Skift Take

Two private equity firms are likely taking a minority stake in Expedia Group at very attractive terms — for the investors. There will be a flood of these types of deals inside the travel industry — and outside it, as well.

Expedia is close to selling a stake to private equity firms Apollo Global Management and Silver Lake Partners, a deal that could provide the online travel giant with an infusion of $1 billion or more.

The Wall Street Journal reported Tuesday that the deal, which is in an advanced stage but could still blow up, comes with board representation for the private equity firms. JP Morgan Chase and Moelis and Co. are advising Expedia on the deal.

If a deal is struck, it would follow news a couple of weeks ago of Silver Lake taking a stake in another travel company, Airbnb.

The Expedia deal could be announced later this week, the Journal said. A spokesperson for Expedia Group declined to comment.

Private equity firms investing in public companies such as Expedia was a trend even before the coronavirus pandemic struck, and it will greatly accelerate now as hundreds of companies inside the travel industry and outside it seek financial saviors to get through the crisis.

Although Airbnb is a private travel company and Expedia Group is public, the two deals would show that Silver Lake Partners, which would have invested in both, understands online travel and feels comfortable in investing funds into it. Many investors shied away from investing in travel pre-Covid-19 and will shun it even more now.

If the deal closes, Silver Lake would now have stakes in two of the leading online travel players when the coronavirus dust settles — if it indeed does.

Private equity companies, flush with cash, can do these deals fairly quickly, which is advantageous to the companies looking for a bailout. Bain & Co. estimates private equity firms have $2.5 trillion at their disposal to invest.

Stiff Terms?

But the terms could be unattractive for the financing beneficiaries, namely Airbnb and Expedia Group. This is expensive money that they are securing.

As is the case for Airbnb, which reportedly has to pay Silver Lake and Sixth Street Partners around a 12 percent interest rate on the financing, Silver Lake and Apollo Global Management undoubtably will be looking for a big return on a stake in Expedia.

The two private equity firms are likely looking for a 15-20 percent total return, including interest on the investment and warrants. It is likely that the investment could come in stages, with $1 billion being the investment in an initial stage, with another billion dollars or so to follow later.

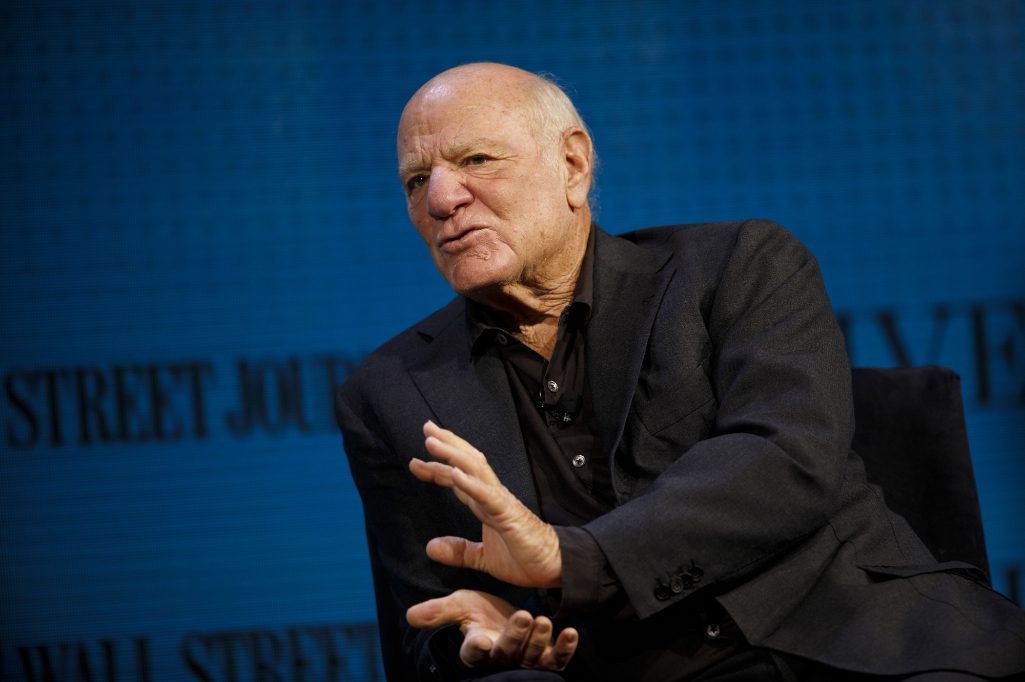

Barry Diller, Expedia Group’s chairman and senior executive, controls about 28 percent of the votes of the company. A $1 billion stake in Expedia Group would be a minority investment and would amount to a much smaller percentage of voting power than Diller currently wields.

Travel companies of all shapes are looking for financing deals to survive the pandemic. Companies such as Airbnb and Expedia, which are handing out refunds and travel credits to different degrees to guests as reservations dried up, lost a bundle of working capital, and this cash flow is unlikely to resume for several months.

Expedia had about $1.4 billion in free cash flow before the coronavirus crisis, according to Moody’s, which lowered its outlook on Expedia Group to “negative” in late March.

Silver Lake and Apollo are riding to Expedia’s rescue — and they are looking for a very attractive payday to lend a hand.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, expedia, mergers, mergers and acquisitions, private equity, silver lake

Photo credit: Pictured is Expedia Group chairman Barry Diller. Two private equity firms may invest in the company to get it through the coronavirus pandemic. Patrick T. Fallon / Bloomberg