Skift Take

There were few surprises in Airbnb's roadshow presentation. It was high on optics and spin, and could have been much more substantive.

Airbnb’s nearly 29-minute roadshow presentation, which the company began showing to investors Tuesday en route to an initial public offering, is heavy on feel-good host and guest imagery and dialogue, but offers little in the way of strategy or financial revelations that weren’t already laid out in its registration statement.

While co-founders Brian Chesky and Joe Gebbia relayed the now-familiar story about Airbnb’s beginnings, and value proposition to stakeholders, a very diverse lineup of hosts and guests from around the world wax on about the wonders of Airbnb.

One guest said “my heart feels more open” when she travels and stays at an Airbnb because of the company’s ties to the community. One host said she’s only five-feet tall but feels “big” because of her economic empowerment from Airbnb. Another cited the “magical experience” of being an Airbnb host.

All may be true. However, it’s not extremely enlightening for a roadshow.

Join Us for the Skift Short-Term Rental and Outdoor Summit – December 9-10

The most substance of the presentation, which is divided into sections about hosts, guests, communities, product demonstrations and financial strengths, among others, came from CFO Dave Stephenson. He reviewed the financials that were already presented in the registration statement, and analyzed in a Skift story.

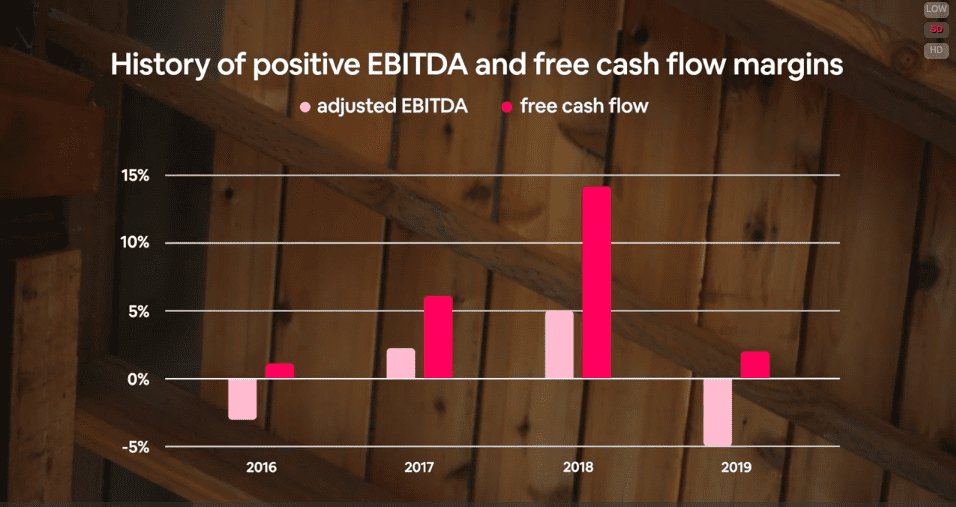

Stephenson wove a tale about the resiliency of Airbnb’s business. He detailed how Airbnb generated positive EBITDA (earnings before interest, taxes, depreciation, and amortization) and free cash flow margins in 2017 and 2018, as shown in the slide, and was cash flow positive in 2019, which he characterized as an investment year.

Citing the pandemic-tinged second and third quarters of 2020, when revenue was down 70 percent and 20 percent, respectively, Stephenson argued that the cost containment moves, including layoffs, that Airbnb carried out early in the coronavirus outbreak, positioned the company for a more attractive cost structure over the long term.

He said marketing adjustments and increased monetization are among factors that can produce future EBITDA margins of around 30 percent.

Referring to coronavirus-era travel patterns when people wanted to travel closer to home, Stephenson said, “They still want to travel. They are just traveling differently.”

Of course, Airbnb officials will likely dive deeper into the companies issues during question and answer sessions.

During the conclusion of the presentation, Chesky basically said that things had come full circle for Airbnb. He said Airbnb had undergone a sort of trial by fire during the pandemic, and is a more focused company today.

“It’s just like the early days all over again,” he said.

Except — if Airbnb starts trading on Nasdaq soon — almost every move Chesky and the company make will be under a spotlight.

Register for our Skift Short-Term Rental and Outdoor Summit – December 9-10

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, guests, hosts, ipo

Photo credit: Airbnb co-founder and CEO Brian Chesky as shown is the company's roadshow presentation December 1, 2020. Airbnb