Skift Take

Yonder, Airside, GogoBus, and TPConnects announced investments this week, showing that startup funding continued despite the recent global coronavirus crisis.

Travel Startup Funding This Week

Each week we round up travel startups that have recently received or announced funding. Please email Travel Tech Reporter Justin Dawes at [email protected] if you have funding news.

This week, travel startups announced more than $5 million in funding.

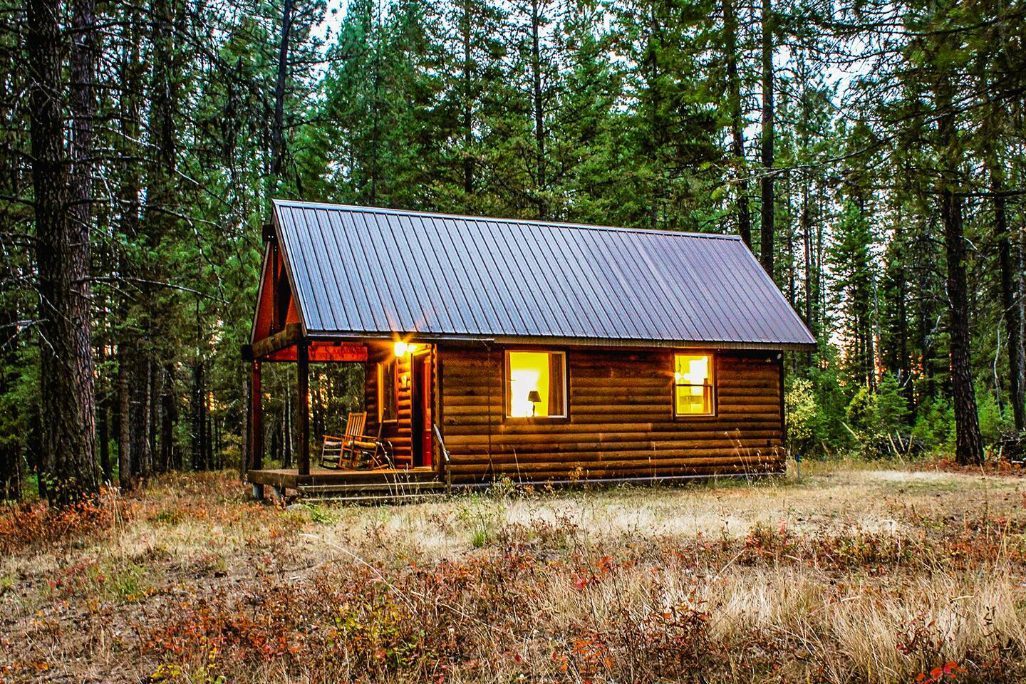

>>Yonder, a booking agency for nature travel in the U.S., said it had raised a $4 million seed round.

Unnamed investors took stakes in the Hamilton, Montana-based startup.

Using Yonder’s site and mobile app, travelers can book overnight stays and activities at farms, ranches, vineyards, and similar “nature immersive” places.

Tim Southwell, permaculture farmer and farm stay owner, created Yonder because he was frustrated by mainstream booking sites underserving the farm stay community. His service aims to expose people to surprising nature-immersive activities and places to stay.

>>Airside, a passenger identification startup, announced that Amadeus Ventures, an arm of the travel tech giant, had made an undisclosed strategic investment in it.

Airside’s biometrically enabled identity verification platform allows U.S. citizens and Canadian visitors to the U.S. to securely pass through customs at 30 airports by using its mobile passport app, which has been downloaded by more than 8 million passengers.

>>GogoBus, an inter-city bus operator in northern India that launched this year, has received an undisclosed, minority strategic investment from Indian travel booking startup Ixigo.

>>TPConnects Technologies, a Dubai-based travel tech business, has received a strategic investment from Flight Centre Travel Group.

Flight Centre took a 22.47 percent stake in the company.

BECO Capital was TPConnects’ lead venture capital investor in a Series A funding round of $4.5 million.

TPConnects helps airlines like Oman Air and travel agencies connect.

The Australian-based travel agency will use TPConnects’ air content aggregator platform, which brings together content based on so-called content based on new distribution capability (NDC) standards, content based on “One Order” standards, and content from global distribution systems.

Skift Cheat Sheet:

We define a startup as a company formed to test and build a repeatable and scalable business model. Few companies meet that definition. The rare ones that do often attract venture capital. Their funding rounds come in waves.

Seed capital is money used to start a business, often led by angel investors and friends or family.

Series A financing is typically drawn from venture capitalists. The round aims to help a startup’s founders make sure that their product is something that customers truly want to buy.

Series B financing is mainly about venture capitalist firms helping a company grow faster. These fundraising rounds can assist in recruiting skilled workers and developing cost-effective marketing.

Series C financing is ordinarily about helping a company expand, such as through acquisitions. In addition to VCs, hedge funds, investment banks, and private equity firms often participate.

Series D, E and beyond These mainly mature businesses and the funding round may help a company prepare to go public or be acquired. A variety of types of private investors might participate.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: funding, startups, vcroundup

Photo credit: The Cottonwood Creek Cabin is a mountain retreat near Chewelah, Washington. Yonder