Skift Take

Hotel companies want technology to streamline operations and reduce labor costs, but labor union pushback and cash-strapped hoteliers will continue to delay widespread tech adoption within the industry.

Hotels emerging from coronavirus lockdowns will increasingly rely on technology to practice social distancing guidelines with features like mobile check-in and room service, companies like Hilton announced in the early days of the pandemic.

A greater tech embrace throughout the hotel industry could even help cut down on labor costs at a time when occupancy rates and room revenue are their lowest in recorded history.

But furloughed corporate workforces, limited cash reserves, and labor union pushback may hinder how much disruption can actually come to hotels in the next few years.

“As always in the hotel world, you’re always fighting the fact there is disassociation between the ownership of hotels — so the people who have to spend the money — and the brand, which mandates the new programs,” said Edouard Schwob, executive vice president of JLL’s hotels and hospitality group. “The hotel brands are always careful about pitching something to owners that may fall into the laps of the union.”

Hotel owners often push back on new hotel brand standards deployed by the global companies, especially higher cost items like technology features. Even features that could ultimately help bring down labor costs face scrutiny in some of the largest U.S. cities due to their potential to displace workers.

A Marriott housekeeper labor contract with Unite Here, the labor union representing the workers, inked in late 2018 includes the stipulation hotel management has to provide a 150-day notice to workers ahead of any tech rollout and provide job training to pivot impacted workers into a new job.

“I think we’re seeing a bit more innovation in Asia than we are in the U.S. when it comes to tech integration in hotels, and a lot of that has to do with the union factor,” Schwob said.

But the pandemic may offer other ways for owners to move ahead with tech adoption and save money. Hotel companies have stressed new heightened cleaning protocols, despite calling for new materials and increased cleaning schedules, would end up being cost-neutral in many markets due to lower labor costs stemming from the push to mobile check-in.

“It creates a little more headroom to bring in what we’ve identified as higher costs in terms of deploying technology,” said Matthew Pohlman, partner at law firm Goodwin. “You have the opportunity to have a neutral cost structure or even a bit of a downtick.”

Tech Investment in a Downturn

There is still a path forward for hotel technology in as financially devastating a year as 2020, but it will certainly be a leaner sector than before.

“A lot of initiatives that were in the pipeline may have been postponed. People who were working on those programs may not be there anymore,” Schwob said. “The brands are really focusing back to the basics in terms of what they’re doing, which is focusing on reopening properties in an efficient manner.”

Hotel companies like Hilton and Marriott had massive rounds of furloughs and layoffs due to cratered travel demand and temporary hotel closings during the pandemic. While the brands haven’t explicitly said which employees or divisions were impacted the most, Schwob said technology research and development was likely hindered due to most industry attention focusing on reopening properties and new health and cleaning standards.

But there isn’t a complete tech blackout in the hotel industry. Brands will likely focus on more affordable technology that can almost immediately be rolled out, like digital room keys and mobile check-in platforms. The upfront cost for OpenKey’s mobile hotel platform is $49 per room along with monthly management fees, according to investors in the company.

“These features aren’t super innovative but are the kinds of soft touches that make the guest feel comfortable and ultimately aren’t that expensive to implement,” Schwob said.

Tech Future

As the industry moves from survival mode into recovery, analysts and executives still see the current downturn in travel as a rare opportunity to disrupt hotel operations and streamline costs.

“Hoteliers only have two levers: revenue and expenses,” Magnuson Hotels CEO Thomas Magnuson said. “It’s really critical to use your technology to pay attention to your operating costs.”

Operations costs often remain high even in a low-demand environment like today, Magnuson added. Software platforms can help struggling operators with something as simple as housekeeping scheduling – “the largest variable in limited-service hotel budgets,” Magnuson said.

But the potential for front-of-house labor spats and even guest preferences for human interaction mean tech features will likely throttle ahead more on the operations side than with actual worker displacement.

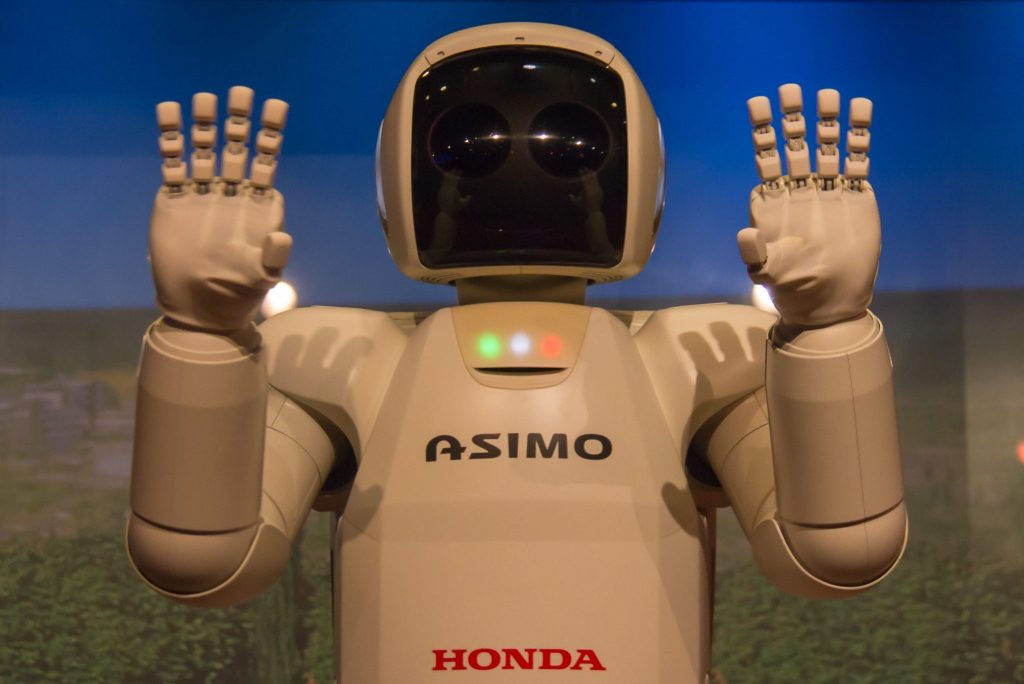

“I don’t see necessarily the case where hotels will be run by robots because you do still want that human interaction,” said Tinyan Asemota, a business law attorney at Goodwin. “I don’t see it being a complete wipeout, but workers will definitely be repurposed.”

Have a confidential tip for Skift? Get in touch

Tags: coronavirus, coronavirus recovery, hotel technology, magnuson hotels

Photo credit: There is a path forward for the hotel industry to embrace technology and cut costs, but labor unions will likely limit how far disruption can go. World Wide Gifts / Wikimedia