Destinations, Take Note: Americans Are More Likely Than Canadians and Brits to Keep Travel Plans

Skift Take

This sponsored content was created in collaboration with a Skift partner.

This new series from SkiftX, Skift’s in-house content studio, highlights the work we’re doing and our vision for the future.

Last month, Skift announced its partnership with Twenty31, an innovation-based management strategy and research consultancy, to help industry leaders build out recovery services for destinations worldwide and develop plausible paths to community renewal.

Over the past few months, Twenty31 has been fielding research to examine how the Covid-19 pandemic is shaping the current travel and destination landscape and what travel and tourism might look like in the future. SkiftX spoke to Oliver Martin, a partner at Twenty31, about the findings from a recent research study which looked at how U.S., UK, and Canadian travelers are thinking about their travel plans between May and October 2020 as the Covid-19 pandemic and associated lockdowns continue to unfold.

SkiftX: Was there anything that particularly surprised you about the results of the survey?

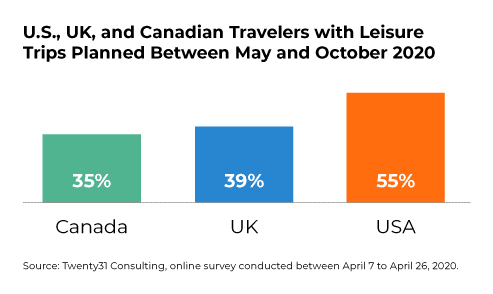

Oliver Martin: One of the most surprising findings was that of the three audiences, Americans were the most likely to travel during the next six months. If anything, I would have thought that on a per capita basis, it would have been those from the UK that would be most likely. Even though the U.S. is ground zero for this pandemic right now, many Americans have continued on the typical path to purchase and maintained their intentions to take trips.

SkiftX: What do you think is the reason behind the higher likelihood of Americans continuing with their travel plans?

Martin: If you look at most developed societies and economies, the U.S. stands out as having a big contrast between the messaging that comes from its public health officials and the messaging that comes from its political leadership. I think Americans are more likely to have kept their travel plans because there's a belief that despite the lockdown — which was shorter than most Western destinations — America is open for business. Yes, many people are taking the lockdown seriously, but there's also been a strong polarization between opening and not opening. I think that's very much influencing the American consumer right now about travel.

SkiftX: Domestic travel is more likely for travelers of all three countries. Do you see the majority of this travel taking place via car, or will people become more comfortable flying within the next six months as well?

Martin: Yes, car travel to destinations closer to home will definitely make up the majority of trips taken in the early days of the rebound, especially this summer. Because people have been at home with their immediate families, trips to visit friends and extended family and hyper-local travel to destinations a few hours away within states, provinces or counties will be predominant in all three countries.

Our data shows that there’s a palatable fear of flying right now, especially when so much is unknown about the air travel experience, such as how crowded the airplane will be, if the passengers and crew will be wearing masks, if there will be a sick passenger on the flight, how long the lines will be at the airport, or if a flight will even take off. There are questions around long-haul destinations as well. It’s difficult to know what’s open where or when things will open, what level of quarantine they might have at the destination, or if a traveler needs to quarantine when they return. The rational thinking and logistics needed for a leisure trip are causing a lot of hesitation, understandably.

SkiftX: What are some things global destinations can do to make international travelers feel more comfortable and welcomed?

Martin: In the early days of the pandemic, there was a lot of messaging out there that emotional marketing messages and public relations will solve the problems of destinations. But the extent of this pandemic has had a dramatic, long-term effect on our society and economy. It will be difficult for destinations to try and appeal to international consumers without having very clear and confident messaging around when they're opening, what opening looks like, and what preconditions and policies are in place. For example, when I land in Athens from Germany, will my wife, son, and I have to be in quarantine for 14 days? Will we have to wait in the airport for eight hours on arrival while we wait for our Covid-19 test results?

Fear is definitely playing a big role, but our research shows that those concerns are less about catching the coronavirus and more about questions around things like quarantining, travel insurance viability, and the logistics of getting sick and hospitalization once at the destination.

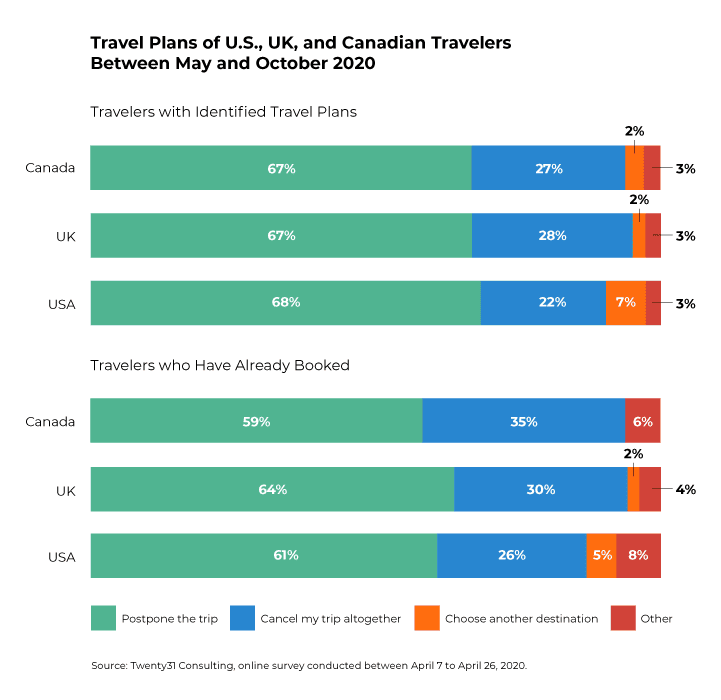

SkiftX: Most respondents said they choose to postpone their travel plans, but nearly one in four travelers across Canada, the U.S. and the UK say they might consider canceling their plans altogether. What are some things DMOs and tour operators can do to sway travelers to postpone rather than cancel?

Martin: I know that destinations and the industries that rely on travel and tourism are hurting right now, and businesses are doing everything they can to stay afloat. But instead of trying to convince travelers to switch from canceling to postponing through digital messaging, social media, the use of influencers, et cetera, it might be more practical to focus on a different consumer group all together: what we call, the “Intrepid Traveler.”

These are the travelers that are willing to keep plans no matter what. They value an experience, even in the midst of everything going on — or specifically because they've stayed at home for 60 or 90 days. These travelers are more likely to choose alternative, off-the-beaten path, tier two and tier three types of destinations, versus more popular urban destinations such as Paris, London, Rome, New York City, or Miami. Destinations have a higher likelihood of enticing these travelers to book versus spinning their wheels and doing everything they can to convince a traveler to postpone their trip instead of canceling it.

SkiftX: This survey measured traveler sentiments about the May to October 2020 timeframe. What are your predictions for travel planning beyond October?

Martin: I tend to laugh when people call themselves futurists in this business, because if this pandemic has taught us anything, it’s that we just don't know what will happen. However, I think that when we look back at past consumer behavior in the travel and tourism industry, we can expect a few things we’ve adapted during this time to stick around for the near future, such as wearing masks, more hand washing, welcoming less people and offering less services in hotel lobbies, lower restaurant capacities, and cleaner hotel rooms and airplanes.

We adapted to the new security regimes in airports after September 11th, as did the private and governmental sectors with the addition of things like passenger lounges and TSA PreCheck. We as a society and as travelers will adapt as needed once again.

SkiftX: What do you think was most interesting about the survey results?

Martin: I’m going to answer this question in a different way. There’s a growing body of research out there about how travelers are thinking about their current and future habits due to the pandemic. I think the most interesting thing that we're going to see is how destinations, tourism organizations, and private sector operators use this intel to adapt their offerings and brand positionings moving forward.

Partner with SkiftX and Twenty31 to help your destination pivot its recovery and rebound strategy during Covid-19. Visit us at skiftx.com or email us at destinations@skift.com.

Alison McCarthy is an Editor on SkiftX.