Skift Take

The pandemic has brought about a permanent and massive digital adoption in Southeast Asia. This structural change should be good for online travel. But first it has to swallow a great deal of bad.

Locked down and restricted to travel, 40 million people in Southeast Asia’s largest countries turned to the internet for the first time this year, compared with a total of 100 million between 2015 and 2019.

This brings to 400 million the total number of internet users to date in the Philippines, Vietnam, Thailand, Malaysia and Singapore, according to a report by Google, Temasek and Bain & Company. That means 70 percent of the total population of 583 million in the six countries surveyed are now online, compared with 62 percent last year.

Not only that, thanks to Covid-19, “they are consuming and not just browsing,” said Google Southeast Asia’s vice president Stephanie Davis during a briefing on Tuesday on the findings of the latest “E-conomy SEA 2020” report.

One in three new users said they consumed a digital service for the first time as a result of lockdowns. Education, groceries and loans were the top purchases. Ninety percent intend to continue their newfound habits post-pandemic.

“The pandemic has accelerated behavior change and online adoption by a year, or two years in some cases, versus our projections,” said Bain’s Aadarsh Baijal, partner and head of digital practice in Southeast Asia. “Consumers and SMEs [small and medium enterprises] have adopted digital financial solutions like never before and a lot of this is here to stay.”

Baijal also noted a narrowing of the digital gap between rural and metropolitan areas. Most of the new users are from rural areas, except for Thailand and Vietnam. As a result, Southeast Asia’s digital economy is becoming more inclusive, he said.

Serious Setback

On the surface, it may seem that Covid-19 has done a great deal of good in quickening the pace of online adoption, which should eventually benefit the region’s travel industry as well, as more people get comfortable and trusting of booking and paying online.

But, in fact, the pandemic has caused a serious setback to online travel, even though Google’s and Bain’s narrative is that it’s only a “temporary” setback.

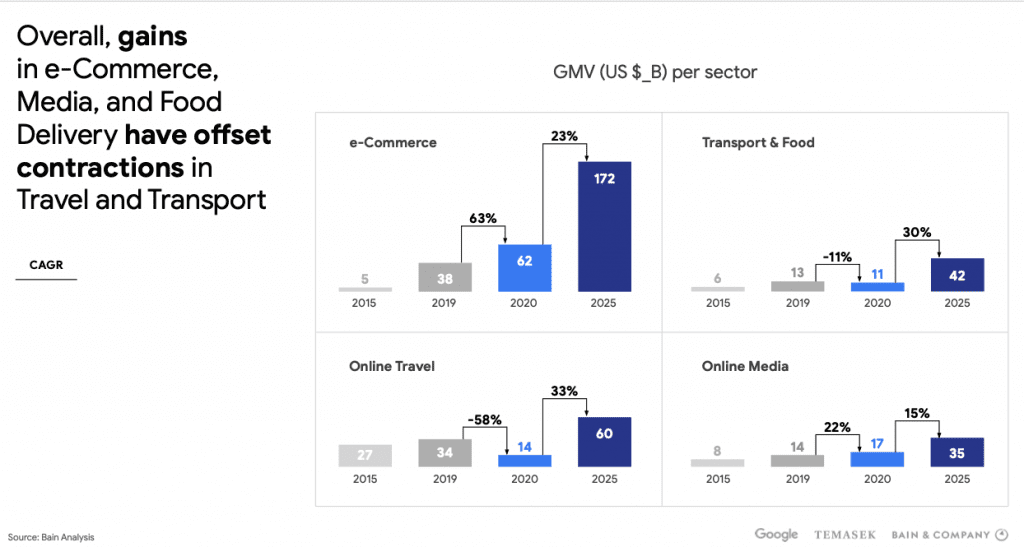

Online travel was what drove Southeast Asia’s internet economy when the annual study was done in 2015 right up to 2018, where each year it was bigger than e-commerce, online media (subscription music/video, online gaming and online advertising) and ridehailing.

There was always a reason for online travel to boom. At first, the rise of low-cost carriers helped shape it into a market worth $19 billion in 2015. In the 2018 survey, it rose to a $30 billion market, as travel bookings kept moving from offline channels such as traditional travel agents and call centers, to online travel agencies and direct to airlines, hotels and vacation rentals.

As one of the first sectors to move online, it matured and was overtaken by e-commerce for the first time in 2019 though not by a wide margin. E-commerce in Southeast Asia roped in $38 billion, online travel $34.4 billion, the latter still showing a moderate growth over 2018. The report attributed this to the rise of budget hotels such as Oyo and RedDoorz, investments made by online travel players on providing tours & activities, and partnerships to expand consumer reach such as that between Booking.com and Grab.

Seeing Southeast Asia’s online travel, e-commerce, online media and ride-hailing crossing $100 billion mark in 2019, the report revised its projection the region’s Internet economy would grow to $300 billion by 2025, from $200 billion it projected in 2015.

Online travel, specifically, would grow to $78 billion by 2025, from $34.4 billion in 2019.

And here’s the serious setback: this year’s report shows online travel contracting 58 percent to just $14 billion, clearly the worst-hit sector. What’s more, its long-term growth has been revised from $78 billion down to $60 billion by 2025 (see chart below).

The current vaccine promise may change that, but the latest report shows how a volleyball of travel lockdowns and reopening has impacted the region’s online travel march.

“The pandemic situation remains in a flux,” Bain’s Baijal told Skift. “That said, we’ve seen a strong surge in demand for what is feasible, which includes a lot of domestic travel, staycations and travel slowly reopening. We are heartened that there is pent-up demand; our primary search indicates people do want to travel over the next six to12 months.

“Our forecast is a resurgence of international travel to pre-Covid level and healthy growth by 2023, and the other parts of online travel by 2022. We’re a little conservative in factoring in a pretty slow year next year.”

Online Travel Diversification?

A 63 percent rise in e-commerce transactions to $62 billion this year contrasted heavily with a 58 percent drop in online travel to $14 billion. The gains in e-commerce, and to a smaller extent in online media consumption and food delivery, helped Southeast Asia’s Internet economy to remain resilient at $100 billion this year, no change from last year.

Online travel agencies such as Traveloka and AirAsia.com which have diversified into e-commerce offerings may be interested to know that consumer electronics, apparel, home/living items, and beauty/personal care products continue to be the staple retail categories. But there has been a jump in food and groceries, which comprises 11 percent of e-commerce transactions, compared with 4 percent in 2015.

Another interesting aspect of this year’s report is how the pandemic has brought about growth in the adoption of nascent sectors such as health technology and education technology. Leading digital health apps were used four times more than before the pandemic, while leading education apps were used three times more.

This has prompted growing investment in the “HealthTech” and “EdTech” sectors, said the report.

However, funding for unicorns in e-commerce, transport & food, online travel and online media slowed to $3 billion in the first half of 2020, from $5.1 billion in the first half of 2019.

“Platforms are now refocusing on their core business and established strengths in order to prioritize a path to profitability,” the report said.

One thing is clear: Southeast Asia is closing the gap with developed markets like the United States, whose Internet economy was 6.5 percent of the gross domestic product in 2016. The region’s Internet economy amounted to 3.7 percent of its gross domestic product in 2019 and is projected to exceed 8 percent by 2025.

Hopefully, pent-up demand will help online travel catch up fast.

Have a confidential tip for Skift? Get in touch

Tags: online travel agencies, southeast asia

Photo credit: Asian travlers on mobile phones in Hanoi. Ed Yourdon / Ed Yourdon on Visualhunt.com / CC BY-NC-SA">Visual Hunt