Skift Take

If domestic travel is the first to come back and stays like that for a while, which countries stand to benefit?

In my continued series of being-a-sucker-for-great-charts, I came across this great hypothetical analysis last week from the hospitality and leisure team at Bernstein (ably led by Richard Clarke), looking at the winners and losers from a staycation boom if *all* international travel demand was redirected domestically.

This is particularly apropos beyond just a thought exercise because the prevalent expectation is that domestic and local travel would be the first type of travel to come back in coming months and into next few years. I have talked about “radical localism” making a comeback in the world and in travel as well.

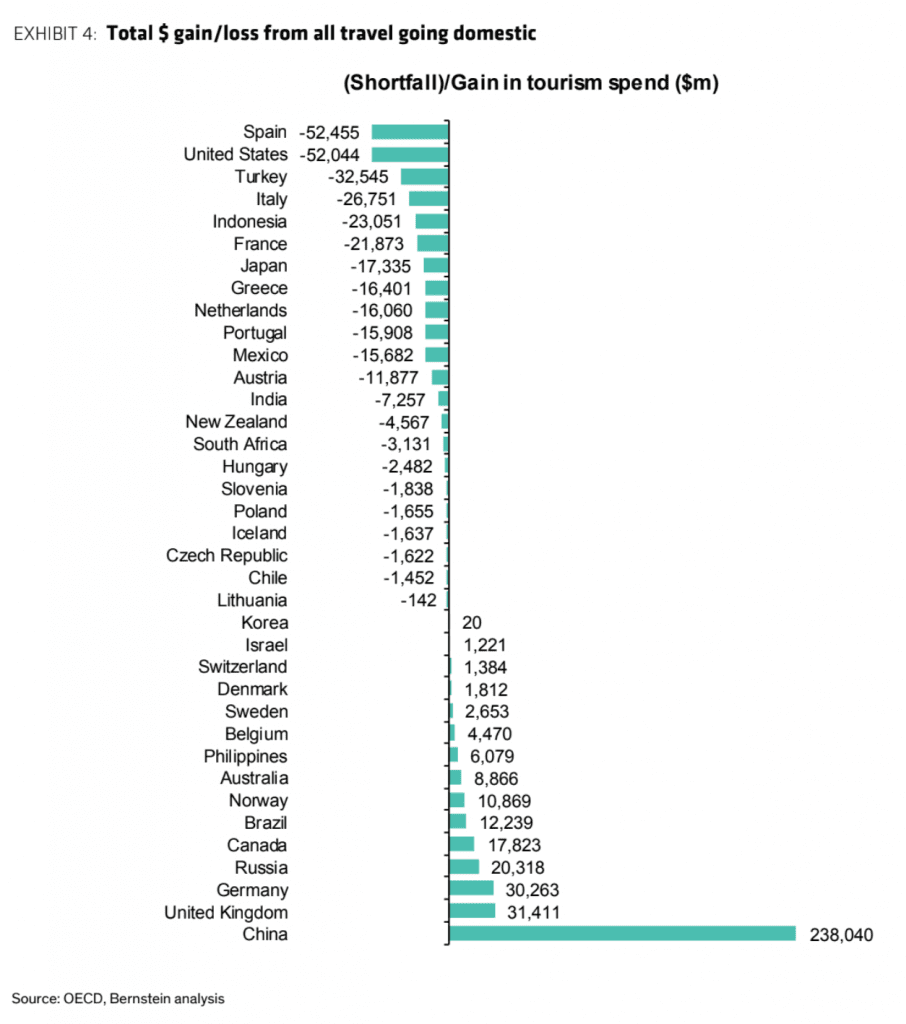

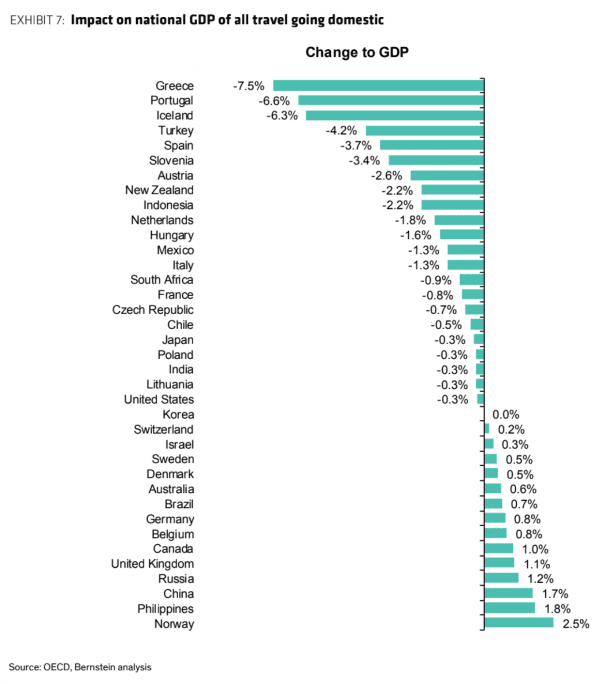

Taking this thread, the Bernstein analysis explores what might happen if, for a full year, all cross-border travel spend was redirected into domestic markets.

Three charts to share from their analysis:

-

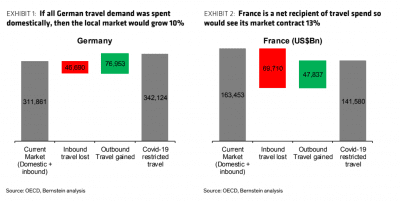

Example winner and loser in all travel-going-domestic scenario: Germany (+10 percent benefit) and France (-13 percent hit). Germany’s domestic travel industry is worth $265 billion, Germans then spend $77 billion abroad (excluding the airfare to get there) and Germany gets $47 billion of inbound tourism spend. If we assume that the $77 billion is now spent in Germany but they lose the $47 billion inbound, then Germany’s total tourism market would grow 10%. France is the opposite, spending $48 billion abroad but gaining $70 billion in inbound spend; all travel switching to domestic would impair the French tourism industry by 13 percent. Click on the chart on the right to see numbers.

Example winner and loser in all travel-going-domestic scenario: Germany (+10 percent benefit) and France (-13 percent hit). Germany’s domestic travel industry is worth $265 billion, Germans then spend $77 billion abroad (excluding the airfare to get there) and Germany gets $47 billion of inbound tourism spend. If we assume that the $77 billion is now spent in Germany but they lose the $47 billion inbound, then Germany’s total tourism market would grow 10%. France is the opposite, spending $48 billion abroad but gaining $70 billion in inbound spend; all travel switching to domestic would impair the French tourism industry by 13 percent. Click on the chart on the right to see numbers.

Is this a realistic scenario, Bernstein asks? Probably an oversimplification, it admits, especially as travel within bubbles of neighbors (e.g. New Zealand and Australia corridor) is being touted rather than pure domestic restrictions. Also, likely not all travel spend gets redistributed as many do a true staycation and stay in their home rather than stay in a domestic hotel and that wouldn’t take into account the economic hit. But still, a worthy exercise to figure out the dynamics of domestic tourism ahead.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus, domestic tourism

Photo credit: TeePee's in Arizona. Steve Walser