-hotel programs to generate revenue between the occasional major event.

Companies that decided to reduce their office footprint during the pandemic rely more on these surviving convention hotels to conduct quarterly meetings, which is an upside to the properties that made it. Some of these businesses even use the work-from-hotel model in select cases as a way to provide a reliable, private office space in lieu of longer arrangements with coworking entities such as WeWork.

But this is still a fairly limited revenue stream and works best when the hotel works in partnership with a coworking company such as the way Proper Hospitality partnered with Industrious.

Hotel Services on the Chopping Block

Despite the pandemic pain, some hoteliers salivated and took advantage of the pandemic-driven ability to accelerate cost-cutting initiatives that were unthinkable in pre-pandemic times, especially in U.S. and European cities with an organized labor presence.

Hoteliers marketed contactless features like mobile check-in and checkout as safety initiatives to limit potentially unsafe interactions between staff and guests. But post-pandemic, these are as common to the hotel industry as mobile boarding passes are to the airlines. Hotels cut labor costs tied to heavily staffed front desks.

The most severe cuts came to housekeeping, which was the biggest labor expense for many hotel owners. Hotel companies quickly eliminated daily room cleanings at most properties during the pandemic as an alleged safety precaution. Labor unions, such as Unite Here, balked at that decision, and claimed it was simply a way to cut costs rather than promote safety.

“That’s complete malarkey,” Unite Here International President D. Taylor told Skift in 2020 in commenting on the hotel industry’s safety argument. “It’s an economic move. Anybody who portrays it any other way isn’t telling the truth.”

U.S. Hotel Occupancy Was Slow to Recover

Although governments and health authorities widely distributed Covid vaccines, and the pandemic is in the rearview mirror, daily room cleanings still aren’t a common occurrence in 2025 — unless guests are willing to pay extra for them.

In a trend that started years before the pandemic, the hotel industry again took a page from the airline sector’s playbook in rebuilding after the pandemic. Services that were once included in the room rate are now unbundled and charged on an a la carte basis, especially in economy-scale hotels.

Sure, guests grumble about the way things were, but they still flock to these properties for loyalty perks. That’s because competitors are likewise charging the new fees, and many guests believe that hotels make for a safer stay than unwieldy short-term rentals when it comes to cleaning and health.

Counterpoint: The hotel industry comeback would rely on corporate travel and major events to kick back into gear, but that hasn’t happened so far.

Sure, vaccines were widely distributed and the pandemic for the most part is a thing of the past. But leisure travel still dominates in an environment where many companies and event planners recognize the cost savings inherent in virtual meetings and remote gatherings. People still fly in for vital business meetings or due diligence trips — but at nowhere near the frequency seen in 2019. That has greatly hampered occupancy rate recovery, especially in urban hotels.

Vacation travelers are back in full force, sometimes even more than pre-pandemic levels, due to pent-up demand and lingering memories of 2020 shutdowns. But those travelers aren’t booking stays in hotels like they once did. Hotel companies banked on travelers craving the familiarity of a major brand coming out of the pandemic. Instead, travelers migrated toward having the control of an entire home or condo through a short-term rental.

In a manner similar to hotels, companies like Airbnb also rolled out stringent health and safety standards during the pandemic to allay fears of the virus. That, along with the convenience of driving to a vacation home distant from pandemic-spiking cities, rapidly accelerated the brand’s appeal to new customers during the year, 2020, when it became a public company. Short-term rentals from Airbnb, Expedia’s Vrbo and others became a viable hotel alternative for both vacationers and even business travelers.

Hotel companies recognized the changing consumer appetite, and many joined the short-term rental fray. Marriott’s Homes & Villas is no longer just a “very small part” of the company, as leaders at the world’s largest hotel company repeatedly said during its launch in 2019. Luxury brands like Four Seasons Hotels & Resorts have their own spin on short-term rentals, placing them as residences within the chain’s resorts, and other global hotel chains expanded into short-term rentals especially as a way to tap into markets where a traditional hotel wouldn’t work.

This push for to focus on leisure travel, or vacationers, further tanked the hotel industry as room rates plummeted. Hotel analysts warned hotel owners to hold the line on rates, even during the pandemic era of low occupancy, since it is so hard to build up daily rates consumers got accustomed to steep discounts.

But with the cash cow of business travel not returning to pre-pandemic levels, hotel owners had little choice but to reduce rates to woo leisure travelers.

This prolonged period of poor performance sparked a wave of hotel loan defaults and property closures. Major urban areas that once generated substantial corporate travel saw owners begin to convert underutilized hotels into apartment or condo developments, and that alleviated housing shortages across many markets.

Download Your Copy of Skift Travel Megatrends 2025

Skift Megatrends 2025 is made possible by our parters: Abu Dhabi Convention & Exhibition Bureau, Accor, and American Express.

Have a confidential tip for Skift? Get in touch