Skift Take

Airbnb's secret sauce is its brand, which allowed it to buck the conventional wisdom and successfully compete against far larger incumbents. Can it maintain that direct traffic advantage if it hopes to scale?

Online travel shoppers are ruthless. They just want the lowest price served up to them in the fastest way possible and care nothing for brand loyalty. Or so the conventional wisdom goes. Airbnb’s S-1 filings, however, show that it is possible to break that mold and win over customers with a unique brand in the age of the ubiquitous Google search.

Perhaps the most important aspect of the Airbnb story is its ability to build a brand. After all, short-term rentals had existed as a sleepy corner of the accommodations market for decades before Airbnb came around. But for most consumers, Airbnb introduced them to the market, or at least reinvigorated the consumer impression of what it meant to stay in a short-term rental. Airbnb has become a verb and denotes a particular way of traveling and staying local.

The Airbnb Advantage

Let’s check in on Airbnb’s peers in the traditional hotel space, Expedia Group and Booking Holdings. Their rooms are highly commoditized with price and location being the most important differentiator for many. That means once they have built out a sufficiently large global inventory of places to stay, the primary way for Expedia and Booking to differentiate themselves is via marketing.

And market they do. Expedia and Booking are two of the largest marketers in the world. Together, they spent more than $10 billion dollars on advertising in 2019. Each have found online performance advertising to be one of the most effective ways to reach the fickle modern traveler. The trouble is there are only a few online advertising marketplaces, of which Google is the largest and most important.

| Brand and Performance Marketing, $M |

Airbnb | Booking Holdings | Expedia Group |

|---|---|---|---|

| 2020 YTD | $ 295 | $ 1,793 | $ 1,395 |

| 2019 | $ 1,140 | $ 4,967 | $ 5,043 |

| 2018 | $ 666 | $ 4,956 | $ 4,670 |

| 2017 | $ 548 | $ 4,596 | $ 4,360 |

As a result, Booking and Expedia, along with the rest of the hospitality industry, pile into a few very crowded search terms (e.g. “cheap hotels in NYC”). With so much money sloshing around, ad prices are bid up. Performance advertising efficiency goes down, but with little-to-no brand loyalty, the large online platforms struggle to get direct traffic and are forced back into this race to the bottom costing billions each year.

Airbnb, however, has short-circuited this fate by building a globally recognizable brand that travelers seem to love. As a result Airbnb gets a huge amount of direct traffic, bypassing Google and the performance marketing rate race entirely.

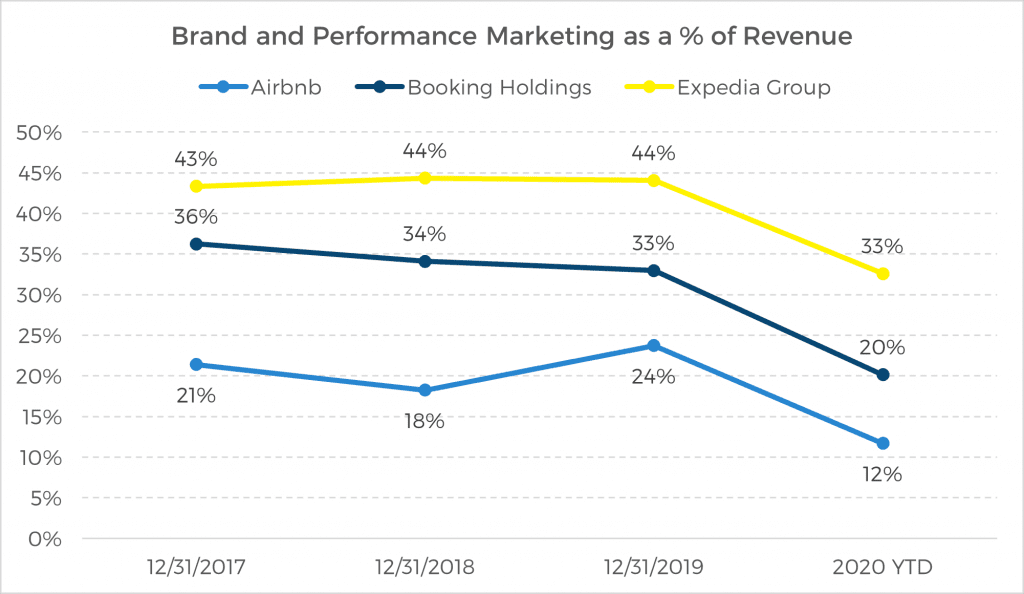

The results show up nicely in Airbnb’s financial results. The greatest drag on margins at Expedia Group and Booking Holdings is their marketing expense. Airbnb consistently outperforms both of these rivals, spending 10-20 percentage points less on brand and performance marketing as a share of overall revenue.

In 2019, every dollar Airbnb spent on brand and performance marketing yielded $33 in gross bookings; At Expedia Group that figure was $21, for Booking Holdings $19.

Traffic Channel Mix

The goal for all travel businesses is to grow their unpaid online traffic — ideally direct, but organic search results would do in a pinch as well.

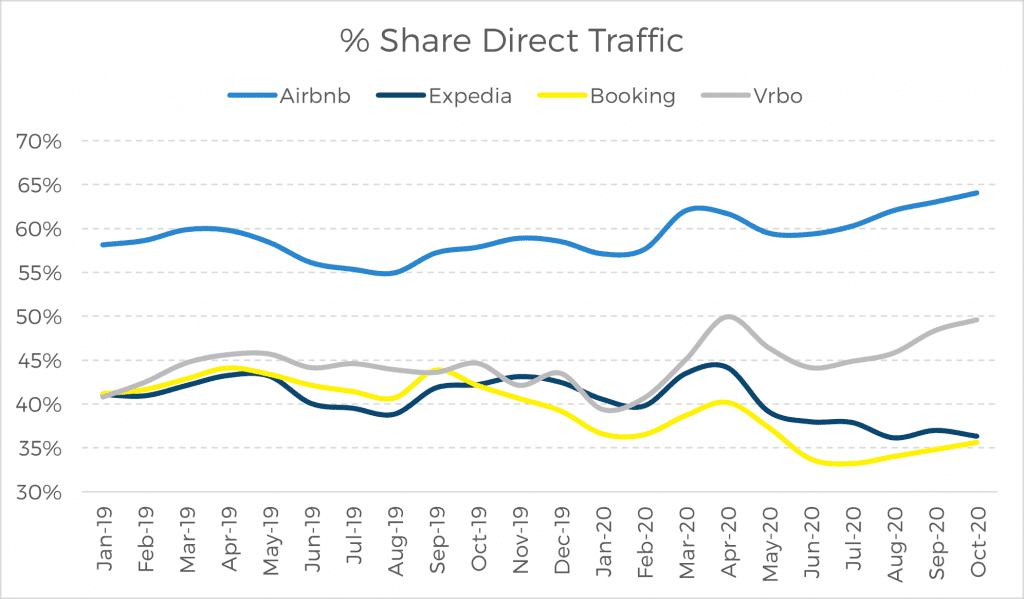

For the year full year 2019, Airbnb received 23% of its global traffic from paid performance search channels. YTD, as Airbnb has cut marketing expense in the face of the pandemic, that traffic figure fell to 9%. This is a higher paid traffic share than many third-party analysts had estimated but we believe it is still far less than other online booking sites receive.

The remainder of Airbnb’s traffic comes direct or from search engine optimization. SimilarWeb estimates that 60 percent-plus of Airbnb’s traffic comes from direct website visits, compared to 40-45 percent at many other sites.

Challenges Lie Ahead

But all is not perfect in Airbnb-land, it seems that no one is immune to Google. In its S-1 filing Airbnb writes that, “We believe that our SEO results have been adversely affected by the launch of Google Travel and Google Vacation Rental Ads, which reduce the prominence of our platform in organic search results for travel-related terms and placement on Google.”

The line almost perfectly mirrors complains raised by TripAdvisor and Expedia. Perhaps there is a chink even in Airbnb’s brand armor.

Part of what made Airbnb’s brand so powerful was a heady mix of its first-mover advantage and the many unique places to stay on its platform. But it is hard to take quirky bed and breakfasts and scale them mass market. Instead most of the new units added will inevitably be condos and apartments that look and feel quite similar.

Further, Airbnb is no longer the only place to instantly book short-term rentals online. On the distribution side Vrbo and Booking.com have both moved aggressively to compete. While on the operator side, new short-term rental brands like Vacasa and Sonder are emerging.

Airbnb has clearly built one of the strongest brands in travel. It then turned around and levered that advantage to gain margin and market share. Can Airbnb maintain its moat while still hitting the lofty growth goals that Wall Street investors place on its shoulders?

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Photo credit: An eco-friendly Airbnb on Mayne Island, BC, Canada. These unique places to stay built Airbnb's brand, but can it maintain that image as it grows? Airbnb