Skift Take

Trivago was glad to see that Booking Holdings kept on advertising, however modestly, and upped its bidding in Trivago auctions while many other partners went silent. If Booking is gaining a bit of market share, it is far from seeing a clear path to recovery as travel demand's trajectory remains a crapshoot.

The adage to never waste opportunities in a crisis seems to be working for Booking Holdings when it came to its strategy for advertising in lodging search company Trivago during the second quarter.

During Trivago’s earnings call Wednesday, Chief Financial Officer Matthias Tillmann said during March and April, some of its partners ceased advertising with the company, and others significantly reduced their campaigns.

“Booking Holdings and their sub-brands (like Booking.com and Agoda) have kept all of their campaigns live throughout the quarter, and have been actually one of the first to adjust the bids upwards when they felt that cancellation rates were under more control and volumes were picking up,” Tillmann said.

Join Us For Our Skift Global Forum Online Conference September 21-23

He said that has helped Booking Holdings increase its “overall share.” Tillmann was referring to Booking’s overall share of advertising spend in Trivago, but it’s not a giant leap to believe this spending would equate to some modest market share gains, as well.

The following chart shows how Booking Holdings increased its share of Trivago’s total referral revenue — the money Trivago generates when travelers click on an advertisement — to 54 percent in the three months ending June 30, up from 39 percent a year earlier. Using the same lens, Trivago’s second largest advertiser, parent company Expedia Group, has seen its share of advertising spend on Trivago plummet to 19 percent.

Booking Holdings Versus Expedia on Trivago

| Company | Trivago Spend | % Trivago Referral Revenue | Trivago Spend | % Trivago Referral Revenue |

|---|---|---|---|---|

| Q2 2019 | Q2 2019 | Q2 2020 | Q2 2020 | |

| Booking Holdings | $98.8 million | 39 percent | $8.6 million | 54 percent |

| Expedia Group | $91.2 million | 36 percent | $3.0 million | 19 percent |

Note: Trivago reports revenue in euros, and we converted it to U.S. dollars.

Source: Trivago

To be sure, Booking Holdings’ advertising spend on Trivago during the second quarter was a modest $8.6 million, down from $98.8 million a year earlier because of the coronavirus pandemic killed travel demand, but Booking’s share of spend in the lodging metasearch platform increased substantially.

So while Expedia Group’s advertising spend on Trivago in the second quarter plunged to just $3 million, and other smaller online travel agencies and hotels ceased advertising on Trivago entirely, Booking Holdings was relatively active in Trivago. Booking was ready to pick up market share as European travel demand picked up in fits and starts.

The Soap Opera

The Booking Holdings and Trivago soap opera has taken many turns in the past few years. Booking Holdings’ dominance of advertising in Trivago in the second quarter is a sharp contrast with the relationship a couple of years ago when Booking reduced its advertising on Trivago in a dispute over then-new Trivago requirements.

Another change and interesting facet about Booking’s performance advertising in Trivago is that Booking.com Chief Marketing Officer Arjan Dijk, a former Google marketing executive, has transitioned away from CEO Glenn Fogel’s earlier push to lean into brand advertising instead of search engine marketing.

In an interview at Skift Forum Europe in June, Dijk said his teams now try to downplay the differences between using hotel ads on Google and television commercials. Dijk labeled that distinction “old school.”

He said Booking.com’s data scientists study consumer behavior data and advertising inventory costs, and use those learnings to allocate marketing dollars cost-effectively, regardless of the platform.

In the interview, Dijk called the distinction “a bit old school.” Dijk argued that this description no longer reflects the sophisticated way different consumers with different behaviors interact with brands and respond to various types of marketing.

Bidding levels in Trivago auctions were down more than 50 percent globally in the second quarter, according to Tillmann. Booking Holdings undoubtably took advantage of that sort of discounting, as well.

For the second quarter, Trivago saw its total revenue drop 93 percent year over year to $18.57 million (euro 16.1 million), and its net loss was $23.3 (euro 20.2 million).

Metasearch Commission Plans Are Having a Moment

Like Google, which recently expanded globally its pay-per-stay program for hotel advertising to help deal with cancellations, Trivago CEO Axel Hefer said the company is seeing “significant interest” from smaller advertisers about a “net cpa,” or a net cost-per-acquisition plan as an alternative to paying a cost-per-click.

Many advertisers, whether it was in Trivago or Google, felt they wasted advertising spend when Covid-19 struck because they paid per click for advertising, but consumers eventually cancelled their stays. So the net commission program, which Trivago is in the process of rolling out, essentially calculates the potential cancellation level when establishing a commission price.

Hefer said Trivago sees an opportunity to provide an additional service to these smaller advertisers by providing them with aggregated data pointing to cancellation rate levels among all advertisers using the platform. That’s because these advertisers fear they can’t predict cancellation rates on their own, he said.

Trivago also has a “gross cpa,” or gross commission program, which enables advertisers to bid on commission rates without taking cancellation rates into account.

Trivago Leaning Back Into TV

Tillman said Trivago in July started increasing its TV advertising, based on heightened demand for nature and beach driving trips from German and Italian travelers, for example.

Hefer said Trivago’s TV partners took a “hugely collaborative approach,” giving the company some free advertising, reducing the company’s TV commitments this year, and pushing some of that mandated spend into 2021.

Trivago is “very happy with the support we’ve been given by our partners,” Hefer said, referring to partners in the television industry.

He pointedly didn’t mention performance marketing support from Google, which has been widely criticized for its lack of partner assistance during the pandemic, and other search engine marketing platforms.

Cities and International Trips in Trouble

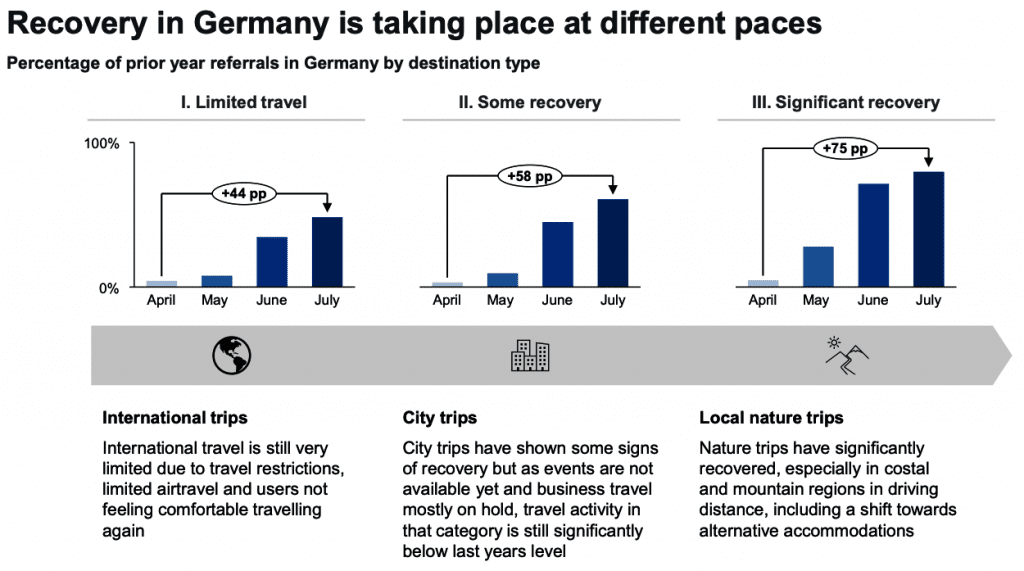

When it comes to its read on travel demand, Trivago some bright spots in parts of Europe, especially for nature and beach drive-trips.

But the company’s vision of how trips to cities and international vacations might play out was dire.

“The recent increase in new COVID-19 cases globally reminds us that recovery will be a long path of ups and downs that we will need to manage in the quarters to come,” Trivago stated in a letter to shareholders. “As travel demand for local leisure trips is highly correlated with the health situation in the respective region, we have seen, for example, a drop in travel activity in many U.S. states since mid-June. We expect the trend towards local leisure travel to persist until well into 2021, city trip activity to remain muted for the remainder of 2020, and international travel to be limited for the foreseeable future.”

Register Now For Skift Global Forum, Happening Online September 21-23

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, booking, booking holdings, commissions, expedia, metasearch, online travel, trivago

Photo credit: Pictured is the Il Boro Tuscany property in France on August 24, 2019. Trivago is seeing increased demand for drive trips to rural areas. R Boed / Flickr.com