Barry Diller's IAC Takes $1 Billion Stake in MGM Resorts With Eye on Online Gaming

Skift Take

Barry Diller's IAC/InterActive said Monday it had taken a 12 percent interest in global hospitality and entertainment company MGM Resorts International. IAC estimated the stake's value at $1 billion, making it a minority investor.

Diller, chairman of the board and senior executive of IAC, has been leading a reorganization of IAC, a New York-based conglomerate. IAC is known for its creative investments at the nexus of technology, media, and commerce.

The online gaming component of MGM clearly stirred interest for Diller.

"What initially attracted us to MGM, besides its leadership in leisure hospitality and gaming, was an area that currently comprises a tiny portion of its revenue – online gaming," said Diller in a statement. Diller is also executive chairman of online travel giant Expedia.

"We believe MGM presented a 'once in a decade' opportunity for IAC to own a meaningful piece of a preeminent brand in a large category with great potential to move online," said the company in a letter to shareholders.

MGM’s most prominent online gaming presence, the BetMGM sports betting platform, is currently live in seven states and on track to expand to four more by the end of 2020, MGM Resorts CEO Bill Hornbuckle said on an investor call earlier this month. The site is slated to bring in $130 million in net revenue for the year.

IAC argued that MGM's current online gaming revenue is "so small that it rounds down to zero." IAC said.

MGM Resorts reported results last week, saying it had a better-than-expected June despite bettings in its Las Vegas properties being down 63 percent year-over-year. (MGM Resorts runs about one out of three the Strip's available rooms.)

A Large Bet for IAC

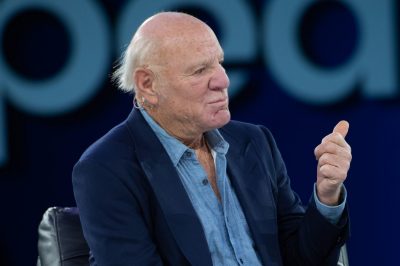

Barry Diller, Chairman and Senior Executive of IAC and of Expedia Group. Source: Expedia Group.

The casino and hotel operator said it has an edge over rivals. In the past 18 months, it has sold nearly all its resorts in a sale-leaseback arrangement that has made billions available in cash.

IAC has owned asset-light, global, internet and media brands, such as Expedia in the past and its current companies Vimeo, a video platform, and ANGI Homeservices, owner of home improvement media brand Angie's List. But regulations for gaming in the U.S. and some other jurisdictions require a company to have a physical presence. So IAC has made an exception for MGM Resorts, which is best-known for having a large real estate footprint.

"Similar to Disney's advantages over pure-play streaming companies with an iconic brand and multiple avenues to monetize the same intellectual property ... We believe MGM also is an aspirational brand, which could be delivered with daily accessibility and offer gaming consumers (including the 34 million M-life Rewards members) a wider range of services, both physical and digital, than any competitor," IAC said. "Our history in driving off-line to online conversion gives us confidence in the path."

IAC reports its earnings Monday after the market close with a conference call Tuesday morning.