The Event Industry Is Being Confronted By Its Napster Moment

Skift Take

I won’t bury the headline: the vast, global events industry is going through its Napster moment through this pandemic, and is in denial on what this will do to it.

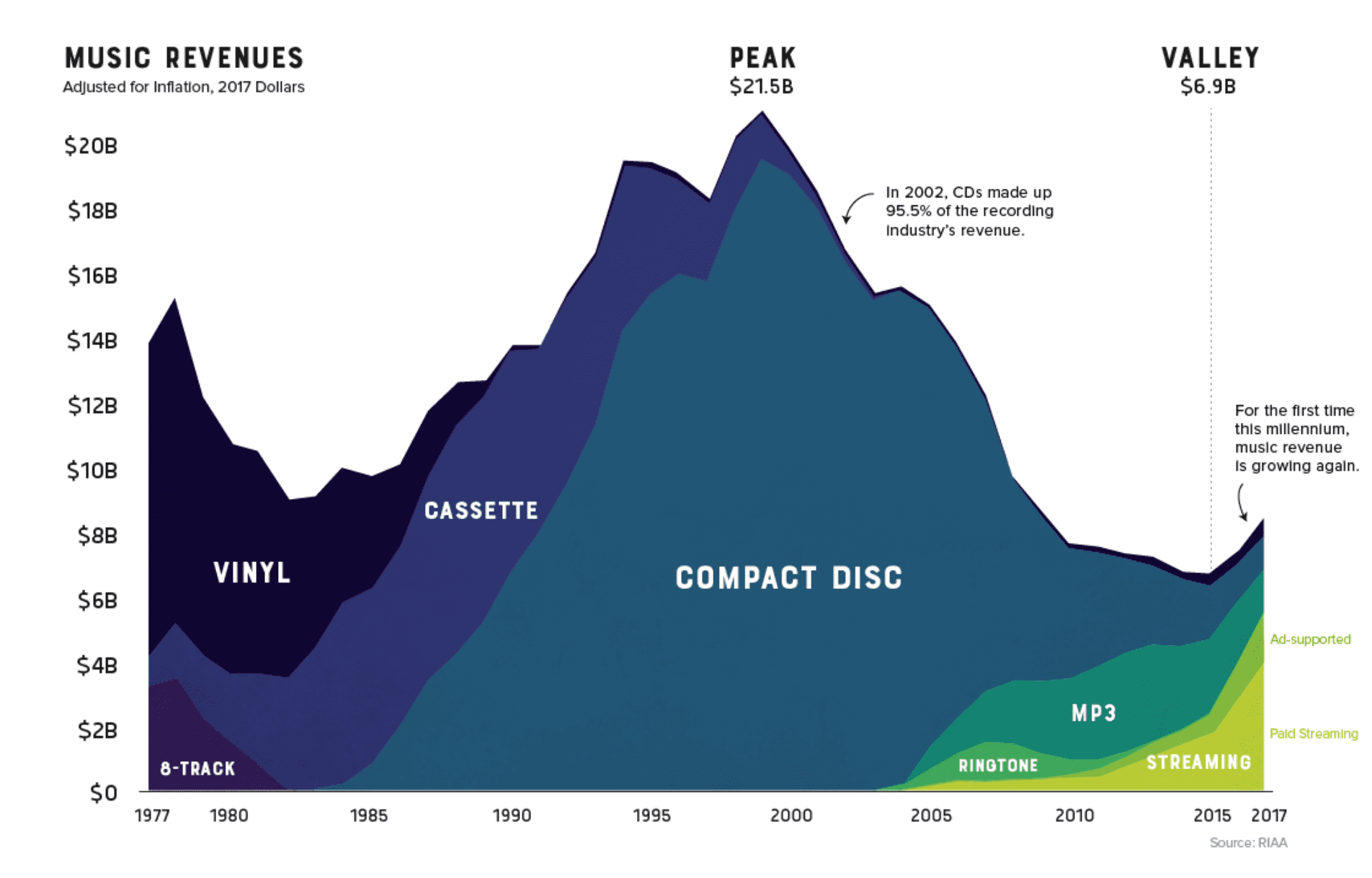

Everything about the underlying economics of this sprawling, diverse, chaotic and highly profitable sector is being undercut by the move to virtual, and 2019 may be the year where the industry’s revenues peaked. This year could be the event industry's 2000 moment à la what happened to the music industry.

I was there during the music industry’s Napster moment in late '90s, a cub reporter covering the vast promise of early internet, and wrote hundreds of stories about what happened to labels and the economic structure of music industry and music acts. I wrote about the atomization of the album into singles and the download boom with rise of Apple's iTunes, and then the start of the streaming boom that led to Spotify and others since.

It completely changed the makeup of the music industry, changed the radio industry along with it, lead to the rise and fall of satellite radio sector, led to a boom in live concerts. It changed how artists got discovered and YouTube’s outsized role in it, and many other innovations that came along that led us to the all-the-music-at-your-fingertips nirvana the listeners are in now. So many jobs were lost, billions of dollars went out of the industry and changed how everything gets done in the sector. It took 15 years for the industry to start growing again, it took 15 years till Spotify and other streaming services became good enough as a service and got adopted widely enough.

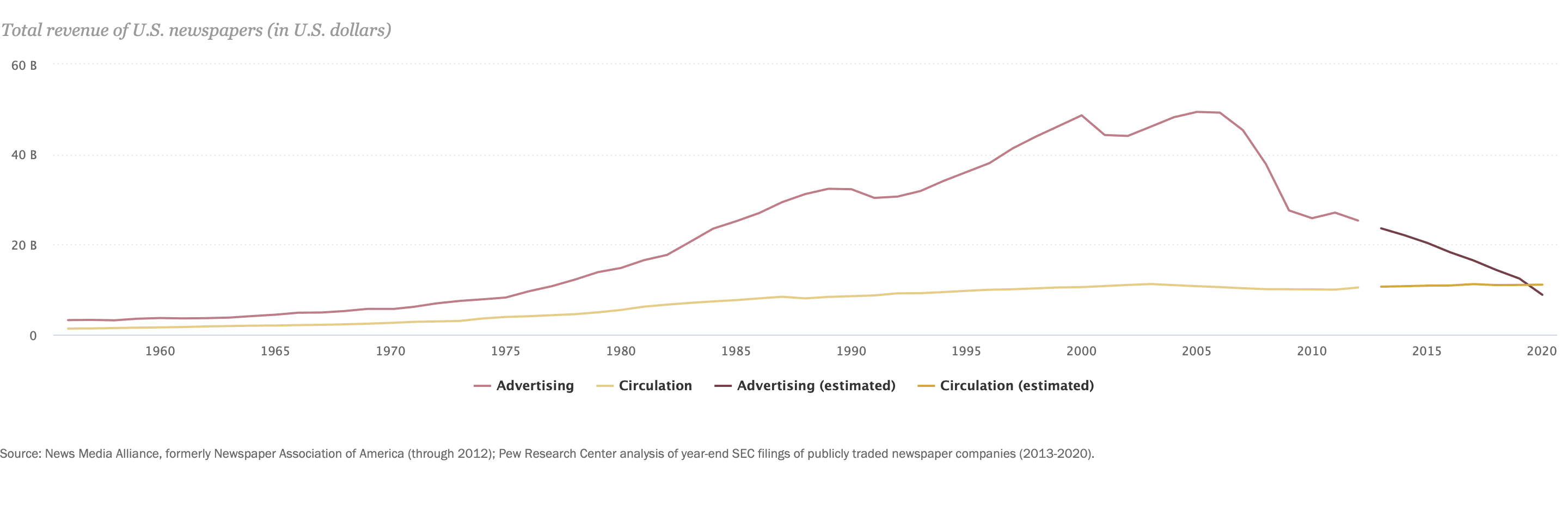

I also wrote hundreds of stories in the early 2000s and later about the economic decimation of the newspaper industry due to the internet becoming the primary mode of distribution and the lessons it didn’t learn from what happened to music just a few years prior.

In fact, my first company that started as a blog at paidContent.org was started to track the news and cross-learnings from then disparate but semi-related industries of news media, information, entertainment and other related sectors that now get lumped together under the term “content” industry. For years I wrote stories about the lessons the newspaper industry was ignoring and not moving to digital channels fast enough, or restructuring their businesses for a different world.

Until I left the daily reporting world in 2010, the video entertainment industry was also going through a lot of changes, and Netflix was on its way to become the force it has. Arguably, the video industry learned the lessons from the music and news industry much better, potentially setting it on a better economic path, but the industry also gave us the best quote ever given by an incumbent resisting digital changes in their sector: “It’s a little bit like, is the Albanian army going to take over the world?” said Jeffrey L. Bewkes, then CEO of Time Warner, in a New York Times story in relation to Netflix. “I don’t think so.” That story was published in December 2010.

LESSON: Never underestimate the invasion of a digital Albanian army in your world.

Zoom is the Napster of the event industry, the ease with which you can put on good-enough virtual events with a global audience, almost for free, much to the undercutting of the underlying economics of the physical events world. All types of business event — conferences, trade shows, conventions — are in danger of their revenues streams of tickets, sponsorships, memberships, and other types of fees being eroded as the world gets used to digital formats and alternatives emerge to physical networking, matchmaking and other tasks we get out of these events.

Billions of dollars have been sucked out of the industry this year as it is completely shut, and virtual is making up only a tiny fraction of that.

We estimate for our Skift events, in the best case scenario, virtual one-day events bring in only about a quarter to a third of what a physical conference revenues used to pre-pandemic, and while that is one example and mileage will vary from industry to industry, company to company, and event to event, very likely revenues from digital events will never get close to offline events. We are habituating the business world to free or almost free events where we used to charge thousands of dollars for conferences and other business events. We are habituating sponsors to pay up fraction of what they used to pay, with more precise targeting that online tech and tracking allows. We are habituating a world to less business travel, a world that is arguably better and happier without so much weight of people criss crossing the planet and countries. We at Skift are estimating that about 10 to 15 percent of business travel demand may leave the market permanently, and it may also lead to the death of single-meeting business trip, all of which will have direct and indirect implications for the events industry.

If you think Zoom and virtual event tech today are clunky, think about the Spotify comment I made above: it took 15 years to perfect the software. The current crop of virtual event software companies — most of them new companies, all of them clunky and prone to malfunctioning in live events — are the Musicnet and Pressplay of the event sector (you really have to be a music industry insider to know that reference!) those early software companies promising the moon on digital music but that were really just 0.1 version of the revolution to come.

Yes, the face to face interaction of meetings will always have a preeminent place, but so much tech on this is still to be built. There is so much left to do on online matchmaking, the biggest aspect of conventions and exhibitions, but it will happen. Much like online/mobile dating was unthinkable until the 2000s and then the matchmaking aspect of it moved completely to digital channels, so could the matchmaking part of the events industry, in fact it would necessarily be lot more efficient that way.

I expect the next five years to bring lots of new interaction tech into existence, some of which we can’t even imagine now. Remember when CNN was mocked widely for its hologram anchor on election night in 2008? Well, why wouldn’t a better version of this be a reality in hybrid offline/online events in the years to come?

Which brings us to the business structure of the events sector. What will happen to the giants of the events industry such as RELX, Informa, Comexposium, Emerald Holdings, Clarion, Tarsus and others? How will they respond to this change in their core businesses?

Some of them have already diversified their holdings beyond events into information services and other subscription focused services over the last decade. What will happen to the events business of media publishers, one of the till-now-fast-growing lifelines they have developed in the last decade through the decimation of their ad-supported business lines? What will happen to the legion of event production companies, event professionals and other front and back of the line employees that make their living through putting on the logistics-heavy events around the world? What happens to venues in a digital first or at best hybrid world? How will convention and group business-led hotels fare through this as they rethink their reason for existence?What will happen to convention & visitor bureaus of cities and regions and how will they reinvent themselves? How will convention cities like Las Vegas, Orlando and others rethink their business mainstays?

More Lessons

Having watched three giant industries go through the changes in the last two decades, here are some common lessons that will potentially apply to the events industry:

- As soon as digital distribution and adoption is injected into the ecosystem — in this case everyone has been forced into digital adoption — it changes the underlying economics especially when it comes to the pricing power, in this case free or cheap events, and lots of them.

- The barriers to entry get lowered and everyone enters into it, the hype cycle comes in and a few years later the shakeout happens. Meanwhile billions of dollars move out of the incumbent sector and lots of jobs are lost.

- The analog dollars become digital pennies, as Jeff Zucker famously said about advertising moving online, and at some point they become dimes, but it never comes back to the former glory in older formats. When it does come back to dollars, newer players like Netflix reformat the whole industry.

- The incumbents always resist the digital transformation and even mock the insurgents with damning quotable quotes, like the Bewkes example above.

- They always loudly proclaim no one wants this inferior digital experience and trot out evidence of current human behavior, which they are half right about: it is an inferior experience to start with, but it doesn't remain after a period of innovation and change.

- New disruptors emerge and larger companies go through lots of short term pain but most likely win out long term — in many cases by gobbling up the disruptors — if they have internalized the lessons of other industries.

- Lots of incumbent intermediaries in the industry get swept aside and the buyer and seller side go direct, until it doesn’t work or scale and new types of intermediaries emerge.

- Early innovators and disruptors mostly do not win long term, but the fast followers do.

- Incumbents have to be ready to cannibalize themselves to survive and thrive.

- Lots of venture and investor dollars are sunk into the sector, with lots of disappointment for most of the startups that fail.

- Lots of innovation comes out that looks like gimmicks in the short run and are subsumed in subsequent industry cycles and become the norm.

- Whoever best controls the largest amount of data is the biggest winner.

- Lots of new niches emerge, some become mainstream over a period of time.

- In the end, the end consumer always, always wins out. You can’t fight that force.

It is important to point out that neither the music nor radio nor the news industry nor the TV/film industry died, its that the incumbent players were simply shunted aside by new companies without the institutional bloat and interests that nearly always keep incumbents from advancing to the next thing.

This much we know: connecting people in a business setting will always be a need, in fact may even be more important in a digitally overloaded world, whether through great editorial in a conference setting or through buyer-and-seller matchmaking in various formats.

Many aspects of the industry will likely move to digital formats but the need for physical interaction for the “last mile” may become even more important, even if it becomes a smaller venue where this happens. Lots of experimentation and openness to failing a lot would be key to success for current incumbents.

Is the event industry ready for this reality?